Unternehmensverkauf: Verkaufsprospekt erstellen

Ein professionelles Verkaufsprospekt ist zentral für einen erfolgreichen Unternehmensverkauf. Dieser Artikel zeigt, wie Sie Ihr Exposé aufbauen, worauf es bei der Präsentation ankommt und wie Sie Datenschutz und Vertraulichkeit sicherstellen.

Warum ein professionelles Exposé so wichtig ist

Ein professionelles Verkaufsprospekt – häufig auch als Exposé oder Informationsmemorandum bezeichnet – ist weit mehr als nur eine nüchterne Auflistung von Zahlen und Fakten. Es ist der erste wirkliche Berührungspunkt zwischen Ihrem Unternehmen und potenziellen Käuferinnen oder Käufern, die sich mit dem Gedanken tragen, in Ihre Firma zu investieren oder diese vollständig zu übernehmen. In vielen Fällen entscheiden die ersten Eindrücke, ob sich eine Interessentin oder ein Interessent überhaupt weiter mit Ihrem Angebot beschäftigt. Ist das Dokument lieblos zusammengestellt, unstrukturiert oder unverständlich, wirkt dies abschreckend. Ein sorgfältig aufbereitetes Exposé hingegen vermittelt Professionalität, Glaubwürdigkeit und Weitsicht – Eigenschaften, die im Rahmen von Unternehmensverkäufen unersetzlich sind.

Die Bedeutung eines professionellen Exposés ergibt sich aus der Komplexität eines jeden Unternehmens. Interessierte möchten schnell und effizient erfassen, wie Ihr Geschäft funktioniert, worin Ihre Stärken liegen, welches Potenzial für Wachstum besteht und welche Risiken zu berücksichtigen sind. Wenn Sie all diese Informationen klar und nachvollziehbar präsentieren, erleichtern Sie potenziellen Käufern die Einschätzung, ob Ihr Unternehmen strategisch zu ihnen passt. Dies kann den gesamten Verkaufsprozess beschleunigen, weil langwierige Nachfragen oder Unsicherheiten reduziert werden. Ein gutes Exposé legt den Grundstein für eine offene, konstruktive Kommunikation und schafft ein Klima des Vertrauens, das in Verhandlungen von unschätzbarem Wert ist.

Gleichzeitig kann ein Exposé helfen, Missverständnisse frühzeitig aus dem Weg zu räumen. Wenn schon auf den ersten Seiten deutlich wird, wie sich Ihr Geschäft modelliert, welche Marktposition Sie einnehmen, welche Kundenkreise Sie bedienen und welche Finanzhistorie hinter Ihrem Erfolg steht, dann verstehen potenzielle Käufer viel schneller, was sie erwartet. Dies steigert nicht nur die Qualität der Gespräche, sondern auch deren Effizienz. Sie können den Fokus schneller auf zentrale Aspekte legen, etwa auf Synergien mit dem eigenen Portfolio oder strategische Wachstumschancen, anstatt sich in detailverliebten Nachfragen zu verlieren.

Darüber hinaus hat ein professionelles Exposé auch aus Ihrer Perspektive Vorteile: Es zwingt Sie, Ihr Unternehmen klar zu analysieren, sich mit seiner Vergangenheit, Gegenwart und Zukunft intensiv auseinanderzusetzen und damit ein noch besseres Verständnis für dessen Stärken, Schwächen und Potenziale zu gewinnen. Dieser Reflexionsprozess kann Ihnen auch unabhängig vom Verkauf helfen, strategische Entscheidungen bewusster zu treffen.

Kurzum: Ein professionelles Verkaufsprospekt ist ein Schlüsselelement, um den gesamten Verkaufsprozess effektiver, transparenter und letztlich erfolgreicher zu gestalten. Es dient als Visitenkarte Ihrer Professionalität, als Wegweiser für potenzielle Käufer und als Filter, um sicherzustellen, dass Sie mit wirklich geeigneten Kandidatinnen und Kandidaten in die Tiefe gehen. Wer diesen Schritt sorgfältig plant und umsetzt, legt eine solide Grundlage für alle weiteren Verhandlungen und schafft echte Mehrwerte – für beide Seiten.

Aufbau des Verkaufsprospekts

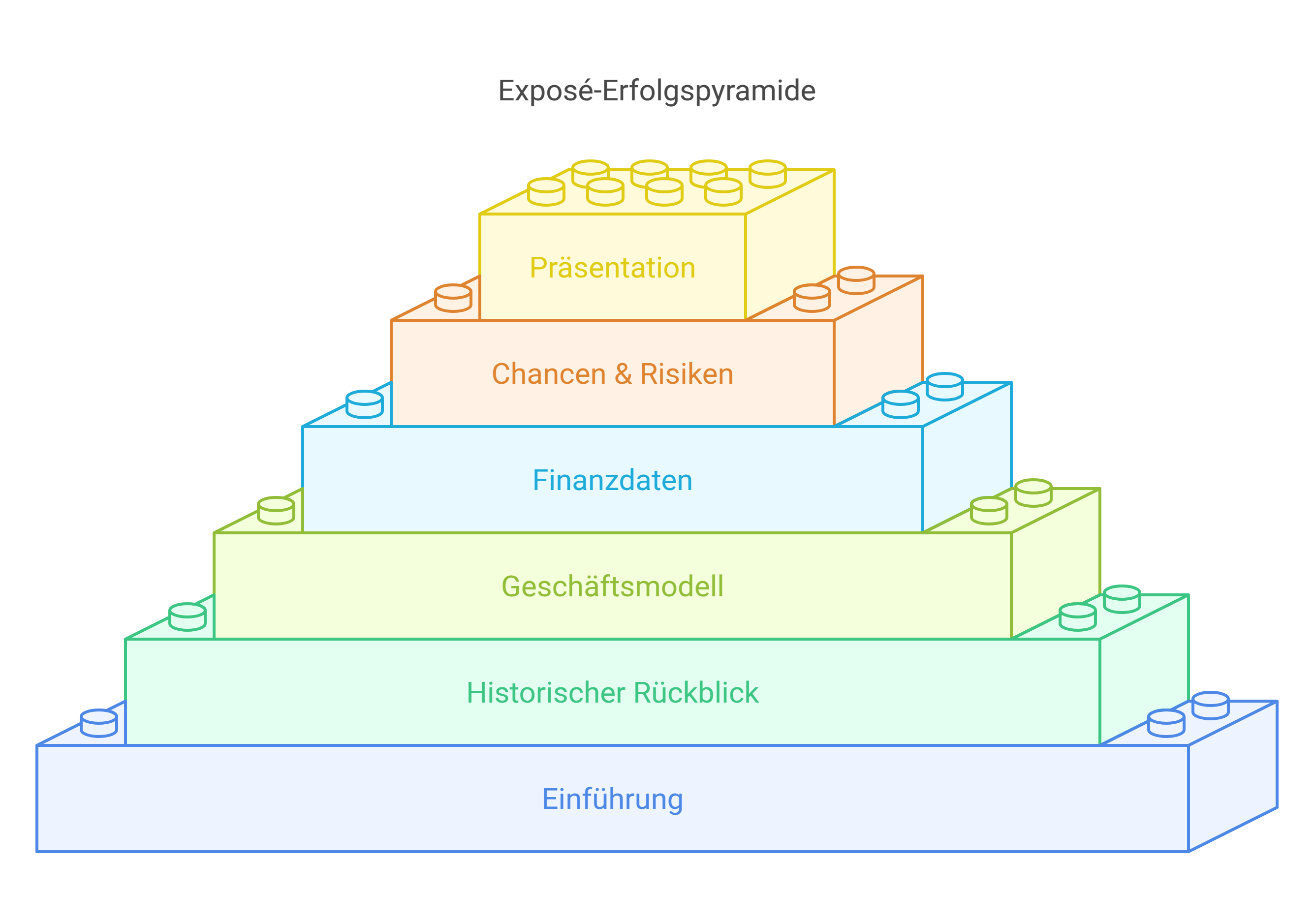

Der Aufbau eines Verkaufsprospekts sollte so gestaltet sein, dass potenzielle Käuferinnen und Käufer mit jedem Abschnitt ein zunehmend vollständigeres Bild Ihres Unternehmens erhalten. Ziel ist es, eine ausgewogene Mischung aus Übersichtlichkeit und Tiefgang zu finden. Ein gutes Exposé muss lesbar und nachvollziehbar sein, ohne jedoch Oberflächlichkeit mit Einfachheit zu verwechseln. Jede Sektion sollte ihren eigenen Schwerpunkt haben, dabei jedoch logisch auf die vorherigen Teile aufbauen. So ergibt sich ein roter Faden, der Interessierten zeigt: Dieses Unternehmen ist strukturiert, reflektiert und weiß, wovon es spricht.

Beginnen Sie in der Regel mit einer kurzen Einführung, die die Grundidee Ihres Geschäftsmodells, die Branche, in der Sie agieren, und die Kernprodukte oder -dienstleistungen vorstellt. Hier ist es sinnvoll, das Unternehmen in wenigen Sätzen auf den Punkt zu bringen: Was macht es besonders, was ist sein Alleinstellungsmerkmal? Anschließend bietet es sich an, einen kleinen historischen Rückblick zu geben. Erklären Sie, wie Ihr Unternehmen entstanden ist, welche Meilensteine Sie erreicht haben und wie sich Strukturen, Belegschaft sowie Führungsriege über die Zeit entwickelt haben. Das schafft Vertrauen und signalisiert Stabilität.

Im nächsten Schritt sollten Sie Ihr Geschäftsmodell detaillierter beleuchten. Beschreiben Sie Ihre wichtigsten Produkte, Dienstleistungen oder Technologien und zeigen Sie, wie diese Wert für Ihre Kunden schaffen. Dabei können ein paar Stichpunkte helfen, die einzelnen Leistungsbereiche übersichtlich darzustellen. Stellen Sie Ihre Kundensegmente und Marktposition vor, heben Sie auf, welche Vertriebskanäle Sie nutzen und welche Rolle Ihr Lieferantennetzwerk oder mögliche Kooperationspartner spielen. Hier ist die Gelegenheit, klarzumachen, was Ihr Unternehmen von anderen Wettbewerbern abhebt. Wenn Sie Daten zu Marktanteilen, Kundenzufriedenheit oder Wachstumsraten Ihrer Branche vorliegen haben, können Sie diese angemessen einfließen lassen, um Ihre Aussagen zu untermauern.

Ein umfangreicher, aber strukturierter Finanzteil bildet oft den Kern des Exposés. Präsentieren Sie hier historische Finanzkennzahlen, etwa die Entwicklung von Umsatz, EBITDA oder Cashflow, und geben Sie einen Ausblick auf die kommenden Jahre. Erklären Sie, welche Faktoren die Performance beeinflussen, wo Sie investiert haben und wo Sie künftig investieren wollen. Ein paar zusammenfassende Tabellen oder Diagramme können helfen, Komplexität zu reduzieren, und lassen sich gut mit begleitenden Erläuterungen kombinieren. Die Kunst besteht darin, präzise und transparent zu sein, ohne den Leser mit Detaildaten zu erschlagen.

Abgerundet wird das Exposé durch einen Abschnitt über Chancen, Risiken und strategische Perspektiven. Betrachten Sie künftige Entwicklungen auf dem Markt, mögliche Expansionspläne oder Innovationsschwerpunkte. Seien Sie dabei ehrlich: Auch Risiken gehören hierhin, seien es veränderte Regulierung, Konkurrenzdruck oder technologische Umbrüche. Ein bewusster Umgang mit Risiken signalisiert Professionalität und schafft Glaubwürdigkeit. Schließlich kann ein kurzer Überblick über die nächsten Schritte im Transaktionsprozess sinnvoll sein, sodass Interessierte wissen, was sie erwartet, wenn sie tiefer einsteigen wollen.

In Summe bietet der Aufbau des Verkaufsprospekts einen klaren Leitfaden: Vorstellung des Unternehmens, Historie, Geschäftsmodell, Finanzdaten, Marktumfeld, Chancen und Risiken, sowie Ausblick und Prozessinformationen. Durch diese logisch aufeinander aufbauenden Teile schaffen Sie eine narrative Linie, die es potenziellen Käuferinnen und Käufern ermöglicht, Ihr Unternehmen ganzheitlich zu verstehen und den Wert des Angebots besser einschätzen zu können.

Dos und Don'ts bei der Präsentation

Die Präsentation des Verkaufsprospekts ist weit mehr als nur das Überreichen eines PDF-Dokuments oder einer gebundenen Broschüre. Sie ist ein essenzieller Teil Ihres Kommunikationsprozesses mit potenziellen Käuferinnen und Käufern und trägt entscheidend dazu bei, wie seriös und überzeugend Ihr Angebot wahrgenommen wird. Ein gutes Exposé ist ansprechend gestaltet, inhaltlich gehaltvoll und gut strukturiert – doch die Art, wie Sie es "ins Schaufenster" stellen, ist mindestens genauso bedeutsam.

Zu den wichtigsten "Dos" gehört, dass Sie einen klaren, logischen Aufbau beibehalten und die Kernaussagen leicht erfassbar machen. Nutzen Sie Zwischenüberschriften, Hervorhebungen und gelegentlich ein paar Stichpunkte, um komplexe Informationen zu gliedern. Eine harmonische Farbwelt, eine gut lesbare Schrift und dezente Grafiken vermitteln Professionalität. Besonders hilfreich sind sorgfältig aufbereitete Diagramme, beispielsweise zur Entwicklung der Umsätze oder der Aufteilung nach Geschäftsbereichen. Sie sollten jedoch stets aussagekräftig sein und nicht nur als bloßer Schmuck dienen.

Ein weiteres "Do" ist es, auf die Verständlichkeit zu achten. Technische Details oder branchenspezifischer Fachjargon haben ihren Platz, sollten aber erklärt werden, sofern nicht klar ist, ob die Adressaten diesen kennen. Ein Verkaufsprospekt soll kein literarischer Hochgenuss sein, sondern die Zielgruppe informieren und begeistern. Wenn Sie Zweifel haben, ob ein Textabschnitt verständlich genug ist, testen Sie ihn an unbeteiligten Dritten: Verstehen diese, was Sie meinen, und können sie die wesentlichen Aussagen in eigenen Worten wiedergeben?

Transparenz gehört ebenfalls zu den wichtigsten Geboten. Potenzielle Käuferinnen und Käufer reagieren sehr empfindlich auf Widersprüche, Ungereimtheiten oder offensichtliche Beschönigungen. Erwähnen Sie daher auch weniger glänzende Aspekte, ohne dabei überkritisch aufzutreten. Ehrlichkeit schafft Vertrauen, und wer glaubwürdig ist, gewinnt in Verhandlungen einen wertvollen Vorteil. Zugleich ist es hilfreich, Ihrer Darstellung einen roten Faden zu geben, der aufzeigt, warum Ihr Unternehmen eine gute Investition ist. Legen Sie nahe, wie sich der Geschäftsbetrieb in bestehende Strukturen eines Interessenten integrieren oder ideal erweitern lässt.

Zu den "Don'ts" zählt etwa, den potenziellen Käufer mit irrelevanten Details zu überfrachten. Unübersichtliche Tabellen mit Dutzenden von Kennzahlen, die nicht erklärt werden, verwirren eher, als dass sie helfen. Ebenso schädlich ist ein reißerischer Tonfall, der als plumpe Verkaufsmasche enttarnt wird. Vermeiden Sie es, nur in Superlativen zu sprechen, und präsentieren Sie keine unrealistischen Wachstumsversprechen. Auch eine zu starke Abkapselung ist kontraproduktiv: Wer alles streng geheim hält und kaum Informationen preisgibt, erzeugt Misstrauen.

Ebenfalls ungünstig ist ein inkonsistentes Erscheinungsbild. Wenn Sie fünf verschiedene Schriftarten und wild wechselnde Grafiken verwenden, entsteht kein stimmiges Gesamtbild, sondern Chaos. Auch die Reihung der Inhalte sollte logisch bleiben. Ein sprunghafter Wechsel von Thema zu Thema signalisiert mangelnde Vorbereitung.

Kurzum: Ein Verkaufsprospekt sollte nicht nur inhaltlich überzeugen, sondern auch gestalterisch und sprachlich. Betrachten Sie es als eine Visitenkarte Ihrer Professionalität, in der Sie Klugheit, Transparenz und Weitsicht demonstrieren. Wenn Sie dabei die richtigen Dos und Don'ts beachten, erhöhen Sie massiv die Wahrscheinlichkeit, dass potenzielle Käuferinnen und Käufer mit Interesse weiterlesen, konkrete Fragen stellen und letztlich seriös in Verhandlungen eintreten.

Datenschutz und Vertraulichkeit

Datenschutz und Vertraulichkeit sind im Kontext eines Unternehmensverkaufs keine bloßen rechtlichen Nebenaspekte, sondern entscheidende Faktoren für das Gelingen des gesamten Prozesses. Ein Exposé gibt in der Regel tiefe Einblicke in Ihr Unternehmen – von Finanzdaten über Kundenstrukturen bis hin zu strategischen Planungen. Wenn solche Informationen in falsche Hände geraten oder ohne Ihre Kontrolle weiterverbreitet werden, kann das schwerwiegende Konsequenzen haben: von Imageschäden bis hin zu negativen Auswirkungen auf bestehende Kundenbeziehungen oder den Wettbewerbsvorteil.

Um dieses Risiko zu minimieren, sollten Sie von Anfang an klare Regeln für den Umgang mit sensiblen Informationen festlegen. Ein zentraler Schritt ist der Abschluss einer Vertraulichkeitsvereinbarung (Non-Disclosure Agreement, NDA), bevor Sie das Exposé an Interessentinnen und Interessenten herausgeben. Dieses Dokument verpflichtet die Empfänger dazu, die erhaltenen Informationen ausschließlich zum Zwecke der Prüfung des potenziellen Erwerbs zu nutzen und nicht an Dritte weiterzugeben. Dadurch erhalten Sie eine gewisse rechtliche Absicherung, falls es zu Missbrauch kommen sollte.

Darüber hinaus ist es ratsam, besonders sensible Daten nur selektiv und in späteren Phasen des Prozesses herauszugeben, wenn sich herauskristallisiert, dass ein ernsthaftes Kaufinteresse besteht. Nicht alle Informationen müssen sofort offengelegt werden. Zu Beginn reichen häufig anonymisierte Kundenlisten, aggregierte Finanzdaten und allgemeine Marktinformationen. Erst wenn die Verhandlungen fortschreiten, können Sie Zug um Zug weitere Details preisgeben. Dies minimiert das Risiko, dass vertrauliche Informationen nach außen dringen, ohne dass ein konkreter Nutzen für den Verkaufsprozess entsteht.

Moderne digitale Datenräume bieten zusätzliche Sicherheitsmechanismen. Sie ermöglichen Ihnen, den Zugriff auf Dokumente genau zu steuern, nachzuvollziehen, wer wann welche Inhalte eingesehen hat, und bei Bedarf den Zugang wieder zu entziehen. Auch eine Verschlüsselung sensibler Dokumente ist möglich, ebenso wie Wasserzeichen oder eingeschränkte Druck- und Downloadrechte. Auf diese Weise behalten Sie stets die Kontrolle über Ihre Informationen.

Achten Sie zudem auf die Einhaltung von Datenschutzgesetzen wie der DSGVO. Wo personenbezogene Daten ins Spiel kommen, müssen Sie sicherstellen, dass deren Verarbeitung rechtlich zulässig ist und die nötigen Informationspflichten erfüllt werden. Ein Verstoß gegen diese Vorgaben kann empfindliche Strafen zur Folge haben und ist zudem ein schlechtes Signal an potenzielle Käufer, dass Sie nicht sorgfältig genug sind.

Letztlich dient die Wahrung von Vertraulichkeit und Datenschutz auch als Signal: Sie zeigen potenziellen Käufern, dass Sie verantwortungsvoll und gewissenhaft mit Ihrem unternehmerischen Know-how umgehen. Das erhöht das Vertrauen in Sie als Geschäftspartner und steigert die Wertschätzung für Ihr Unternehmen. Ein strukturiertes, gut durchdachtes Vorgehen in Sachen Geheimhaltung ist daher kein lästiges Muss, sondern ein zentraler Qualitätsfaktor, der zum Gelingen des gesamten Verkaufsprozesses beiträgt.

Fazit

Ein professionell erstelltes Verkaufsprospekt ist weit mehr als nur ein Instrument, um potenzielle Käuferinnen und Käufer über Ihr Unternehmen zu informieren. Es ist ein strategisches Werkzeug, das dazu beiträgt, Interesse zu wecken, Vertrauen aufzubauen und den Wert Ihres Unternehmens klar aufzuzeigen. Wenn Sie den Aufbau des Exposés mit Bedacht wählen, inhaltliche Schwerpunkte sinnvoll setzen und dabei auf eine ansprechende, nachvollziehbare Präsentation achten, schaffen Sie beste Voraussetzungen für ein konstruktives Miteinander im weiteren Verkaufsprozess.

Die Bedeutung eines klug gestalteten Exposés wird vor allem dann deutlich, wenn man bedenkt, wie komplex und zeitaufwändig ein Unternehmensverkauf sein kann. Mit einem durchdachten Dokument, das strukturiert über Historie, Geschäftsmodell, Finanzdaten, Marktumfeld, Chancen und Risiken informiert, ersparen Sie allen Beteiligten unnötige Nachfragen. Dadurch können sich Interessentinnen und Interessenten rasch ein Bild von Ihrem Unternehmen machen, was ihre Entscheidung, in weitere Gespräche einzusteigen, deutlich erleichtert. Gleichzeitig signalisieren Sie damit Professionalität, was in Verhandlungen ein entscheidender Vorteil sein kann.

Besonders wichtig ist, dass Sie auch die "weichen" Faktoren im Blick behalten: Ein verständlicher, menschlich klingender Schreibstil, eine klare Bildsprache in Infografiken und Tabellen sowie gelegentliche Stichpunkte, um Kerninformationen hervorzuheben, helfen dabei, die Inhalte leichter erfassbar zu machen. Übertriebene Geheimniskrämerei oder ein rein werblicher Tonfall wirken hingegen abschreckend. Stattdessen sollten Sie Offenheit, Authentizität und Glaubwürdigkeit in den Vordergrund stellen.

Auch Datenschutz und Vertraulichkeit sollten Sie als festen Bestandteil in Ihre Überlegungen einbeziehen. Mit NDAs, sicheren Datenräumen und einem durchdachten Rollout der Informationen zeigen Sie Verantwortungsbewusstsein. Diese Sorgfalt signalisiert potenziellen Käufern, dass Sie auch in der gemeinsamen Zukunft gewissenhaft und verlässlich agieren werden.

Letztlich ist das Exposé aber nur ein Schritt im Gesamtprozess. Es ist eine Grundlage, auf der persönliche Gespräche, vertiefte Due-Diligence-Prüfungen und abschließende Verhandlungen aufbauen können. Das Ziel ist es, eine Atmosphäre des gegenseitigen Respekts und des Verständnisses zu schaffen, in der beide Seiten mit klarem Blick auf die Chancen und Herausforderungen in den Transaktionsprozess gehen. Wer beim Erstellen des Exposés Sorgfalt, Klarheit und Offenheit walten lässt, ebnet den Weg für einen erfolgreichen Unternehmensverkauf, der nicht nur finanziell, sondern auch strategisch ein Gewinn für alle Beteiligten sein kann.

Artur Morozas

Co-Founder & CEO

Für Artur, Geschäftsführer von viaductus, ist die Nachfolge im deutschen Mittelstand ein Herzensthema. Nach seinem Studium an der Technischen Unversität München gründete er viaductus, um Unternehmen und Unternehmer zu unterstützen, erfolgreich den Übergang in die nächste Generation zu ermöglichen.

Über den Autor

Artur Morozas

Co-Founder & CEO