Earn-Out: Achieving a Fair Acquisition Price through Performance Participation

Earn-Outs are a variable component of the purchase price in corporate transactions. They link part of the payment to the achievement of specific targets after the acquisition. This article explains the functionality of earn-outs and illustrates them with three practical examples.

In business acquisitions, the purchase price is often a contentious issue. Buyers and sellers have different perceptions of the company's value. The seller sees the historical development, knows the strengths of their company intimately, and is often emotionally involved. The buyer, on the other hand, focuses more on future prospects and risks. They do not want to overpay and usually calculate more cautiously.

A foundation for this is the business valuation: Determining the fair value using established methods such as discounted cash flow or multiplier approaches.

Definition: Earn-Outs

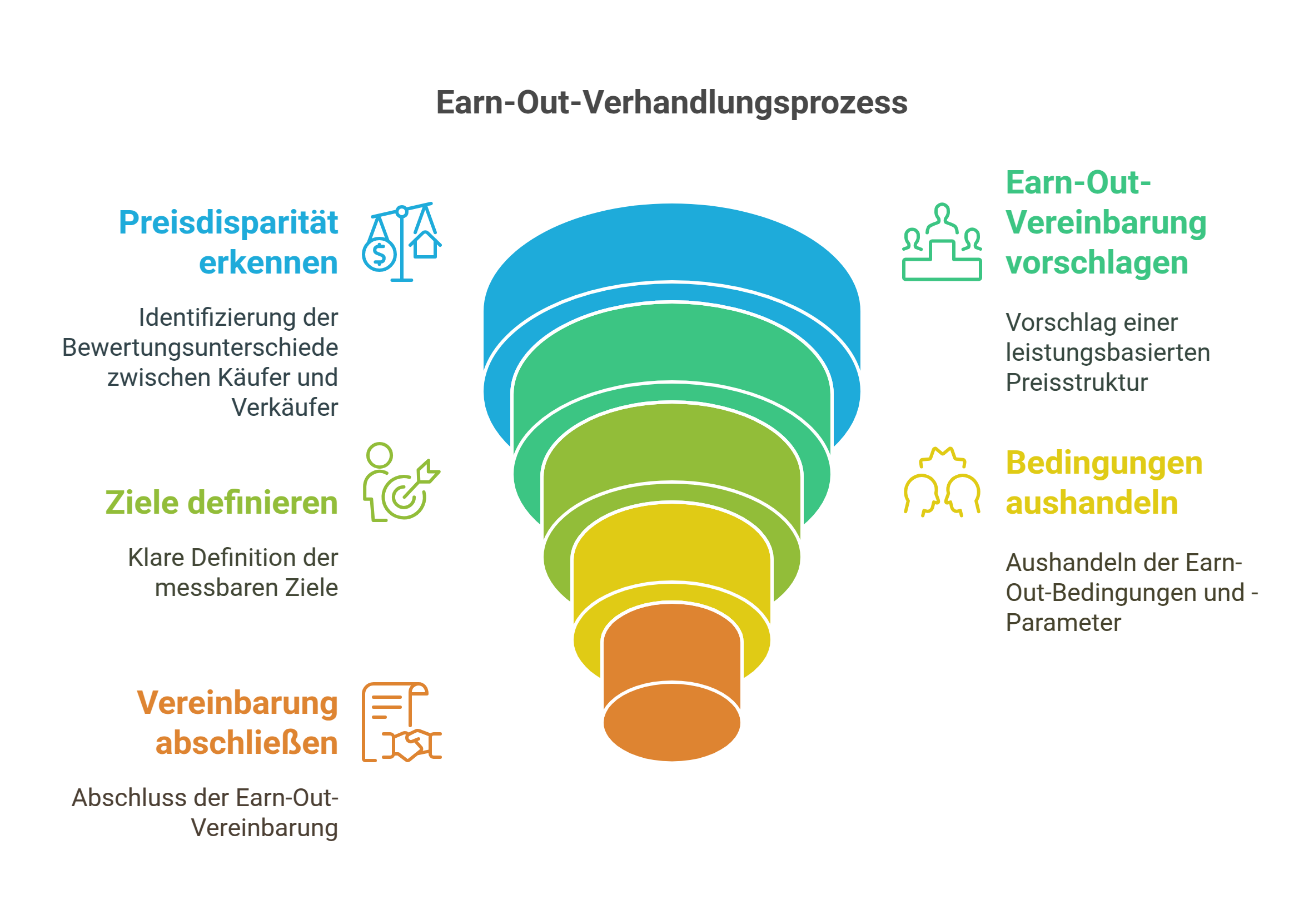

What can be done when price expectations are far apart? One option is so-called earn-outs. In this case, part of the purchase price is made variable and linked to the achievement of certain goals after the acquisition. The idea behind this is that the seller has the opportunity to achieve a higher price through good future performance. The buyer, in turn, reduces their risk by initially paying less and only paying the full price upon success.

Earn-outs can be structured in various ways. Financial metrics such as revenue, EBIT, or cash flow are often used as the basis for measurement. However, qualitative goals are also possible, such as the introduction of new products, the exploration of new markets, or the integration of the acquired company into the buyer's structures. It is important that the target parameters are clearly defined and measurable.

Examples of Earn-Outs

A hypothetical example: Machinery company A acquires supplier B. A sees significant growth potential for B's products but doubts whether the projected revenues are realistic. B's owners are convinced that the projections are achievable and want to prove this within the framework of an earn-out. They agree on a base purchase price of €10 million. Additionally, there will be an earn-out of up to €5 million if certain revenue targets are met in the three years following the acquisition. This way, A has less risk, and B has the chance to achieve a higher price through good performance.

A second example from practice: A software company acquires a smaller competitor to integrate its innovative technology into its own product portfolio. Since the success of this integration is fraught with uncertainties, part of the purchase price is structured as an earn-out. The target parameters here are not financial in nature but relate to development milestones such as the successful migration of existing customers, the release of a new software version with integrated functionalities, or the training of the sales team on the new products.

A third example shows that earn-outs can also play a role in succession planning: An entrepreneur sells her company to a financial investor to retire. To ensure a smooth transition, she is to remain with the company as a consultant for two more years. Her know-how is crucial for transferring important customer relationships and training the new management. Therefore, part of the purchase price is structured as an earn-out and is contingent upon her staying on board for two years and achieving specific goals related to customer retention and knowledge transfer.

Details of the Earn-Out Structure

In practice, there are countless variations of earn-outs. They can be structured linearly or in tiers, have caps and floors, and relate to overall goals or sub-goals. The specific structure always depends on the individual case. It is crucial that the goals are incentive-compatible and fair for both sides. The seller must realistically have the chance to achieve the goals. The buyer, in turn, must have operational control to not undermine goal achievement.

The details of goal determination and calculation are also important. How and by whom are the relevant parameters such as revenue or EBIT determined? What adjustments are provided for special effects like restructuring costs? What is the process if there are disagreements? All of this should be clearly regulated from the outset, ideally with the support of experienced M&A advisors and lawyers.

It is clear: Earn-outs are not a panacea. They can make acquisitions very complex and also harbor potential for conflict. If the parties do not agree on whether the goals have been achieved, it can lead to lengthy disputes. The accounting and tax treatment is often tricky and requires good advice.

Advantages and Disadvantages of Earn-Outs

Nevertheless, earn-outs can be a very useful tool to bridge price differences and fairly distribute risks between buyer and seller. They create a convergence of interests and give both sides the chance for a good deal. The seller has the prospect of a higher price if they continue to perform successfully. The buyer pays less if expectations are not met. Thus, earn-outs can help bridge the famous "gap" between buyer and seller expectations and enable transactions that might not otherwise occur.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO