Employee Participation as a Succession Model for SMEs

Business succession poses significant challenges for many small and medium-sized enterprises. This article explores employee participation as an innovative and promising solution to the succession problem.

The future of the German SME sector faces a significant challenge. In the coming years, hundreds of thousands of small and medium-sized enterprises (SMEs) will need to find a succession solution. Estimates suggest that by 2026, approximately 190,000 owners plan to retire from their business activities due to age. In total, around 600,000 SMEs are seeking suitable successors.

The problem is that many of these companies, often successful family businesses with decades of tradition, have no concrete succession plans. According to a study by KfW, almost 60% of successions expected in the next five years are still completely unresolved. Without a successor, businesses face closure, with corresponding consequences for jobs and value creation.

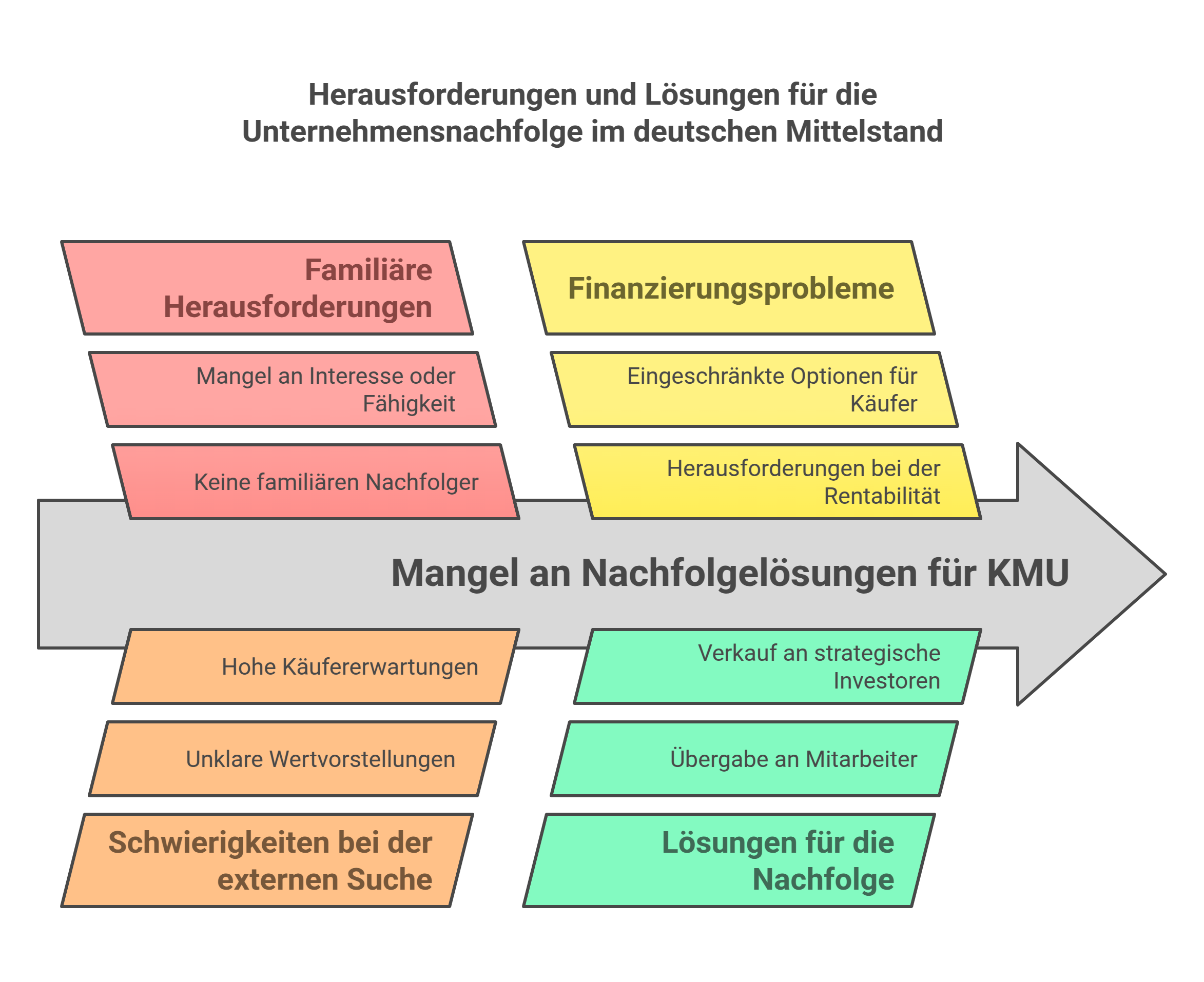

The causes of this succession problem are varied. Often, there are no longer any interested family members willing or able to continue the business. At the same time, finding external successors proves difficult. Reasons include unclear perceptions of the company's value by the current owners, high expectations from potential buyers regarding profitability, or lack of financing options.

Given this situation, new, creative approaches to business succession are needed. Three possible options that are gaining increasing importance in practice are:

- Gradual transfer to an external successor

- Sale to a strategic investor

- Transfer to the employees

Gradual Transfer to an External Successor

In a gradual transfer to an external successor, the successor is initially employed as a manager and given the opportunity to familiarize themselves with and prove themselves in the company. Over several years, they gradually acquire shares until they hold the majority. This allows the previous owner to gradually withdraw from the operational business. Advantages include continuity in leadership and the opportunity for the transferor to actively accompany the takeover process. The challenge lies in finding a suitable successor whom the previous owner trusts and who can raise the financial means for the share acquisition.

Sale to a Strategic Investor

Selling to a strategic investor, such as a larger company from the same industry, is another option. Advantages for the seller include an immediate influx of liquidity and complete release from responsibility. For employees and the company, a strong partner can open up opportunities, such as through synergies or additional resources. Risks include the potential disbandment or relocation of the company and the loss of independence.

Transfer of the Company to Employees

A third option is transferring the company to employees, for example, through employee participation. This approach has gained significant importance in recent years and offers many advantages. For one, committed and familiar executives can be retained and tied to the company. They are given the chance to engage in entrepreneurial activities themselves and benefit from future value increases.

For the transferor, the often difficult search for an external buyer is eliminated. Additionally, they can flexibly and gradually design the transfer process by gradually transferring shares to employees and thus successively withdrawing from leadership responsibilities. Financing is either through employees' own funds or a combination of debt and equity, with repayment from ongoing earnings.

An important advantage of employee transfer is the preservation of the company's identity and culture. Long-term employees know the strengths, values, and traditions of the company and carry them into the future. For customers, suppliers, and other stakeholders, an internal succession solution signals continuity and stability. At the same time, new opportunities arise to further develop structures and processes and bring new momentum to the company.

Crucial to the success of employee participation as a succession model is a careful selection process to identify the right candidates. In addition to professional qualifications and leadership potential, they must also be characteristically and personally capable of taking on entrepreneurial responsibility. Equally important is the design of participation conditions, which must be attractive to employees while ensuring a fair purchase price for the previous owner.

Overall, it is evident that employee participation as a succession model is an innovative and promising option for SMEs, gaining importance in light of demographic changes and the intensifying succession problem. It allows committed employees to become entrepreneurs themselves, creating a double win-win situation: for the previous owner, who knows their life's work is in good hands, and for the employees, who face an entrepreneurial future. Those who wish to explore the possibilities of this model for their company should do so early and with expert advice.

Sources:

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO