Management Buy-Out: When Managers Become Entrepreneurs

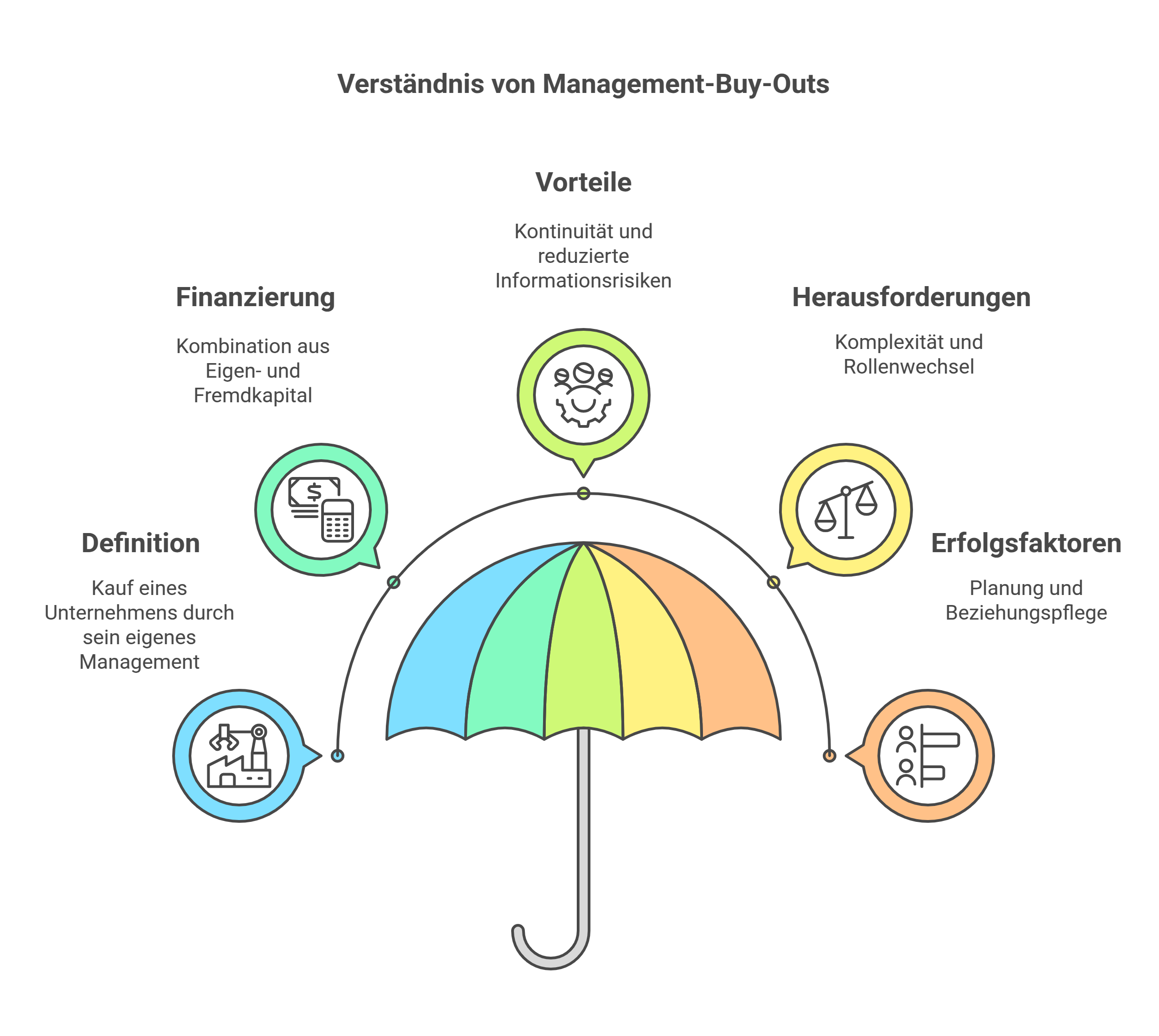

Learn all essential information about Management Buy-Outs (MBO) as a tool for business succession. This article explores the background, opportunities, challenges, and success factors when management takes over a company.

A Management Buy-Out (MBO) refers to the purchase of a company by its own management. This form of business acquisition has gained significant importance in recent years, especially in the context of business succession in medium-sized enterprises. In this article, we explore the background, opportunities, and challenges of Management Buy-Outs.

What is a Management Buy-Out?

In an MBO, the management team of a company, often together with external investors, takes ownership from the previous shareholders. They either purchase the entire company or carve out parts of it. The crucial point is that the acquiring management was already in a leading position within the company before the transaction. Unlike a Management Buy-In, where the buyer comes from outside the company, in an MBO, the buyer comes from within. The change in ownership resolves the classic conflict of interest between employed management and company owners, known as the principal-agent conflict. After the buy-out, the managers themselves become shareholders and directly benefit from the success of "their" company.

How is an MBO financed?

Typically, only a small portion of the purchase price comes from the management's personal assets. The majority is raised through a combination of equity and debt.

Private equity firms or other financial investors often act as equity providers. They provide capital to later sell their shares at a profit after the successful development of the company. Debt financing is predominantly provided through bank loans.

When the proportion of debt is particularly high, it is referred to as a Leveraged Buy-Out (LBO). This presents both opportunities and risks: If the company develops as planned, the leverage effect acts as a return booster. However, if the company encounters difficulties, there is a risk of over-indebtedness.

The financing is complex and must be carefully planned to achieve a solid capital structure. High debt levels can become a risk. An important tool can be Earn-Out models, which link the purchase price to future successes.

Advantages of Management Buy-Outs

MBOs have proven to be an effective tool for business succession. They offer a range of advantages for both sellers and buyers:

- Selling owners without suitable family successors can transfer their life's work to a team they have known and trusted for years. Continuity in strategy and leadership is more likely than with a sale to outsiders.

- During the sales process, fewer sensitive company details need to be disclosed externally, as the management, as the buyer, is already well-acquainted with the situation. This reduces the risk of confidential data falling into competitors' hands.

- For the acquiring management, an MBO is a significant opportunity to engage in entrepreneurship and directly benefit from the company's value increase. This creates high motivation and willingness to perform.

- Financial investors see MBOs as an attractive investment opportunity. Compared to acquisitions by external management, MBO teams know their company "inside and out" and are well-acquainted with the market and customers.

A special case is turnaround buy-outs in economically distressed companies. Here, insiders from management often see future prospects that outsiders do not recognize. If they are willing to bear the entrepreneurial risk themselves, an MBO can be the lifeline.

Challenges and Risks

As attractive as Management Buy-Outs are in many situations, several challenges must be overcome:

- The financing is complex and must be carefully planned to achieve a solid capital structure. High debt levels can become a risk.

- The transition from manager to entrepreneur also requires a change in mindset. This transformation does not always succeed.

- In negotiations with former owners, conflicts of interest may arise if the management, due to its information advantage, is tempted to undervalue the company to achieve a lower purchase price.

- In turnaround buy-outs, the acquiring managers bear particularly high entrepreneurial risk. If the turnaround fails, there is a risk of total loss of the invested capital.

Success Factors for MBOs

To mitigate these risks and fully leverage the opportunities of Management Buy-Outs, early planning and preparation are recommended, ideally several years before the planned transaction. Key elements include:

- Developing a convincing business plan with plausible assumptions about business development, investment needs, and earnings growth

- Building sustainable relationships with financing partners, both on the equity and debt sides

- Open communication and trust-building between the buying management and selling owners

- Careful regulation of shareholder positions in the purchase agreement, such as shareholder agreements with clear veto rights, information rights, and exit arrangements

- Early clarification of succession planning for the MBO team itself to ensure long-term stability

Additionally, the motivation and incentivization of the second management level and the workforce are crucial success factors. The introduction of employee participation programs has proven effective in many cases.

Conclusion

Management Buy-Outs are an exciting option for business sellers and executives when the conditions are right, and both parties are well-prepared. For owners looking to sell, especially in medium-sized enterprises, new possibilities for non-family succession arrangements open up.

For managers, the step into entrepreneurship is a significant opportunity but also a challenge. Those who think and act entrepreneurially, do not shy away from financial risks, and demonstrate leadership strength can be very successful as MBO entrepreneurs. The trend towards more buy-outs by management is likely to continue.

Sources: