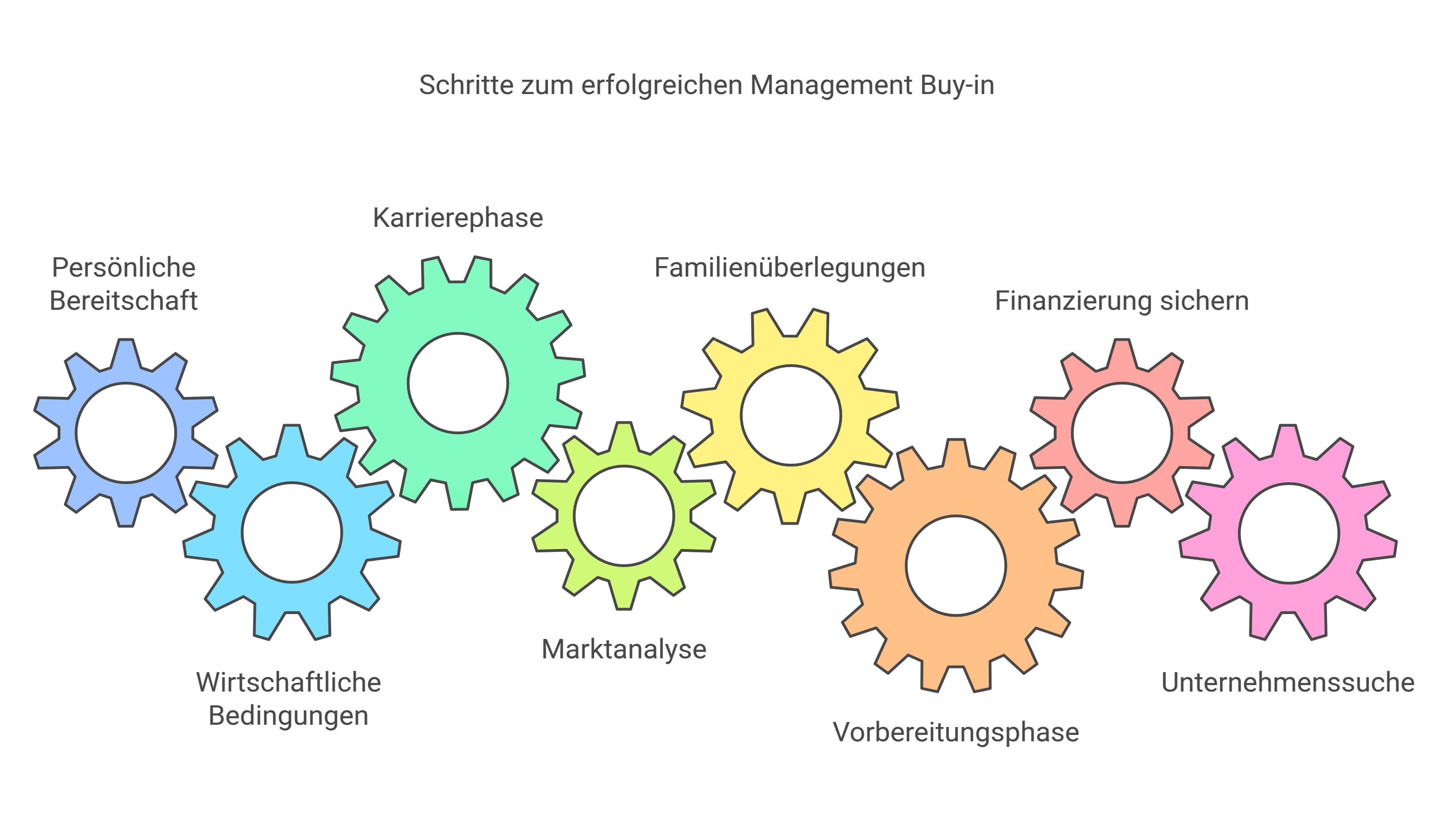

Management Buy-In - Achieve Your Own Company in 5 Steps

This article outlines 5 important factors for a management buy-in.

Das Wichtigste in Kürze:

- The right timing: Ideally with sufficient leadership experience and initial equity reserves

- Financing: Combination of equity (15-25%), bank loans, and alternative financing sources such as subsidies

- Company search: Conduct a systematic search through M&A advisors, networks, and thorough due diligence

- Negotiation: Professional purchase price determination and legally sound contract design with experienced advisors

- Integration: Structured transition and clear communication with all stakeholders

1. Finding the Right Timing

The dream of owning a business doesn't necessarily have to start with a new venture. More and more experienced executives are choosing a management buy-in as a strategic path to entrepreneurship. The right timing for this significant step is crucial—both from a personal and economic perspective.

Personal Readiness

Deciding to buy a company is akin to a complex chess game where various factors must align perfectly. Initially, personal readiness is paramount: Do you have sufficient leadership experience? Are you emotionally and mentally prepared to take full responsibility for an existing company and its employees? This self-reflection is the first critical step on the path to a successful management buy-in.

Economic Conditions

Simultaneously, economic conditions play a central role. The market for business acquisitions is subject to constant fluctuations. During times of low interest rates and stable economic conditions, better financing opportunities often arise. You should also closely monitor industry-specific developments: Is there a generational change in your target industry? Are there structural changes that open up new opportunities?

Where Do You Stand in Your Career?

Your career phase is another crucial factor. The ideal timing for a management buy-in is often between the ages of 35 and 50. During this phase, you typically have the necessary professional experience and industry knowledge, may have built up initial equity, and still possess enough energy and innovation for a fresh start. Additionally, at this age, you usually have a valuable professional network that can be helpful in finding suitable acquisition candidates and securing financing.

Market Analysis

Market analysis also plays an important role in timing. Carefully observe developments in your target industry: How are business acquisition prices evolving? What trends are emerging? An anti-cyclical strategy can be promising—when others hesitate, the best opportunities for a business acquisition sometimes arise.

Family Aspect

The family aspect should not be underestimated. A management buy-in often involves an intensive preparation phase followed by years of high workload. Therefore, the timing should also be compatible with personal and family circumstances. Have open discussions with your family about your plans and ensure you have their full support.

Preparation

Preparation for a management buy-in ideally begins years before the actual acquisition. Use this time to refine your profile, gain relevant experience, and build a solid network. Monitor the market for business sales in your target industry and establish contacts with key intermediaries such as M&A advisors, business brokers, and potential financing partners.

2. Securing the Right Financing

Traditional Bank Financing as a Solid Foundation

For many management buy-in candidates, bank financing remains the first point of contact—and for good reason. Banks have decades of experience in business financing and often offer tailored solutions for acquisitions. However, as a potential buyer, you must meet some key prerequisites: Excellent creditworthiness is as important as convincing equity, which typically should account for at least 15-25% of the purchase price. Banks also place great emphasis on your previous industry experience and leadership skills. A detailed business plan is indispensable—it must not only cover the purchase price financing but also plausibly outline future business development. Particularly important: Pay attention to the valuation of the assets to be acquired, as they often serve as collateral. Many banks offer special promotional loans for business acquisitions, which provide more favorable terms and longer maturities. A combination of various bank products—from traditional loans to working capital loans to mezzanine financing—can be the optimal solution.

Exploring Alternative Financing Sources

Beyond traditional bank financing, a wide range of alternative financing options has gained significant importance in recent years. Private equity firms can contribute not only capital but also valuable know-how and networks as co-investors. However, you must be aware that these partners usually pursue a clear exit strategy and ambitious return targets. Family offices and wealthy private investors (business angels) often offer more flexible terms and longer-term perspectives. They particularly value the personal component and your entrepreneurial vision. Crowdfunding and crowdlending platforms have established themselves as innovative financing alternatives but are more suitable for smaller financing components or as a supplement to traditional financing. A particularly interesting option is the vendor loan, where the previous owner leaves part of the purchase price as a loan. This can be seen as a positive signal for the company's future viability and often facilitates negotiations with other capital providers. Subsidies from government institutions, EU programs, or regional economic development agencies can also play an important role—early and thorough research is worthwhile here.

Innovative Financing Strategies and Structuring Options

The art of successful management buy-in financing often lies in the skillful combination of various instruments. An increasingly popular approach is "smart financing," where the purchase price payment is linked to future business performance (earn-out models). This reduces the initial financing volume and fairly distributes the risk between buyer and seller. Involving existing management through management participation programs can also ease financing and ensure important continuity. Another option is "asset-based lending," where specific company assets (machinery, real estate, receivables) are specifically used as a financing basis. Silent partnerships or silent participations offer the opportunity to raise additional capital without overly restricting entrepreneurial control. Innovative financing instruments such as convertible bonds or profit participation rights can also be interesting components. A particular trend is "ESG-linked loans," where financing terms are linked to achieving sustainability goals—this can be especially relevant when acquiring companies in future-oriented industries. The tax optimization of the financing structure should always be kept in mind, as well as the flexibility for future adjustments to the capital structure.

3. Company Search & Evaluation

Systematic Search for the Right Company

Searching for the right acquisition candidate is often like the proverbial search for a needle in a haystack—however, there are proven ways and strategies that can lead to success. Initial points of contact are often M&A advisors, business sales platforms, and specialized succession exchanges. Auditors, tax advisors, and lawyers can also provide valuable leads on entrepreneurs willing to sell through their networks. A proactive approach can also be worthwhile: Approach entrepreneurs in your target industry directly, even if they have not yet officially offered their company for sale. Often, interesting opportunities arise from such conversations.

Evaluation Criteria and Initial Analysis

When initially screening potential acquisition candidates, you should proceed systematically. Develop a criteria catalog that considers both hard factors (revenue, profit, market position) and soft factors (corporate culture, employee structure, innovation potential). Particularly important are:

- Market position and competitiveness

- Customer structure and relationships

- Technological status and innovation potential

- Quality and motivation of employees

- Financial metrics of recent years

- Investment needs and hidden risks

- Dependencies on key personnel

- Location factors and regional market conditions

Professional Company Valuation

Valuing a company is a combination of science and art. There are various recognized methods that are usually applied in combination:

Multiples Method

The multiples method is widely used in practice and relatively easy to apply. The company value is determined by multiplying key figures (e.g., EBIT, EBITDA) with industry-standard factors. For an initial assessment of the company value, you can use the Viaductus Company Value Calculator. This offers a quick orientation but should only be understood as a first point of reference.

Income Approach

This method is based on the future expected earnings of the company. It involves:

- Forecasting future earnings

- Discounting with a risk-adjusted interest rate

- Summarizing to a present value

The method is more complex but often more realistic than pure multiple valuation.

Discounted Cash Flow Method (DCF)

The DCF method is standard, especially for larger transactions. It considers:

- Future free cash flows

- Weighted Average Cost of Capital (WACC)

- Terminal value

This method often provides the most well-founded results but also requires the most assumptions and expertise.

Due Diligence as a Decisive Phase

After the initial valuation and pre-selection, detailed due diligence follows. This typically includes:

Financial Due Diligence

- Analysis of financial statements

- Review of planning calculations

- Evaluation of working capital

- Analysis of cost structures

Legal Due Diligence

- Review of all contracts

- Analysis of legal risks

- Examination of patents and licenses

- Labor law aspects

Commercial Due Diligence

- Market and competition analysis

- Customer structure and relationships

- Supplier relationships

- Business model analysis

Technical Due Diligence

- Condition of facilities

- IT infrastructure

- Production processes

- Innovation pipeline

It is important to be supported by experienced experts during due diligence. An experienced team of auditors, lawyers, and industry experts can uncover critical risks and provide important arguments in negotiating the purchase price.

Valuation in the Current Market Situation

Consider current market factors in the valuation, such as:

- Industry-specific challenges

- Technological disruptions

- Regulatory changes

- Economic developments

- Sustainability aspects (ESG criteria)

These factors can significantly influence the company value and should be included in the overall evaluation.

4. Negotiation & Acquisition Structure

The Art of Purchase Price Negotiation

Negotiating the purchase price is more than just haggling over numbers—it is the beginning of an important business relationship. The seller has built their life's work, and this emotional aspect should always be respectfully considered in negotiations. Nevertheless, a factual approach is essential. The basis for determining the purchase price is the results of the company valuation and due diligence. Experience shows that flexible purchase price models often lead to a win-win situation. For example, part of the purchase price could be linked to future successes (earn-out), reducing the risk for both parties and allowing both the seller and buyer to participate in future success.

Professional Contract Design as a Foundation

The business acquisition contract is the legal heart of the transaction and should be crafted with the utmost care. Experienced M&A lawyers are indispensable here, as the contract must consider all eventualities while remaining practical. Particular attention should be paid to the seller's warranties and guarantees. These should reflect the findings from due diligence and secure critical points. The precise definition of closing conditions is also essential—when exactly does the company transfer, and what prerequisites must be met? The contract design should also optimally consider the tax aspects of the transaction, which can often have significant impacts on the overall structure.

Strategically Planning the Transition Phase

The period between contract signing and actual acquisition is a particularly sensitive phase that must be carefully planned. A detailed transition plan regulates the gradual transfer of responsibilities and authorities. The previous owner possesses valuable implicit knowledge about the company, its customers, and employees. This knowledge must be systematically transferred. A multi-month transition phase, where the seller remains available as an advisor, often proves beneficial. This also provides employees and business partners with the necessary security.

Communication as the Key to Success

An often underestimated aspect of the acquisition is communication. It begins in the negotiation phase, where absolute confidentiality must be maintained to avoid causing unrest among employees, customers, and suppliers. Once the acquisition is confirmed, open and transparent communication is crucial. Employees are the most important target group—their support is essential for future success. A well-thought-out communication plan specifies who is informed when and how. You should be authentic and present, convey your vision for the company, and simultaneously assure stability and continuity.

Legal and Organizational Integration

The formal acquisition is just the beginning of a longer integration process. Contracts must be transferred, powers of attorney redefined, and processes adjusted. Particularly important is the integration of IT systems and accounting. Aligning corporate culture and leadership style also requires time and sensitivity. Professional project management helps to approach these complex tasks in a structured manner and not overlook anything. You should focus on the most important areas of action and not initiate too many changes at once.

Successfully managing negotiation, acquisition, and integration requires a balanced mix of strategic foresight and attention to detail. The process is akin to a marathon, where you must demonstrate both endurance and timing. With the right preparation and professional support, you can set the course for a successful future as a business owner.

5. Post-Merger Integration: The Critical First Months

The First 100 Days as the Foundation for Success

The period immediately following the acquisition is crucial for the long-term success of a management buy-in. The first 100 days not only leave a lasting impression on employees and business partners but also set the tone for the company's future development. In this phase, it is important to maintain balance: On the one hand, you must actively assume your leadership role and initiate changes; on the other hand, you should appreciate what already exists and not act hastily. Start with a thorough analysis of operational processes and corporate culture. Identify quick wins—quickly implementable improvements that send positive signals without overwhelming the company.

Employee Leadership in Times of Change

The success of a management buy-in stands and falls with the support of employees. They are in a phase of uncertainty—the familiar owner has left, and new structures are emerging. Your task is to build trust while demonstrating clear leadership. Personal conversations with key employees are a priority. Listen, show appreciation for what has been achieved, and convey your vision for the future. Establishing a regular feedback process helps to recognize moods early and counteract them. Identifying and retaining key performers is particularly important—they are the multipliers for your change initiatives.

Professional Change Management

Changes are inevitable and necessary after a management buy-in. The art lies in designing them so that they are supported by the organization. A structured change management process helps to systematically approach the transformation. Start by defining a clear vision and strategy. This must be both motivating and realistic. Develop concrete goals and measures from this, which you summarize in a master plan. Prioritization is important—not everything can and must be changed immediately. Establish a change board with key executives to steer and monitor the transformation.

Sensitively Shaping Cultural Change

Integrating two corporate cultures—your vision and the established corporate culture—is one of the most sensitive aspects of the post-merger phase. Cultural change takes time and cannot be mandated. First, analyze the existing culture: What values do employees live by? How are decisions made? What unwritten rules exist? Develop a cultural vision that combines the best of both worlds. Leading by example is more important than prescribing—your daily decisions and behavior shape the new culture more than any strategy paper.

Stabilizing Operational Business

While you initiate changes, daily business must continue—smoothly, if possible. Establish clear responsibilities and reporting structures. Regular performance monitoring helps to detect deviations early. Particular attention should be paid to customer relationships during this phase. Actively seek contact with key customers and personally assure them of the continuity of the business relationship. Supplier communication should not be neglected either—stable supply chains are essential, especially in phases of change.

Post-merger integration is a complex balancing act between change and stability, between swift action and careful consideration. The key to success lies in the right mix of clear leadership and sensitive moderation of change. With a structured approach, authentic communication, and the necessary sensitivity, you can set the course for a successful future in this phase. Remember: Rome wasn't built in a day—give yourself and the organization the time needed for sustainable transformation.

Also, read our article on ETA in Germany.

Conclusion: The Path to a Successful Management Buy-in

- 1A management buy-in is a complex but well-structurable process. Success is based on five essential pillars: careful preparation, solid financing, systematic company search, professional negotiation, and structured integration.

- 2The right balance between thorough analysis and targeted action is crucial. Professional due diligence and support from experienced advisors are indispensable. Financing should ideally rest on multiple pillars, with 15-25% equity as a guideline.

- 3The acquisition process requires both strategic foresight and operational excellence. With the right preparation and a structured approach, the path to owning your own company can be successfully paved.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO