M&A Advisors as Strategic Partners: How Sellers Benefit from Professional Support

For business sellers, collaborating with an experienced M&A advisor is a critical success factor. This comprehensive article highlights the diverse advantages of professional guidance throughout the sales process and offers valuable tips for optimizing the transaction.

The sale of a company is a unique and often challenging event for most entrepreneurs. To optimally manage the complex process and achieve the best possible outcome, the support of a specialized M&A advisor is invaluable. This article demonstrates how sellers can benefit from the expertise and resources of professional advisors.

Strategically Prepare the Sales Process

Thorough preparation is the key to a successful business sale. M&A advisors assist sellers in making their company "sale-ready" and maximizing its value. This initially involves a comprehensive analysis of the company to identify strengths, weaknesses, and optimization potential.

An important aspect is the choice of the appropriate legal form. Depending on the initial situation, a change of legal form from GmbH to AG may be advisable to make the company more attractive to potential buyers. The use of holding structures or the incorporation of a foreign holding can also offer advantages depending on the circumstances.

Additional levers to increase value include optimizing documentation and processes, standardizing workflows, and establishing a second management level. Early clarification of issues such as the protection of IP and trademark rights or labor law matters also creates security for buyers and enhances the attractiveness of the acquisition target.

Realistically Determine Company Value

A central task in the sales process is determining a market-appropriate company value. Only on this basis can the seller develop realistic price expectations and negotiate confidently. M&A advisors are experts in company valuation and are familiar with the relevant influencing factors and valuation methods.

In addition to classic methods such as the DCF method or the multiple method, they also consider non-financial factors such as market position, innovation strength, and management quality. Equally important is the consideration of the market environment and relevant comparable transactions.

A professional company valuation by an M&A advisor protects sellers from typical mistakes such as an overly emotional price expectation or the use of incomplete financial data. Instead, they receive a solid and objective basis for pricing and negotiation.

Identify and Approach Suitable Buyers

Another advantage of working with an M&A advisor lies in professional buyer sourcing. M&A advisors have a broad network of potential investors, including strategic buyers as well as private equity and family offices. Through targeted outreach and professional preparation of sales documents, they generate interest among potential buyers and initiate a competitive bidding process for the company.

Conducting a structured bidding process is also part of an experienced M&A advisor’s repertoire. By obtaining and evaluating various offers, the sale price can be optimized, and the best partner for the company can be found. Particular attention is paid to identifying buyers who not only offer financially attractive terms but also fit strategically and culturally with the company.

Professionally Manage and Support the Sales Process

An M&A advisor is an indispensable partner for sellers in structuring and executing the entire sales process. From creating a convincing process letter to supporting the due diligence and contract negotiations, the advisor professionally manages all steps in the seller’s interest.

A key aspect is expectation and information management with all parties involved. The M&A advisor acts as the central contact and coordinator, relieving the seller of time-consuming coordination. Additionally, they support internal and external communication to transparently and professionally inform employees, customers, and other stakeholders about the sales process.

In negotiations with prospective buyers, the M&A advisor is a valuable partner at the seller’s side. With negotiation skills and tactical expertise, they achieve the best possible terms for their client, whether regarding the purchase price, guarantees and liability provisions, or the seller’s future role. Depending on the situation, the advisor develops tailored transaction models, for example within the framework of a gradual handover or by implementing earn-out structures.

Optimize Tax and Legal Aspects

A decisive success factor in the sale of a company is the optimization of tax and legal aspects. M&A advisors work closely with specialized tax consultants and auditors to structure the transaction in a tax-efficient manner and minimize legal risks.

Approaches include, for example, the use of tax exemptions under §§ 14 and 16 EstG, tax-efficient structuring of distributions, or optimization of capital gains. The tax specifics of share sales involving employee participation or the handling of issues such as pension commitments also require expertise and experience.

When selling to foreign investors, M&A advisors assist in reviewing double taxation agreements and the tax structuring of cross-border transactions. This helps minimize liability risks and optimize the sale proceeds.

Conclusion: M&A Advisors as a Success Factor in Business Sales

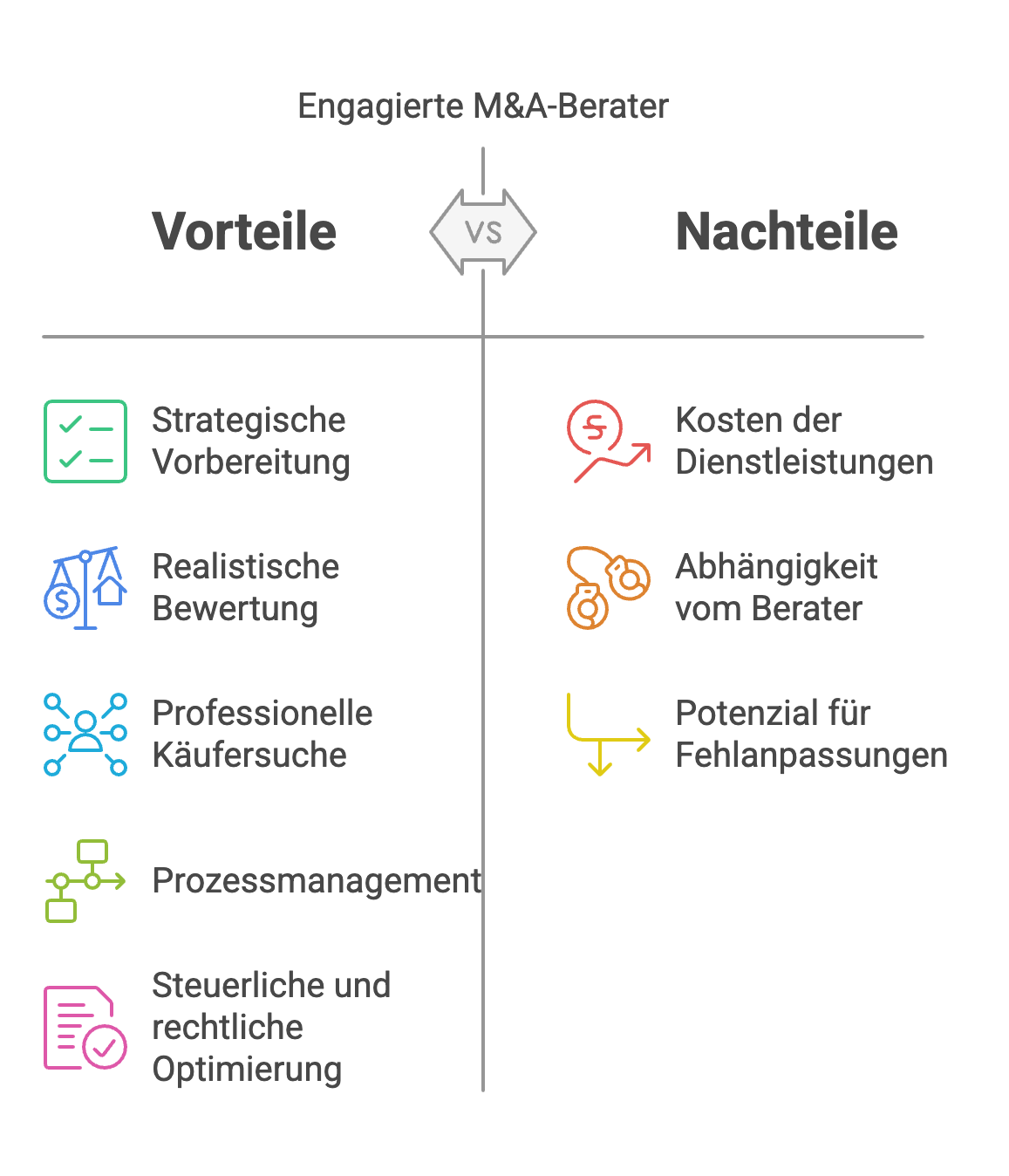

Working with a qualified M&A advisor offers decisive advantages for business sellers: from the strategic preparation of the sales process through professional buyer sourcing and negotiation to the optimization of tax and legal aspects, they benefit from the expertise and resources of specialists.

Entrepreneurs who want to sell their life's work in the best possible way and pass it on to new hands should view the support of an M&A advisor as an important investment in the success of the transaction. With the right partner by their side, they can not only optimize the sale proceeds but also set the course for a successful future of the company. Early and careful selection of the right advisor is therefore one of the most important decisions in the entire sales process.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO