How to Identify Untrustworthy Prospective Buyers

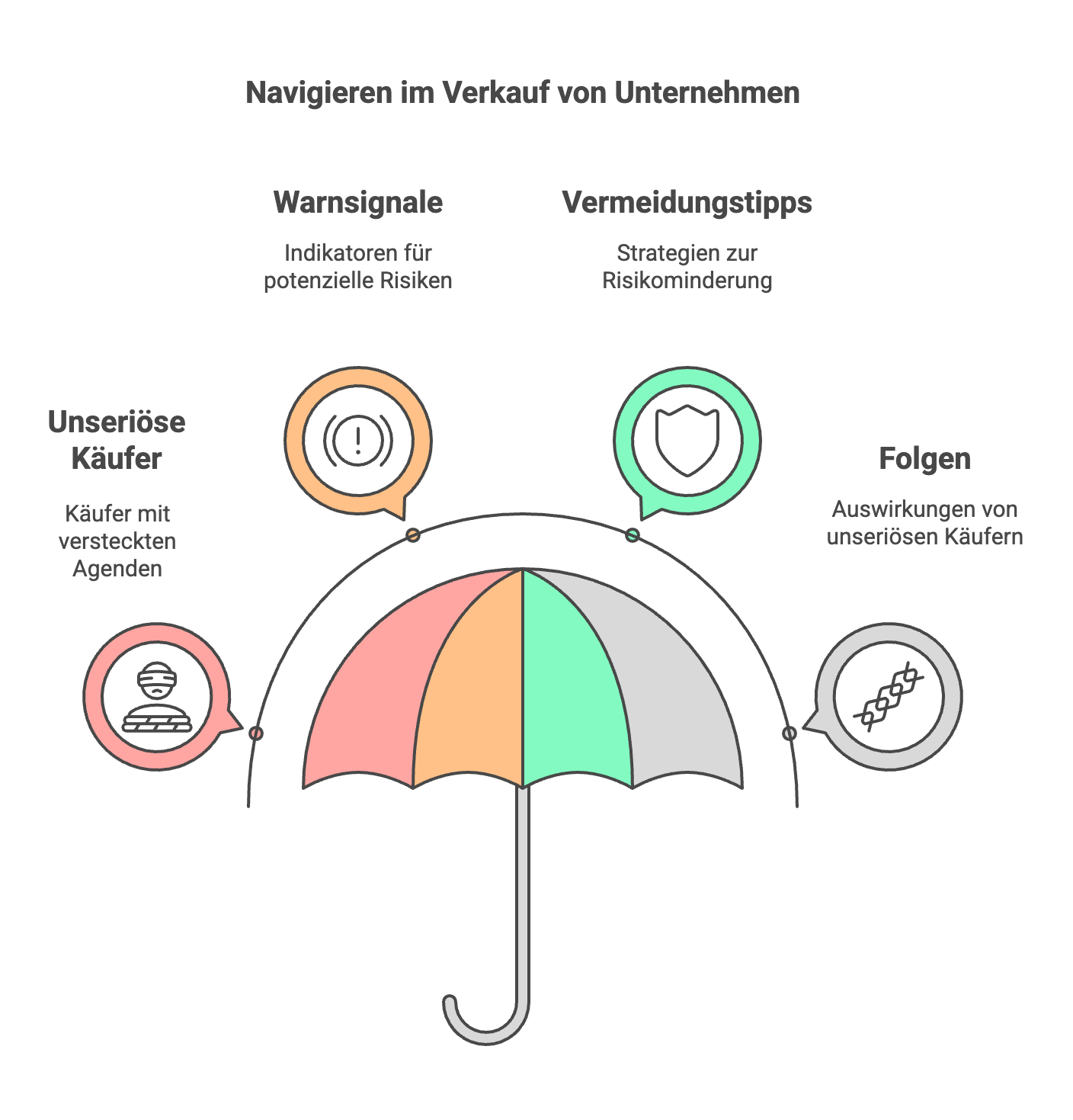

The sale of a company is a complex process that requires careful planning and the selection of the right buyer. Untrustworthy prospective buyers can significantly disrupt this process and, in the worst case, lead to financial losses, wasted time, and reputational damage. This guide article helps you recognize and avoid untrustworthy prospective buyers.

Selling a business is a complex process that requires careful planning and selecting the right buyer. Untrustworthy prospective buyers can significantly disrupt this process and, in the worst case, lead to financial losses, wasted time, and damage to your reputation. This guide article helps you identify and avoid untrustworthy buyers.

What Are Untrustworthy Prospective Buyers?

Untrustworthy prospective buyers are individuals or companies who claim to be interested in purchasing a business but actually pursue other objectives. These objectives may include:

- Data gathering: They want to obtain confidential information about your company to use it for their own purposes or to sell it to competitors.

- Wasting time: They have no genuine interest in buying but merely want to stall or sabotage the sales process.

- Fraud: They attempt to gain financial advantages through deception or false promises.

Examples of untrustworthy behavior include unrealistic offers, unclear sources of financing, lack of interest in due diligence, excessive confidentiality demands, or aggressive negotiation tactics. Additionally, there are fraudsters who pose as prospective buyers to access sensitive data or money. One common scam involves pretending there are bank fees for transferring the purchase price and asking the seller to cover these costs.

Warning Signs of Untrustworthy Prospective Buyers

Several warning signs may indicate untrustworthy buyers. Pay particular attention to the following:

-

Unrealistic offers: An offer significantly above market value can be a sign that the buyer is not serious. They might be trying to lure you with an inflated price only to later push for a price reduction or other concessions.

-

Unclear financing sources: A buyer who cannot clearly explain their financing or makes it dependent on unrealistic conditions should be treated with caution. They may not have the necessary funds to pay the purchase price.

-

Lack of interest in due diligence: A serious buyer will be keen to thoroughly review your company (due diligence). If a buyer shows no interest in relevant documents or asks no questions, this may indicate a lack of seriousness.

-

Excessive confidentiality demands: Non-disclosure agreements are common in business sales. However, if a buyer demands excessive secrecy beyond protecting sensitive data, this could be an attempt to misuse information to your detriment. Examples include requesting detailed financial data before a letter of intent is signed or seeking extensive access to customer relationships and operational processes without a concrete purchase interest.

-

Aggressive negotiation behavior: A serious buyer typically negotiates fairly and respectfully. Aggressive behavior, threats, or constant pressure can signal untrustworthy intentions.

Untrustworthy buyers often exploit sellers’ inexperience and time pressure. Therefore, it is important to carefully scrutinize offers and demands and seek professional advice if in doubt.

Tips to Avoid Untrustworthy Prospective Buyers

To avoid untrustworthy buyers, consider the following tips:

-

Thorough research: Conduct detailed research on the potential buyer. Check their financial situation, business activities, and reputation.

-

Request references: Ask the buyer for references and contact them. Speak with former business partners to learn more about the buyer’s credibility.

-

Clear communication of expectations: Clearly communicate your expectations for the sales process and the buyer. Establish early on which criteria are important to you and which points are non-negotiable (deal breakers).

-

Work with experienced advisors: Engage experienced advisors such as lawyers, tax consultants, or business consultants. They can help you manage the sales process professionally and identify untrustworthy buyers.

-

Trust your instincts: If you have a bad feeling about a prospective buyer, proceed with caution. Trust your intuition and, if necessary, terminate negotiations.

Consequences of Working with Untrustworthy Prospective Buyers

Collaborating with untrustworthy buyers can have serious consequences:

-

Loss of time: Negotiations with untrustworthy buyers can consume a lot of time that you need for other important business tasks. In the worst case, negotiations fail after months of discussions, forcing you to restart the sales process.

-

Financial risks: Untrustworthy buyers may try to lower the purchase price, delay payments, or fail to pay altogether. In the worst case, you could be left with significant costs or even lose your business.

-

Damage to reputation: Failed negotiations or an unfavorable sale can harm your company’s reputation. This can negatively affect customer relationships, employee motivation, and future business prospects.

-

Cyberattacks: Fraudsters may use fake purchase interest to introduce malware into your systems. This can lead to access to sensitive data used for extortion, identity theft, or sabotage of your company.

Conclusion

Selling a business is a major decision with far-reaching consequences. Choosing the right buyer is crucial for the success of the sales process and the future of your company. By recognizing the warning signs of untrustworthy buyers and following the tips in this guide, you can minimize the risk of dealing with an unreliable buyer.

Stay vigilant, carefully review offers and demands, and do not let yourself be pressured. When in doubt, seek professional assistance to protect your interests and ensure a successful business sale. A wrong decision in buyer selection can cost you not only time and money but also the reputation and future viability of your company.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO