Successfully Shaping Business Succession with M&A Advisors: Continuity and Future Security through Professional Support

A well-planned and structured business succession is a critical success factor for the long-term continuity of a company. This article explains how M&A advisors can effectively support the complex succession process and provide valuable insights for a future-oriented alignment.

A business succession is one of the greatest challenges in the lifecycle of a company. Beyond emotional and interpersonal aspects, complex legal, tax, and financial issues must be resolved. Professional support from experienced M&A advisors can significantly influence the success of the generational transition and help position the founder’s legacy for future viability.

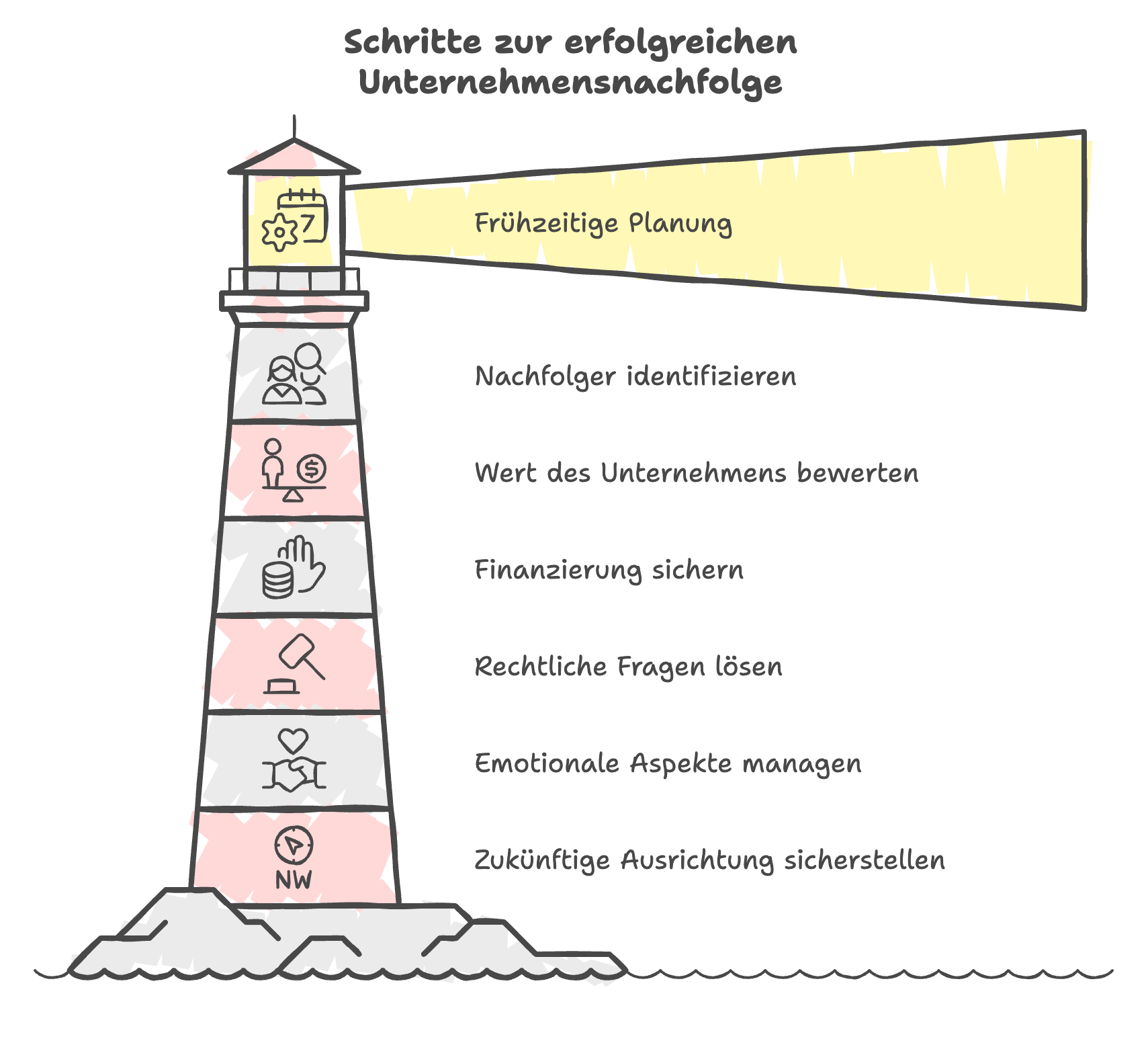

Early Planning as the Key to Success

A successful business succession requires time. Experts recommend starting the process early and approaching it strategically. M&A advisors assist entrepreneurs in developing a structured succession plan that takes all relevant aspects into account.

This begins with a thorough analysis of the company to identify strengths, weaknesses, and optimization potential. Based on this, a realistic timeline can be established and a profile for the ideal successor derived. M&A advisors help in the search and selection of suitable candidates, whether within the family, among the management team, or through external recruitment.

An important success factor is the early establishment of a second management level. Through targeted personnel development and succession management, potential successors can be retained within the company and prepared for their future role. M&A advisors support the development of tailored qualification programs and the design of attractive career prospects.

Exploring External Business Succession Options

If no suitable successor is found within the family or business environment, an external solution may be considered. M&A advisors have extensive networks and can specifically approach potential candidates. These include strategic investors as well as financial investors, such as private equity firms or family offices.

Another option is the search through specialized successor pools and marketplaces. M&A advisors are familiar with leading platforms and can assist entrepreneurs in creating compelling company profiles. Conducting a structured bidding process is also part of the service portfolio of experienced M&A advisors.

Transparently Determining Company Value

A central challenge in business succession is the question of company valuation. Only on the basis of a realistic valuation can fair terms be achieved for all parties involved. M&A advisors are experts in this field and understand the relevant influencing factors and valuation methods.

In addition to analyzing "hard" factors such as assets, earnings, and market position, they also consider "soft" factors like innovation capability, customer loyalty, and employee potential. By applying sound methods such as the asset-based valuation method or the multiplier method, a transparent and reliable valuation is achieved.

M&A advisors raise awareness of common valuation errors such as emotionally inflated price expectations or the use of incomplete data. Through professional preparation of figures and objective comparative analyses, they ensure transparency and a solid basis for negotiation.

Developing Tailored Financing Concepts

Financing a business succession is often challenging, especially when the successor lacks sufficient equity. M&A advisors collaborate with experts to develop customized financing concepts that consider individual circumstances.

The spectrum ranges from traditional bank loans and subsidies to innovative models such as mezzanine capital or seller financing. A gradual transfer of company shares or a combination of various instruments may also be appropriate depending on the situation.

M&A advisors understand the requirements of capital providers and assist in creating convincing business and financial plans. Through forward-looking capital and liquidity planning, they ensure the financial stability of the company during the transition process and beyond.

Avoiding Legal and Tax Pitfalls

Structuring a business succession is also complex from a legal and tax perspective. M&A advisors work closely with specialized attorneys and tax consultants to develop an optimal structure and minimize liability risks.

Key topics include the adjustment of partnership agreements, regulation of voting rights and share transfers, as well as the protection of trademark and patent rights. Inheritance and gift tax aspects, as well as the optimal design of contracts with employees and business partners, must also be considered.

Through proactive planning and the use of design options, such as business asset allowances or tax-advantaged transfer forms, tax burdens can be reduced and the success of the succession arrangement increased.

Professionally Managing Emotional Aspects

A business succession is not only a rational but also an emotional process. Especially in family businesses, conflicts can arise between founders and successors or within the shareholder family. Resistance among employees is also not uncommon when a new owner takes over management.

M&A advisors are experienced mediators and can help reduce emotional tensions. Through conflict management and professional moderation, they support consensus-building and the definition of common goals. The emotional detachment of the former owner and their role after the handover are also important aspects that an M&A advisor addresses with sensitivity.

Through targeted communication measures, M&A advisors ensure transparency and acceptance among employees, customers, and business partners. Professional press and public relations strengthen trust in the company’s future viability and safeguard its reputation during the succession process.

Conclusion: Designing Business Succession with a Future-Oriented Approach

A business succession is a multifaceted process that encompasses both rational and emotional aspects. Collaborating with an experienced M&A advisor offers entrepreneurs decisive advantages: from strategic planning and financing design to moderating interpersonal issues, they benefit from the expertise and resources of specialists.

Through a structured approach, forward-looking scenario planning, and the development of future-oriented concepts, M&A advisors lay the foundation for the successful continuation of the founder’s legacy — opening new opportunities for sustainable and value-driven development.

Engaging a qualified M&A advisor early is therefore a worthwhile investment that pays off for all parties involved. Entrepreneurs should initiate the succession process promptly and rely on expert support to optimally position their company for the future.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO