AI Revolutionizes the M&A Market: How Artificial Intelligence is Transforming Mergers and Acquisitions

Artificial intelligence is changing the way mergers and acquisitions are conducted. Discover how AI technologies are transforming the M&A process and the opportunities and challenges associated with it.

Das Wichtigste in Kürze:

- AI is changing the way mergers and acquisitions are conducted

- AI technologies increase the efficiency of due diligence processes

- AI systems assist in analyzing corporate data

- AI systems can identify potential risks early on

- AI systems can accelerate the speed of M&A transactions

Artificial Intelligence: A Turning Point for M&A

Mergers & Acquisitions (M&A) are at a technological turning point. With the increasing proliferation of artificial intelligence (AI), traditional processes such as business valuation, due diligence, and post-merger integration are being fundamentally transformed. AI is more than just a tool – it is becoming the decisive factor for efficiency and success in the M&A world.

AI in the M&A Market: Growing Significance

The use of AI technologies in M&A transactions is rapidly increasing. According to a Deloitte study, the use of AI could boost the efficiency of due diligence processes by up to 50%. Investment banks and consulting firms are also heavily investing in machine learning algorithms to optimize data analysis, market observation, and decision-making processes. The market for AI in the financial sector is growing annually by over 25%, particularly changing the way medium-sized companies operate, benefiting from lower costs and faster processes.

For more on generative AI in the M&A market, especially in the succession process for crafts, read our guide.

Revolutionizing Due Diligence with AI

Due diligence, a central and often resource-intensive component of M&A transactions, is being drastically optimized by AI. Traditionally, teams require weeks or months to analyze all relevant data – AI can accomplish this in just a few days.

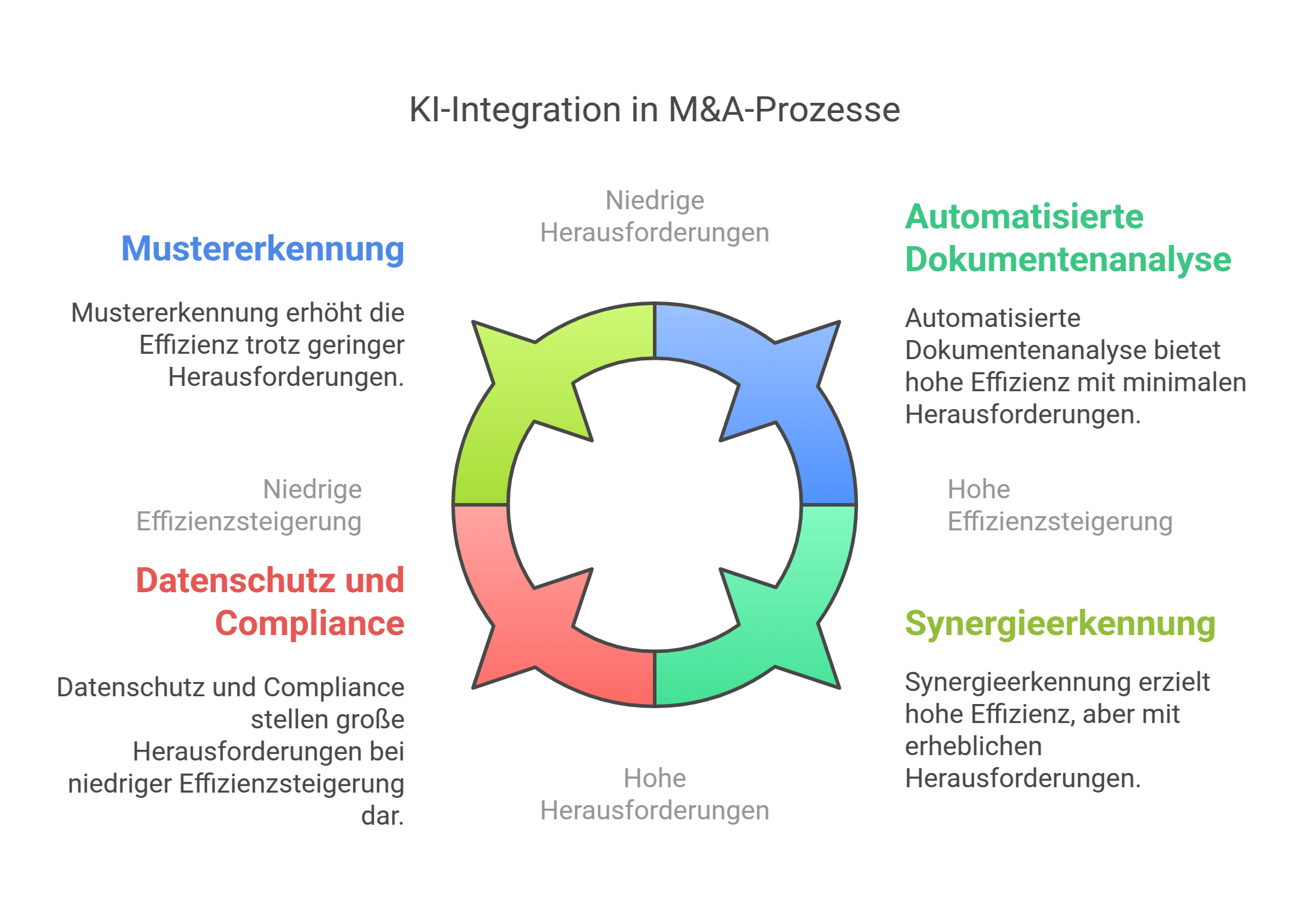

Automated Document Analysis

AI systems like Kira Systems or Leverton use Natural Language Processing (NLP) to analyze and categorize thousands of documents in a short time. For example, relevant contract clauses, liability risks, or termination periods can be automatically identified. The tagging is precise, minimizing errors and speeding up processes.

Pattern Recognition and Risk Assessment

AI-driven algorithms detect patterns in financial data that human analysts might overlook. Systems like Ayasdi identify anomalies in accounting records or potential weaknesses in supply chains and contracts. This increases accuracy and reduces the risk of costly misjudgments.

Cost and Time Efficiency

By automating repetitive tasks, the costs of due diligence are significantly reduced. Studies show that companies can save up to 30% of the total transaction costs when relying on AI-supported systems.

Business Valuation: Precision and Speed through AI

Business valuation is another area where AI brings groundbreaking changes. Traditional valuation models like the earnings value method or the discounted cash flow method (DCF) are often time-consuming and prone to errors. AI revolutionizes these processes with new technologies.

Real-Time Data Analysis

AI platforms like Alphasense process large volumes of financial and market data in real-time. They consider not only obvious parameters like revenue and profit but also subtler factors like market sentiment or potential disruptions.

Predictive Analytics

With the help of predictive analytics, AI models can simulate future scenarios and predict likely developments. This significantly improves the accuracy of revenue and profit forecasts and aids in making more informed purchasing decisions.

Limitations of AI in Valuation

Despite all advancements, evaluating soft factors such as corporate culture, management quality, or innovation capability remains a challenge. Here, the expertise of human advisors is still indispensable.

Integration and Post-Merger Management

After completing a transaction, the focus shifts to integrating the companies. AI can also be crucial here by identifying potential synergies and facilitating operational consolidation.

Identifying Synergies

AI tools like Palantir Foundry help uncover synergy potentials between two companies by analyzing and optimizing data from various departments. For example, cost reductions in the supply chain or new market opportunities can be identified early.

Cultural Integration

Cultural differences are among the most common reasons for merger failures. AI-based analyses of employee feedback and communication patterns can help identify and proactively address cultural tensions.

Monitoring and Success Measurement

AI-supported dashboards enable continuous monitoring of integration and provide real-time data for success measurement. This allows for early adjustments.

Challenges in Using AI in M&A

Despite its numerous advantages, integrating AI into M&A processes also presents challenges:

- Data Protection and Compliance: Handling sensitive corporate data requires the highest security standards.

- Initial Costs: Implementing AI systems can be costly, especially for smaller companies.

- Technical Know-How: Companies need trained personnel to effectively use AI tools.

- Integration into Existing Processes: Adapting traditional workflows to AI technologies requires time and resources.

Conclusion: Humans and Machines as a Success Team

The combination of AI technology and human expertise is the key to successful M&A transactions. While AI accelerates and refines processes, strategic decision-making remains in the hands of experienced advisors. Companies that invest in AI early secure decisive competitive advantages – both through cost savings and better decision-making foundations.

Recommendations for SMEs

- Start with small projects, such as automated document analysis.

- Use cloud-based M&A platforms for lower entry costs.

- Train your employees to fully exploit the potential of AI.

- Consider bringing in external experts to facilitate the transition.

- Pay attention to data protection and compliance from the outset.

The use of AI in the M&A sector is an investment in the future. Companies that familiarize themselves with the possibilities now will be able to conduct complex transactions faster, more accurately, and more efficiently.

Sources:

Making an Impact - Noerr AI and M&A: Seize Opportunities, Manage Risks

Opportunities & Risks of AI in the M&A Process for SMEs - Sell Firm & Find Successor

The Impact of Artificial Intelligence on M&A Transactions - Handelsblatt Live

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO