Company Sale 2025: These 7 Things Must Be Considered

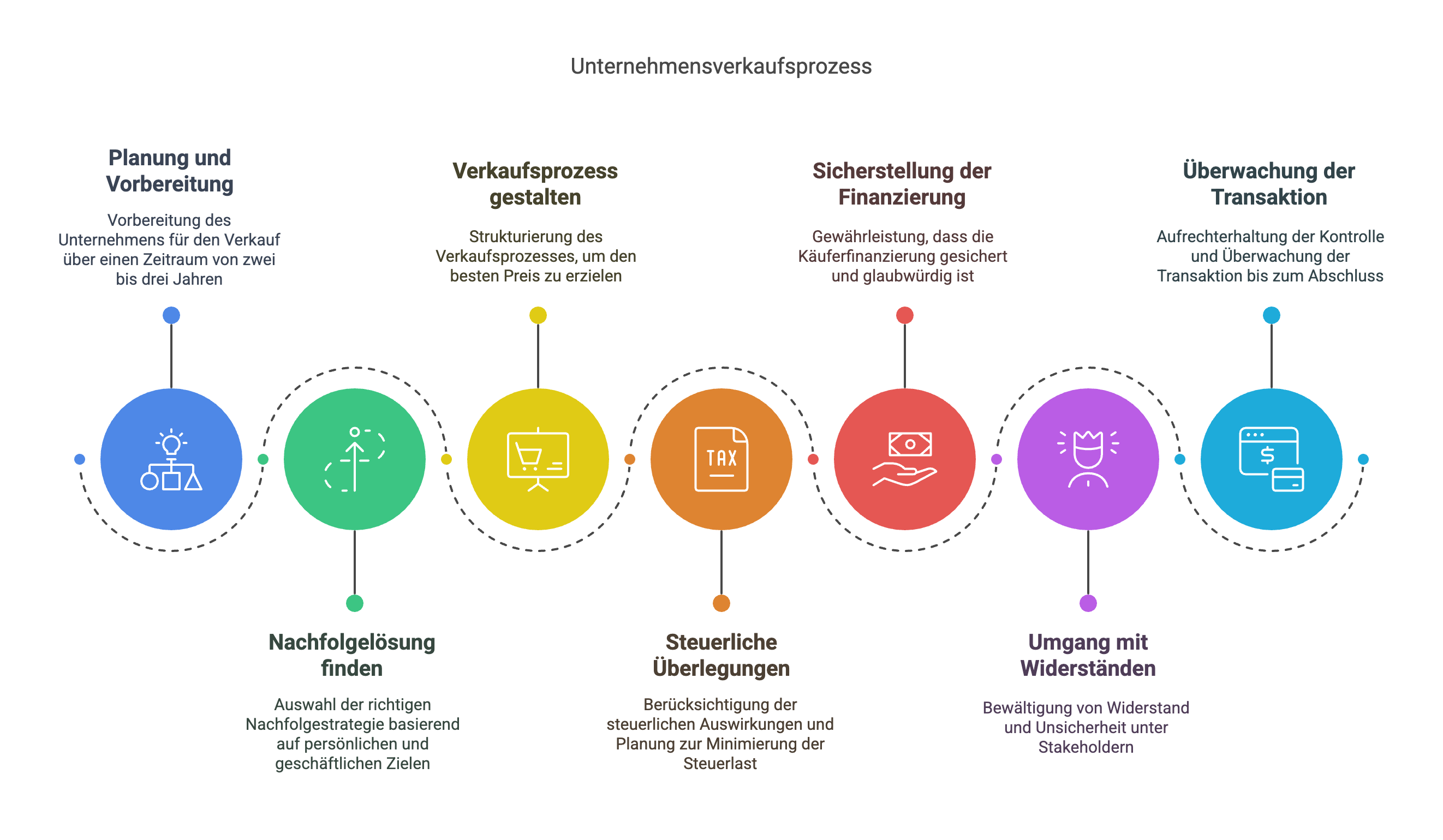

If you plan to sell your company in 2025, you should consider these 7 things. From early planning to the process.

Are you planning to sell your company in 2025? You are not alone. Many entrepreneurs will face this issue in the coming years, whether due to age, lack of succession, or strategic considerations. However, the sales process requires careful preparation. We will show you what to pay attention to in order to successfully sell your life's work and achieve the best possible price.

1. Plan and Prepare Early

A company sale is not a sprint but a marathon. Experts recommend allowing at least two to three years for preparation. Use this time to make your company ready for sale:

- Optimize processes and structures

- Ensure a solid earnings and financial position

- Identify and address weaknesses

- Develop a compelling equity story

A professional business valuation can provide valuable insights into where your company stands and which levers you can still adjust.

2. Find the Right Succession Solution

Whether it’s an internal transfer within the family, a management buyout (MBO), or a sale to a strategic investor — each succession solution has its advantages and disadvantages. Consider early on which path is right for you, your family, and your company.

Take into account not only financial aspects but also your personal goals and values. Perhaps it is important to you that your life’s work remains in the family or that the company’s headquarters are preserved? Or you want to engage socially and donate part of the sales proceeds? All of these factors play a role in choosing the appropriate succession model.

3. Conduct the Sales Process Professionally

A structured, competitive sales process is key to achieving the best possible price for your company. This includes, among other things:

- Creating compelling sales documents

- Identifying and approaching suitable potential buyers

- Conducting professional due diligence

- Negotiating purchase price and contract terms

Bring experienced M&A advisors on board early to guide you through the complex process. This investment usually pays off many times over.

4. Consider Tax Implications

The tax consequences of a company sale should not be underestimated. Depending on the legal form, sales structure, and personal situation, significant tax payments may be due. However, with clever tax planning, taxes can often be minimized and the net proceeds optimized.

For example, check whether you can benefit from exemptions and tax incentives. The timing of the sale and the allocation of the purchase price can also provide tax advantages. Your tax advisor will recommend the appropriate strategy.

5. Secure Financing

Buyers today are more demanding than ever when it comes to financing company acquisitions. Prepare for potential buyers to expect reliable financial plans, solid collateral, and a convincing business model from you.

As a seller, you can support financing by offering seller loans, preparing your company for funding programs, or enabling the buyer to take over gradually. The better the financing is secured, the smoother and faster the sale can be completed.

6. Manage Resistance

Not everyone involved will always be happy about the planned company sale. Long-standing employees or family members often react with uncertainty or rejection to the news.

This calls for sensitivity, transparency, and clear communication. Involve key stakeholders early, listen to their concerns and wishes, and show appreciation. Initial resistance can often be overcome if those affected have the opportunity to actively participate in the process.

7. Trust is Good, Control is Better

Signing the purchase agreement does not mean the money is already in your account. Especially with complex transactions, many things can go wrong—from buyer financing difficulties to antitrust clearance issues to unexpected liability claims.

To avoid unpleasant surprises, remain vigilant until the very end. Secure important commitments contractually, agree on guarantees and indemnities, and keep an eye on incoming payments. Again, professional support from experienced transaction lawyers is invaluable.

Conclusion

Selling your own company is probably one of the greatest entrepreneurial challenges there is. It requires careful preparation, professional process management, and not least a good measure of personal detachment.

However, if you consider the points mentioned and bring the necessary expertise and the right partners on board, nothing stands in the way of a successful transaction. In the end, you will not only receive an attractive sales price but also the satisfaction of having entrusted your life’s work to good hands.

So: Use the remaining time to make your company fit for the future and the sale. With the right strategy and a healthy dose of composure, you will master this challenge—and soon be able to devote yourself to new goals and projects.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO