Tantieme des GmbH-Geschäftsführers: Steuerliche Regelungen und Praxisbeispiele

Die Tantieme bietet eine attraktive Möglichkeit, GmbH-Geschäftsführer erfolgsabhängig zu vergüten. Dieser Artikel beleuchtet die steuerlichen Aspekte der Tantieme und zeigt anhand von Praxisbeispielen, worauf es bei der Ausgestaltung der Tantiemevereinbarung ankommt.

Einleitung

Die Tantieme ist eine variable Vergütungskomponente, die für GmbH-Geschäftsführer eine attraktive Möglichkeit darstellt, am Erfolg des Unternehmens beteiligt zu werden. Gleichzeitig wirft die Tantieme aber auch viele Fragen hinsichtlich der steuerlichen Behandlung auf. Sowohl für die GmbH als auch den Geschäftsführer ist es wichtig, die einschlägigen Regelungen zu kennen und die Tantiemevereinbarung so zu gestalten, dass steuerliche Fallstricke vermieden werden. Dieser Artikel gibt einen Überblick über die Grundlagen der Tantieme, beleuchtet die steuerlichen Aspekte und zeigt anhand von Praxisbeispielen, worauf es bei der Ausgestaltung ankommt.

Eine Tantieme ist eine erfolgsabhängige Vergütung, die zusätzlich zum Festgehalt an einen GmbH-Geschäftsführer gezahlt wird. Im Gegensatz zum fixen Grundgehalt, das unabhängig vom Unternehmenserfolg gezahlt wird, ist die Tantieme direkt an bestimmte Erfolgskennzahlen gekoppelt.

Charakteristika der Tantieme:

- Erfolgsabhängigkeit: Die Tantieme wird nur gezahlt, wenn bestimmte vorab definierte Erfolgsziele erreicht werden.

- Anreizfunktion: Durch die direkte Kopplung an den Unternehmenserfolg soll die Tantieme als Leistungsanreiz für den Geschäftsführer dienen.

- Nachträglichkeit: Die Tantieme wird typischerweise nach Abschluss des Geschäftsjahres und der Erstellung des Jahresabschlusses berechnet und ausgezahlt.

- Variabler Charakter: Die Höhe der Tantieme kann je nach Geschäftsverlauf schwanken – von null bis hin zu erheblichen Beträgen.

- Freiwilligkeit vs. Anspruch: Je nach vertraglicher Ausgestaltung kann die Tantieme als freiwillige Leistung oder als fest vereinbarter Anspruch ausgestaltet sein.

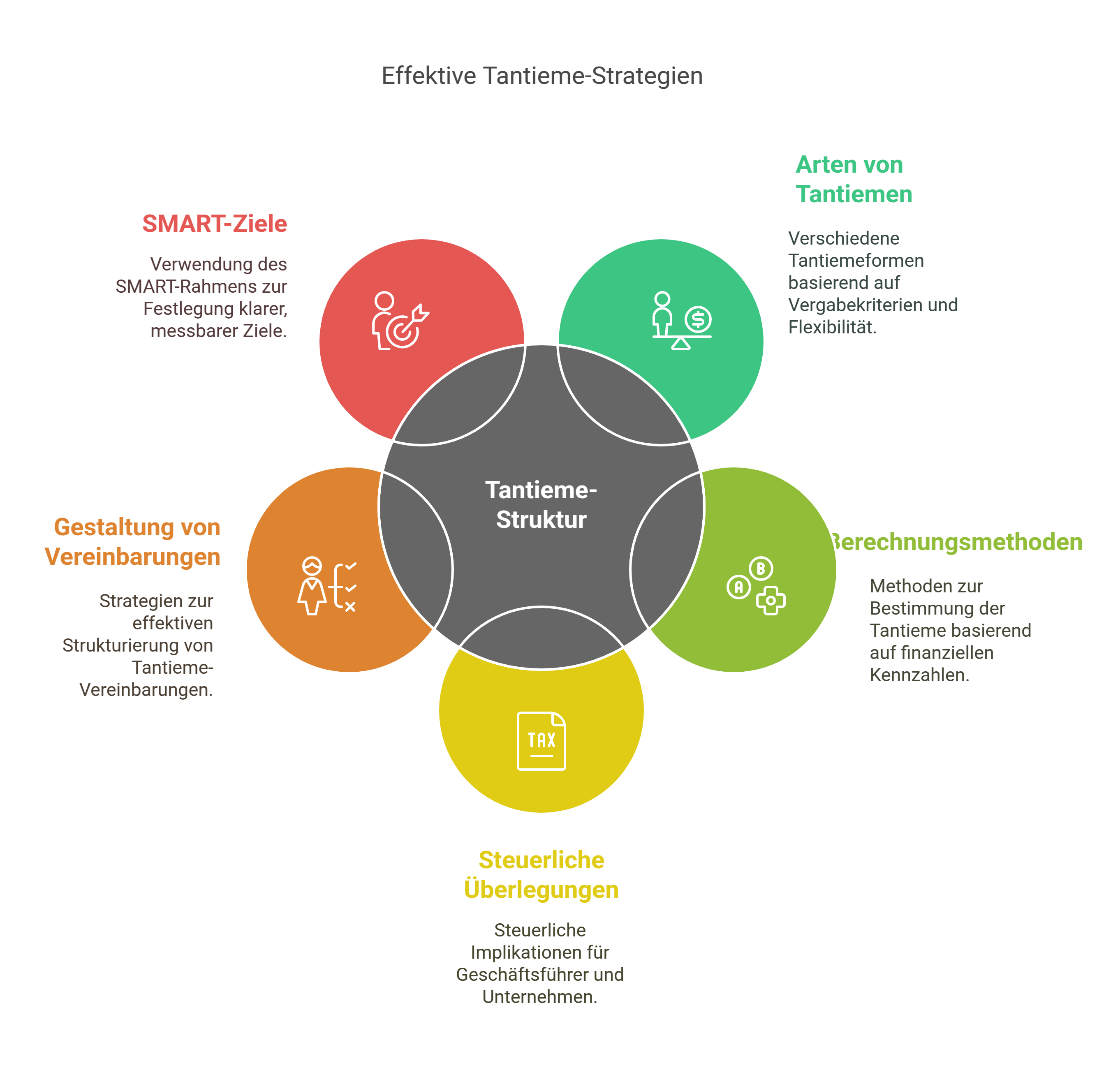

Arten von Tantiemen

In der Praxis haben sich verschiedene Arten von Tantiemen herausgebildet, die sich hinsichtlich der Bemessungsgrundlage und der Festlegung der Zielparameter unterscheiden:

-

Vertraglich festgelegte Tantiemen: Hier werden die Rahmenbedingungen für die Tantieme, wie Zielgrößen, Bemessungsgrundlagen und Prozentsätze, vorab im Anstellungsvertrag des Geschäftsführers fixiert. Dies schafft Planungssicherheit auf beiden Seiten.

-

Ermessenstantiemen: Bei dieser Variante entscheidet die Gesellschafterversammlung nach Ablauf des Geschäftsjahres über die Höhe der Tantieme. Es besteht somit kein vorab festgelegter Anspruch des Geschäftsführers. Ermessenstantiemen bieten mehr Flexibilität, bergen aber auch ein gewisses Konfliktpotenzial.

-

"Goodwill"-Prämien: Hierunter versteht man einmalige Sonderzahlungen, die bei Erreichen bestimmter Meilensteine oder außerordentlichen Leistungen gewährt werden, z.B. die erfolgreiche Integration eines akquirierten Unternehmens.

-

Kombinationen und hybride Modelle: In der Praxis finden sich oft Mischformen, bei denen etwa ein Teil der Tantieme vertraglich fixiert ist und ein anderer Teil nach Ermessen festgelegt wird oder verschiedene Zielparameter kombiniert werden.

Berechnung der Tantieme

Für die Berechnung der Tantieme sind zwei Aspekte entscheidend: die Wahl der Bemessungsgrundlage und die Festlegung des prozentualen Anteils, den der Geschäftsführer erhält. Übliche Bemessungsgrundlagen sind Kennzahlen wie der Jahresüberschuss, das EBIT oder bestimmte Umsatz- oder Ertragsziele. Denkbar ist auch eine Kombination mehrerer Bezugsgrößen.

Der prozentuale Anteil des Geschäftsführers an der jeweiligen Bezugsgröße wird individuell festgelegt und richtet sich nach verschiedenen Faktoren wie der Branche, der Unternehmensgröße und dem Verantwortungsbereich des Geschäftsführers. Üblich sind Werte zwischen 1% und 5%, in Einzelfällen auch darüber.

Ein vereinfachtes Beispiel: Angenommen, die GmbH erzielt einen Jahresüberschuss von 500.000 EUR. Im Anstellungsvertrag des Geschäftsführers ist eine Tantieme von 2% des Jahresüberschusses vereinbart. In diesem Fall beläuft sich die Tantieme auf 10.000 EUR.

Steuerliche Aspekte der Tantieme

Aus steuerlicher Sicht sind bei der Tantieme zwei Dimensionen zu beachten: die Behandlung beim Geschäftsführer und bei der GmbH.

Für den Geschäftsführer stellt die Tantieme steuerpflichtigen Arbeitslohn dar, der im Zuflussjahr der Einkommensteuer unterliegt. Wichtig ist, dass die Tantieme auch der Sozialversicherungspflicht unterliegen kann, wenn die Jahresarbeitsentgeltgrenze überschritten wird.

Auf Ebene der GmbH stellt sich die Frage der Abzugsfähigkeit als Betriebsausgabe. Grundsätzlich sind Tantiemen abzugsfähig, soweit sie angemessen sind. Unangemessen hohe Tantiemen können hingegen als sogenannte verdeckte Gewinnausschüttungen (vGA) qualifiziert werden, was zur Folge hat, dass sie den steuerpflichtigen Gewinn der GmbH nicht mindern.

Um eine vGA zu vermeiden, muss die Tantieme vorab zivilrechtlich wirksam vereinbart werden und einem Fremdvergleich standhalten, d.h. auch ein fremder Geschäftsführer hätte eine entsprechende Vergütung erhalten. Zudem darf die Gesamtausstattung des Geschäftsführers nicht außer Verhältnis zur Leistung der Gesellschaft stehen. Als Faustregel gilt, dass die Gesamtbezüge eines Geschäftsführers nicht mehr als 75% des Ergebnisses vor Steuern und Tantiemen betragen sollten.

Gestaltung von Tantiemevereinbarungen

Um eine wirksame und steuerlich optimale Tantiemevereinbarung zu treffen, sollten einige Punkte beachtet werden:

- Klare Definition der Zielparameter und Bemessungsgrundlagen im Voraus

- Orientierung an gängigen Marktusancen bei der Höhe der Tantieme

- Verwendung präziser und rechtssicherer Formulierungen im Vertrag

- Einholung steuerlicher und rechtlicher Beratung

Insbesondere bei komplexeren Vereinbarungen mit mehreren Zielgrößen empfiehlt es sich, auf bewährte Mustervereinbarungen zurückzugreifen und diese an die individuellen Bedürfnisse anzupassen. Eine professionelle Begleitung durch Steuerberater und Rechtsanwälte kann helfen, steuerliche Risiken zu minimieren und die Interessen beider Seiten optimal auszubalancieren.

Zielvereinbarungen und Tantieme

Die Wirksamkeit einer Tantiemevereinbarung hängt entscheidend von der Qualität der zugrunde liegenden Zielparameter ab. Sinnvoll ist es, sich bei der Zieldefinition an der sogenannten SMART-Formel zu orientieren. SMART steht dabei für:

- Specific (spezifisch): Die Ziele sollten klar definiert und eindeutig formuliert sein.

- Measurable (messbar): Die Zielerreichung muss anhand objektiver Kriterien überprüfbar sein.

- Achievable (erreichbar): Die Ziele müssen anspruchsvoll, aber realistisch sein.

- Relevant (relevant): Die Ziele sollten sich an den strategischen Unternehmenszielen orientieren.

- Time-bound (terminiert): Es muss ein klarer Zeitrahmen für die Zielerreichung definiert werden.

Ein Beispiel für eine SMART-formulierte Zielvorgabe wäre: "Steigerung des Umsatzes im Produktsegment X um 10% im Vergleich zum Vorjahr bis zum 31.12."

Je konkreter und überprüfbarer die Ziele definiert werden, desto einfacher ist später die Ermittlung der Zielerreichung und desto geringer ist das Konfliktpotenzial zwischen Gesellschaft und Geschäftsführer.

Praxisbeispiele und Fallstudien

Abschließend soll anhand einiger Praxisbeispiele illustriert werden, wie Tantiemevereinbarungen in unterschiedlichen Unternehmen ausgestaltet sein können:

-

Beispiel 1: Handelsbetrieb mit einfacher Tantiemeklausel

Die A-GmbH, ein mittelständischer Großhändler, vereinbart mit ihrem Geschäftsführer eine Tantieme in Höhe von 3% des Jahresüberschusses. Weitere Zielparameter werden nicht definiert. Die Tantiemevereinbarung schafft einen Anreiz für profitables Wachstum, ist aber noch wenig spezifisch.

-

Beispiel 2: Technologie-Startup mit kombinierten Zielgrößen

Die B-GmbH, ein junges Softwareunternehmen, legt für ihren Geschäftsführer eine mehrstufige Tantieme fest. 50% der Tantieme werden an die Erreichung bestimmter Meilensteine bei der Produktentwicklung geknüpft, 30% an das Kundenwachstum und 20% an die Einhaltung des Finanzplans. Durch die Kombination verschiedener Steuerungsgrößen werden unterschiedliche Unternehmensziele adressiert.

-

Beispiel 3: Medienunternehmen mit Ermessenstantieme

Die C-GmbH, ein traditionsreicher Zeitungsverlag, vereinbart mit ihrem Geschäftsführer eine Grundtantieme von 2% des EBIT. Zusätzlich kann der Aufsichtsrat nach Ermessen eine Sondertantieme von bis zu 50.000 EUR festlegen, wenn besondere strategische Ziele erreicht wurden, z.B. die Etablierung neuer Digitalformate. Die Ermessenstantieme schafft Flexibilität für Ziele, die sich im Voraus schwer quantifizieren lassen.

In der Praxis zeigt sich, dass es nicht das eine perfekte Modell gibt, sondern dass die Tantiemevereinbarung individuell auf die Bedürfnisse und Ziele des jeweiligen Unternehmens zugeschnitten werden muss. Wichtig ist, dass die Zielgrößen aussagekräftig und die Vergütungsregeln klar definiert sind. Zudem sollte die Tantiemevereinbarung regelmäßig überprüft und bei Bedarf angepasst werden.

Die 75/25-Regelung bei Tantiemen – Erklärung und Beispiele

Was besagt die 75/25-Regelung?

Die sogenannte 75/25-Regelung ist eine von der Finanzverwaltung und Rechtsprechung entwickelte Faustregel zur Beurteilung der Angemessenheit einer Geschäftsführervergütung, insbesondere bei Gesellschafter-Geschäftsführern. Nach dieser Regel sollte die Gesamtvergütung des Geschäftsführers (Festgehalt plus Tantieme) nicht mehr als 75% des Gewinns vor Steuern und vor Abzug der Geschäftsführervergütung betragen. Anders ausgedrückt: Mindestens 25% des erwirtschafteten Gewinns sollten beim Unternehmen verbleiben.

Die 75/25-Regelung dient vor allem als Indiz bei der Prüfung, ob eine verdeckte Gewinnausschüttung (vGA) vorliegt. Wird der Schwellenwert überschritten, ist dies ein Hinweis darauf, dass die Vergütung möglicherweise nicht mehr dem Fremdvergleich standhält und teilweise durch das Gesellschaftsverhältnis veranlasst sein könnte.

Praktische Beispiele zur 75/25-Regelung:

Beispiel 1: Einhaltung der 75/25-Regelung

Die XYZ-GmbH erwirtschaftet im Geschäftsjahr 2024 einen Gewinn vor Steuern und vor Abzug der Geschäftsführervergütung in Höhe von 400.000 EUR. Der Gesellschafter-Geschäftsführer erhält ein Festgehalt von 120.000 EUR sowie eine Tantieme in Höhe von 60.000 EUR, insgesamt also 180.000 EUR.

Berechnung:

- Gesamtvergütung des Geschäftsführers: 180.000 EUR

- Maximal zulässige Vergütung nach 75/25-Regel: 400.000 EUR × 75% = 300.000 EUR

- Tatsächlicher Anteil der Vergütung am Gewinn: 180.000 EUR / 400.000 EUR = 45%

Fazit: Die Vergütung liegt mit 45% deutlich unter der kritischen Grenze von 75%. Die 75/25-Regelung ist eingehalten, ein Risiko einer verdeckten Gewinnausschüttung besteht insoweit nicht.

Beispiel 2: Überschreitung der 75/25-Regelung

Die ABC-GmbH erwirtschaftet im Geschäftsjahr 2024 einen Gewinn vor Steuern und vor Abzug der Geschäftsführervergütung in Höhe von 200.000 EUR. Der Gesellschafter-Geschäftsführer erhält ein Festgehalt von 120.000 EUR sowie eine Tantieme in Höhe von 80.000 EUR, insgesamt also 200.000 EUR.

Berechnung:

- Gesamtvergütung des Geschäftsführers: 200.000 EUR

- Maximal zulässige Vergütung nach 75/25-Regel: 200.000 EUR × 75% = 150.000 EUR

- Tatsächlicher Anteil der Vergütung am Gewinn: 200.000 EUR / 200.000 EUR = 100%

Fazit: Die Vergütung liegt mit 100% deutlich über der kritischen Grenze von 75%. Es besteht ein erhöhtes Risiko, dass das Finanzamt einen Teil der Vergütung (nämlich 50.000 EUR) als verdeckte Gewinnausschüttung behandelt.

Beispiel 3: Gestaltungsmöglichkeit mit Tantiemenvorbehalt

Um das Risiko einer verdeckten Gewinnausschüttung zu minimieren, könnte die ABC-GmbH aus Beispiel 2 eine Tantiemenregelung mit Vorbehalt einführen:

"Der Gesellschafter-Geschäftsführer erhält eine Tantieme in Höhe von 40% des Jahresüberschusses vor Steuern und vor Tantieme, maximal jedoch in einer Höhe, dass die Gesamtvergütung (Festgehalt plus Tantieme) 75% des Jahresüberschusses vor Steuern und vor Tantieme nicht übersteigt."

Bei einem Gewinn von 200.000 EUR und einem Festgehalt von 120.000 EUR würde die Tantieme dann automatisch auf 30.000 EUR begrenzt:

- Maximale Gesamtvergütung: 200.000 EUR × 75% = 150.000 EUR

- Festgehalt: 120.000 EUR

- Verbleibender Spielraum für Tantieme: 150.000 EUR - 120.000 EUR = 30.000 EUR

Wichtige Hinweise zur 75/25-Regelung:

-

Keine gesetzliche Verankerung: Die 75/25-Regelung ist keine gesetzlich festgeschriebene Norm, sondern lediglich eine Orientierungshilfe, die von Rechtsprechung und Finanzverwaltung entwickelt wurde.

-

Einzelfallbetrachtung: Ob eine verdeckte Gewinnausschüttung vorliegt, hängt von zahlreichen weiteren Faktoren ab, wie Branchenüblichkeit, Unternehmensgröße, Verantwortungsbereich des Geschäftsführers etc.

-

Dokumentation: Um eine steuerliche Anerkennung der Tantieme zu gewährleisten, ist eine gute Dokumentation der Angemessenheit wichtig, z.B. durch Gehaltsvergleichsstudien oder Benchmarks.

-

Gestaltungsmöglichkeiten: Eine Überschreitung der 75/25-Regel kann durch verschiedene Gestaltungen vermieden werden, z.B. durch Tantiemenvorbehalte, Mehrstufentantiemen oder eine Verteilung der Tantieme auf mehrere Jahre.

-

Beherrschende Gesellschafter-Geschäftsführer: Bei beherrschenden Gesellschafter-Geschäftsführern (Beteiligung > 50%) ist besondere Vorsicht geboten, da hier die Anforderungen an die Angemessenheit und Fremdüblichkeit der Vergütung besonders streng geprüft werden.

Die 75/25-Regelung bietet somit eine praktikable Orientierungshilfe für die steuerlich optimale Gestaltung von Tantiemevereinbarungen und hilft, das Risiko einer verdeckten Gewinnausschüttung zu minimieren. Eine individuelle steuerliche Beratung ist jedoch in jedem Fall zu empfehlen, um die konkrete Situation des Unternehmens und des Geschäftsführers angemessen zu berücksichtigen.

Fazit

Die Tantieme ist ein wirkungsvolles Instrument, um Geschäftsführer am Erfolg der GmbH zu beteiligen und Leistungsanreize zu setzen. Bei der Ausgestaltung sind jedoch einige rechtliche und vor allem steuerliche Aspekte zu beachten, um Risiken wie eine verdeckte Gewinnausschüttung zu vermeiden. Eine sorgfältige Vertragsgestaltung auf Basis klar definierter Zielparameter ist essenziell.

Gesellschafter und Geschäftsführer sollten sich ausreichend Zeit für die Erarbeitung einer individuell passenden Tantiemeregelung nehmen und dabei auch steuerlichen und rechtlichen Rat einholen. Mit einer durchdachten und präzise formulierten Tantiemevereinbarung steht einem motivierenden und zielorientierten Vergütungssystem nichts im Wege.

So kann die Tantieme dazu beitragen, die Interessen von Gesellschaft und Management in Einklang zu bringen und das volle Potenzial des Unternehmens auszuschöpfen.

Sie interessieren sich für eine GmbH-Veräußerung? Hier erfahren Sie mehr.