Business Succession Instead of Start-Up: The Smart Path to Self-Employment

Discover why taking over an existing business is often a better alternative to starting a new one. This guide highlights the advantages, challenges, and key steps involved in business succession.

When people think of starting a business, they usually picture something specific: an innovative business idea, a dynamic team, a garage as the birthplace of the company. However, there is another path to self-employment that is often overlooked: business succession. Especially in the mid-sized sector, taking over an established company offers many advantages compared to starting a new business.

Why Consider Succession?

The number of companies seeking successors is high. Many owners of small and medium-sized enterprises are approaching retirement and have no family successor. For entrepreneurs, this presents an attractive opportunity: instead of starting from scratch, they can build on a solid foundation.

The advantages are clear:

-

Established Market Position: An existing company has already built a customer base and a reputation in the industry. The successor can build on this and does not have to start from zero.

-

Experienced Team and Processes: When taking over a company, you also take on an experienced team and proven workflows. This saves time and resources that would otherwise need to be invested in building these from the ground up.

Learn more about the advantages of succession compared to a startup in our article on Succession as a Driver of Innovation.

-

Immediate Revenue: An ongoing business generates revenue from day one. The successor does not have to wait months for the first income but has a solid financial base right from the start.

-

Lower Risk: Starting a new business always involves uncertainties. Will the product be accepted by the market? Will the business model be viable? In a takeover, these questions have already been positively answered.

Of course, succession also brings challenges. The handover process must be carefully planned and managed. Corporate culture and customer relationships need to be transferred with care. However, with the right preparation and support, these hurdles can be overcome.

How to Find the Right Company?

The first step toward succession is finding the right company. There are several ways to do this:

-

Personal Network: Many takeovers arise from personal contacts. Those well connected in an industry often hear early about companies seeking successors.

-

Business Marketplaces: There are specialized platforms where companies looking for successors are listed. Learn more about the pros and cons of business marketplaces in our detailed guide.

-

Chambers and Associations: Chambers of commerce and industry as well as trade associations often have information about companies available for takeover. Specialized succession advisors can also assist in the search.

-

Direct Approach: Sometimes it’s worthwhile to approach companies directly, even if they are not officially for sale. Owners are often open to discussions, even if they are not actively looking.

When selecting a company, various criteria must be considered: Does the industry fit your skills and interests? Is the chemistry right with the current owner? What is the company’s financial situation? A thorough analysis and evaluation are indispensable.

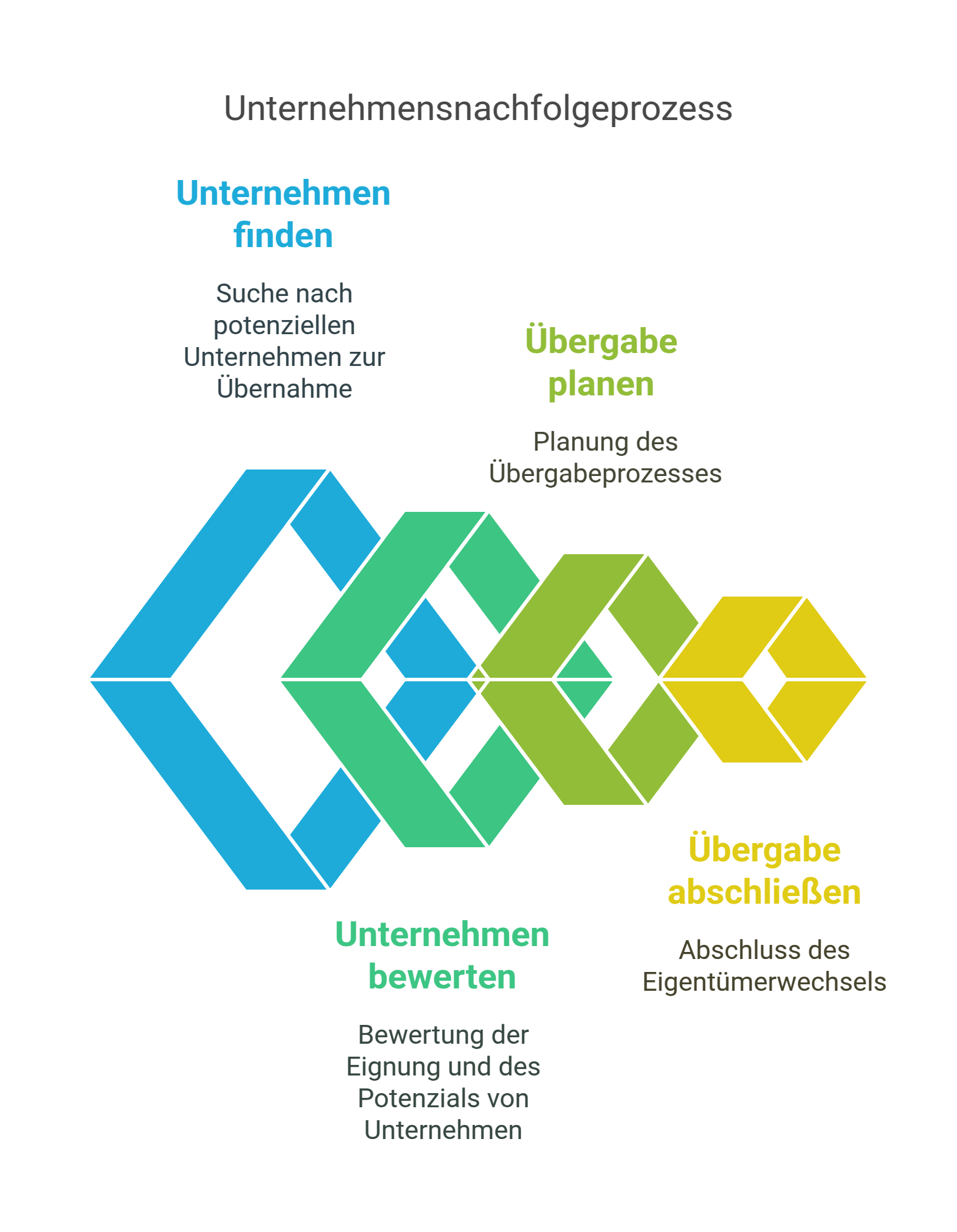

How to Manage the Handover Process?

Once the right company is found, the actual handover process begins. This should be carefully structured and accompanied, ideally with the support of experienced advisors.

Key steps include:

-

Getting to Know Each Other: In intensive discussions, the seller and buyer get to know each other. The goal is to build trust and align expectations and visions.

-

Due Diligence: A thorough examination of all relevant aspects of the company takes place — from finances and contracts to employees.

-

Price Negotiation: Based on due diligence and a solid company valuation, the purchase price is negotiated. This often requires tact and sensitivity.

-

Contract Drafting: The handover process is formalized in a detailed contract. This covers not only the purchase price but also issues such as non-compete clauses, transition periods, and employee commitments.

-

Integration and Communication: After the legal transfer, the real integration work begins. This includes involving employees, informing customers and suppliers, and adjusting processes and structures.

Depending on complexity, a handover process can take several months or even years. A phased takeover, where the former owner remains available as a consultant or mentor for a period, has proven effective in many cases.

Conclusion

Business succession is often an underestimated but highly attractive option for entrepreneurs. It offers the chance to build on a stable foundation and benefit from the experience and customer base of an established company.

At the same time, it is a sustainable solution for the mid-sized sector. Through succession, years of accumulated know-how are preserved, jobs are secured, and the economic strength of the region is reinforced.

However, succession is not a given. It requires careful planning, thorough preparation, and professional support. Those who take on and master this challenge have a good chance of realizing their entrepreneurial dream — and successfully continuing the predecessor’s legacy.

Are you considering business succession or looking for a successor for your own company? We are happy to support you in this exciting process. Schedule a non-binding initial consultation with our experts and let’s set the course for a successful future together.

Artur Morozas

Co-Founder & CEO

For Artur, Managing Director of viaductus, succession in the German SME sector is a topic close to his heart. After studying at the Technical University of Munich, he founded viaductus to help companies and entrepreneurs successfully transition to the next generation.

About the author

Artur Morozas

Co-Founder & CEO