M&A Advisors: Why the Investment Pays Off for Buyers

Buyers face a variety of challenges when acquiring a company. An experienced M&A advisor can professionally guide the process and significantly influence the success of the transaction. This article highlights the benefits of collaborating with M&A experts.

The purchase of a company is a complex matter that requires not only entrepreneurial intuition but also extensive expertise and experience. Especially for buyers who do not regularly engage in transactions, the support of a specialized M&A advisor can provide decisive advantages.

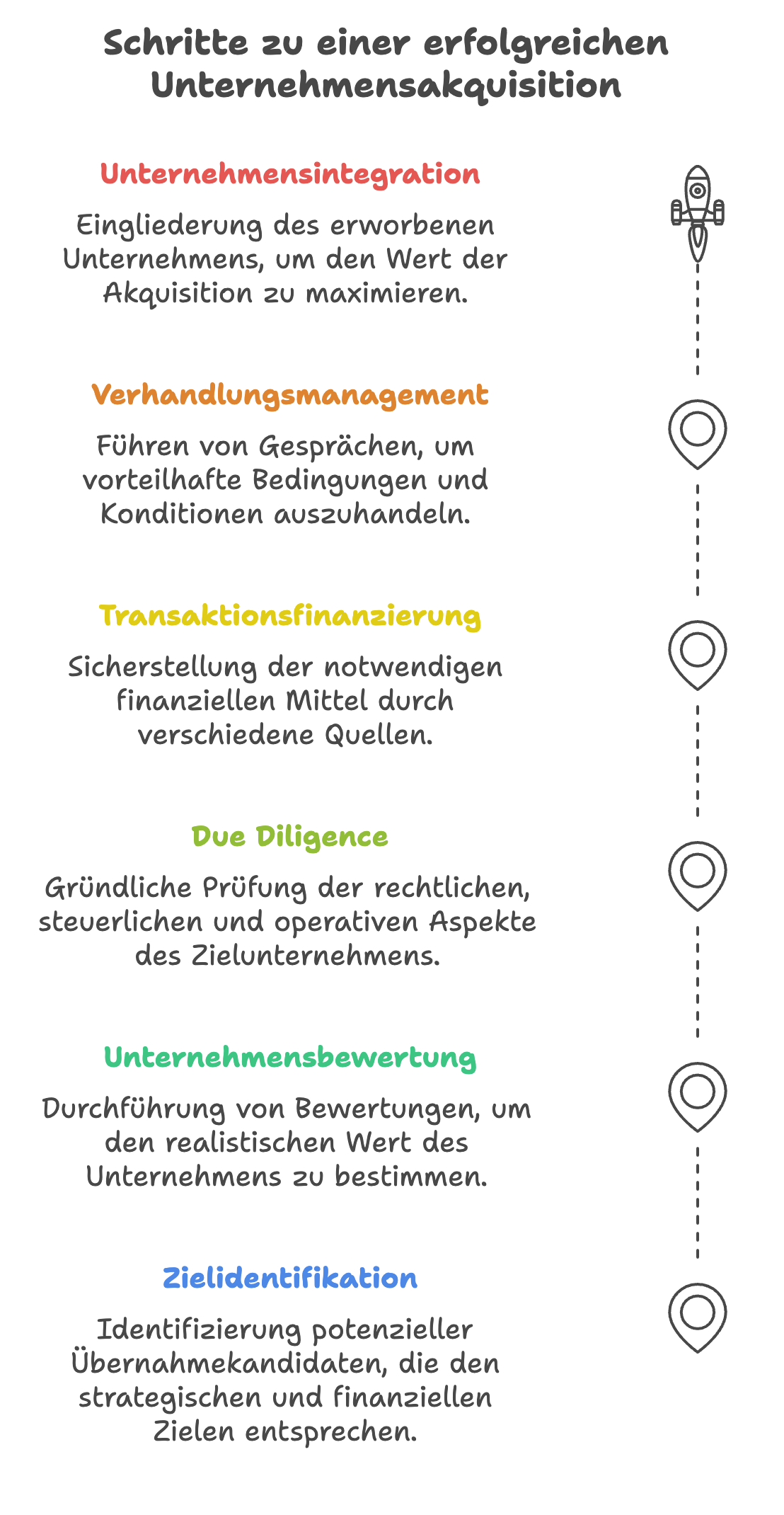

Professional Search and Selection of Target Companies

Identifying suitable acquisition candidates is the first step toward a successful company purchase. M&A advisors have extensive networks and market knowledge to find potential target companies that meet the buyer’s strategic and financial requirements. This also includes discreetly approaching companies that are not actively for sale.

Thorough Company Valuation and Due Diligence

A central task in the M&A process is determining a realistic company value. M&A advisors are familiar with common valuation methods such as the multiple method or the DCF method and can provide a well-founded assessment of the value.

Equally important is a careful due diligence to identify opportunities and risks of the transaction. Specialists in legal due diligence, tax due diligence, and business due diligence analyze the legal, tax, and operational aspects of the acquisition target and provide the buyer with a solid basis for decision-making.

Support with Transaction Financing

Another advantage of working with an M&A advisor lies in assistance with financing the transaction. In addition to traditional bank loans, alternative financing forms such as mezzanine capital or a leveraged buyout (LBO) may also be appropriate depending on the situation.

Private equity investors or family offices can also be engaged for financing. M&A advisors understand the requirements of capital providers and can assist in developing convincing financing concepts.

Professional Negotiation Management

An experienced M&A advisor is also a valuable partner during negotiations with the seller. They are familiar with the usual process steps such as the non-binding offer (NBO), drafting the process letter, and conducting a structured bidding process.

Through skillful negotiation, better terms can be achieved and risks minimized. Even after the transaction is completed, the advisor supports the integration of the acquired company, helping to maximize the value of the acquisition.

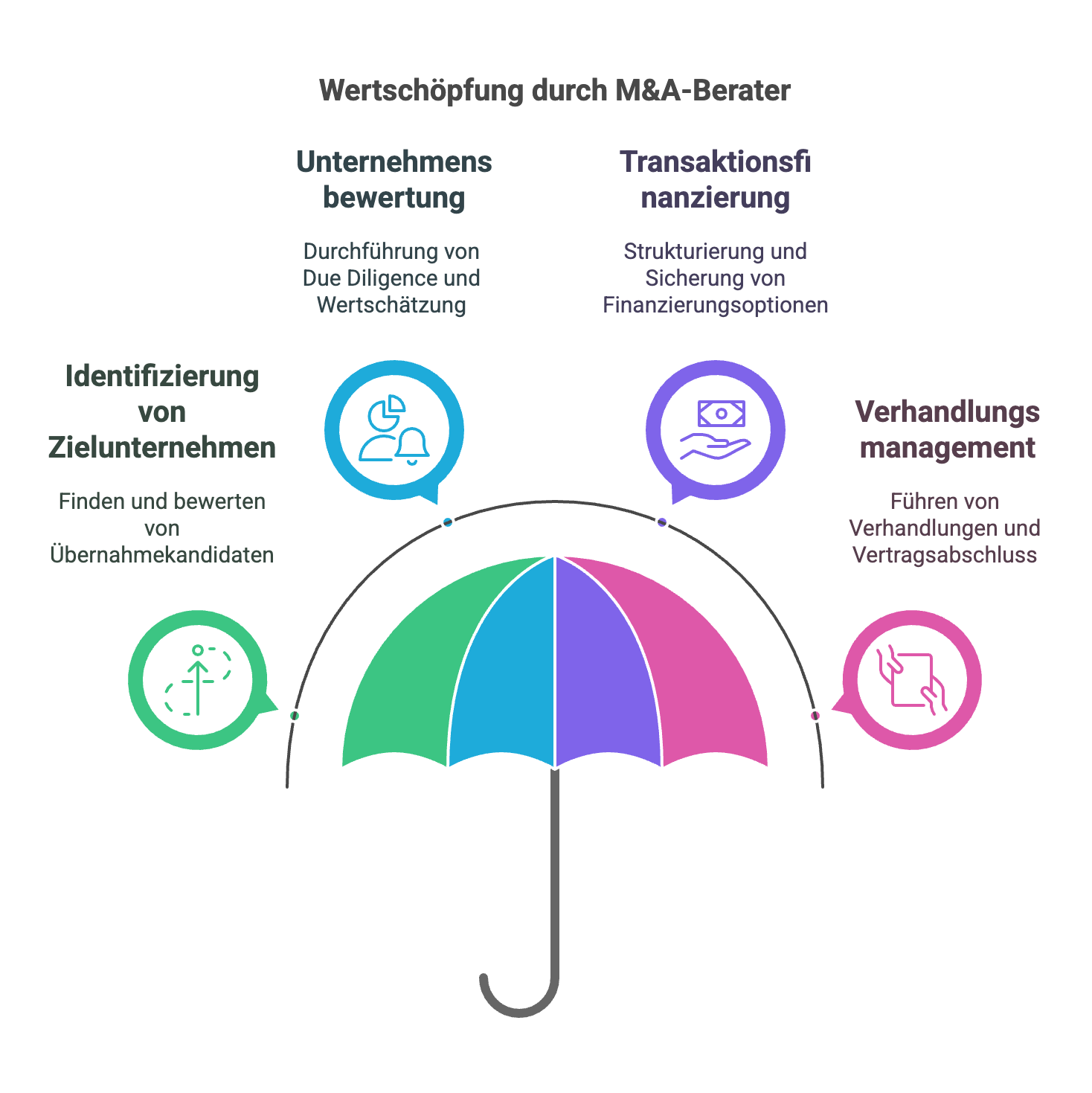

Conclusion: M&A Advisors Create Added Value for Buyers

Engaging an M&A advisor is a strategic decision that pays off for buyers in many ways. From the search and valuation to financing and contract conclusion, they benefit from the expertise and resources of specialists.

This helps minimize transaction risks, secure better terms, and professionally manage the entire process. For companies looking to grow through acquisitions, collaborating with a qualified M&A advisor is a worthwhile investment in the success of their acquisition strategies.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO