Employee Participation as a Succession Model in the SME Sector: Advantages, Challenges, and Success Factors

Employee participation is gaining importance as a succession solution in the SME sector. This article highlights the advantages of this innovative model, outlines challenges, and provides valuable tips for successful implementation.

Business succession presents significant challenges for many medium-sized companies. In the coming years, hundreds of thousands of small and medium-sized enterprises (SMEs) will need to find suitable successors. Often, there are no interested parties within the family, and the search for external candidates proves difficult. Against this backdrop, employee ownership models are gaining increasing importance as an innovative succession solution.

Employee Ownership: A Win-Win Situation

Transferring the company to committed employees offers many advantages. On one hand, competent managers familiar with the business can be retained. They gain the opportunity to become entrepreneurial themselves and participate in future success.

For the transferor, the often difficult search for an external buyer is eliminated. The handover process can be designed flexibly by transferring shares step-by-step. Additionally, the company’s identity is preserved, as long-standing employees carry its values and traditions into the future. This signals continuity to customers, suppliers, and other stakeholders.

Challenges and Success Factors

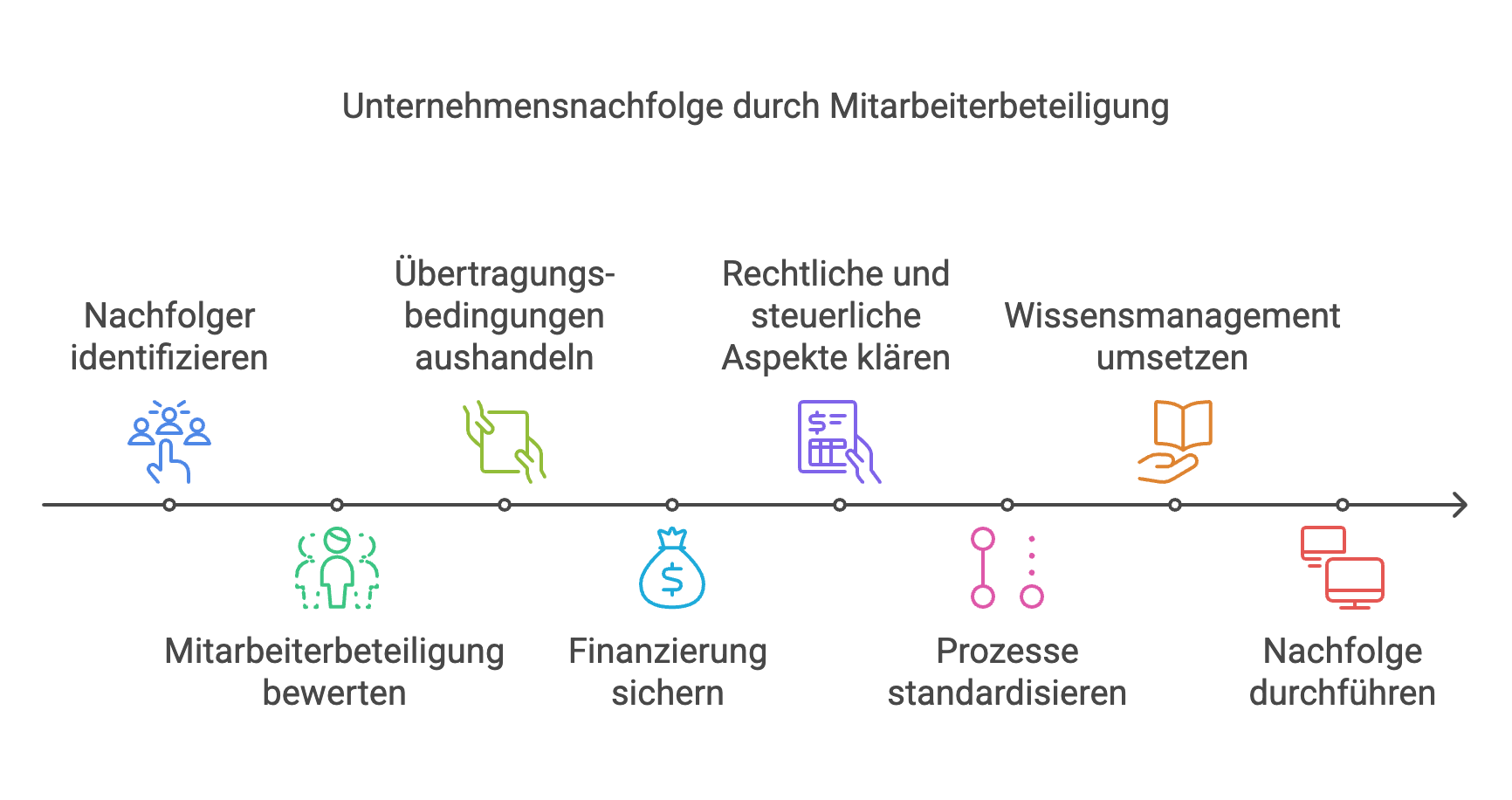

A careful selection process is crucial for success to identify the right candidates. In addition to professional qualifications, candidates must also be personally capable of assuming entrepreneurial responsibility. Equally important are attractive ownership terms that ensure a fair purchase price for the original owner.

Financing is usually achieved through a combination of equity and debt capital. Repayments can be made from ongoing earnings. Seller loans are also an option. Supportive measures include ERP funding programs or initiatives from regional economic development agencies.

To successfully manage business succession, long-term preparation is essential. This includes the development of a second management level, the standardization of processes and documentation, as well as effective knowledge management.

Legal and tax aspects must also be clarified early on—from the adjustment of corporate agreements to labor law issues and tax optimization.

Conclusion

Employee ownership opens up new perspectives for medium-sized companies in succession planning. With a structured process, careful planning, and professional support, this innovative model can be successfully implemented—creating a genuine win-win situation for transferors, employees, and the company itself.

Those wishing to explore the possibilities for their business should act early. A first step can be searching for suitable candidates through successor pools and marketplaces. With the right team, thorough preparation, and competent assistance, nothing stands in the way of a successful business succession through employee ownership.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO