5 Important Lessons I Had to Learn Before My First Business Acquisition

Discover the valuable insights I gained from my first business acquisition and how you can leverage them for your own success.

Das Wichtigste in Kürze:

- Time Management: Acquiring a business is a complex process that typically takes 6-12 months and requires careful planning.

- Due Diligence: A comprehensive review must include not only financial aspects but also legal, operational, and personnel factors, with the help of external experts.

- Personnel Strategy: Early identification of key employees and a well-thought-out communication strategy are crucial for a successful acquisition.

- Finances: In addition to the purchase price, hidden costs, working capital, and post-acquisition investments must be considered in financial planning.

1. The Purchase Process Takes Longer Than You Think

Acquiring a business is a complex process that takes significantly more time than many buyers initially assume. In reality, an average business acquisition takes between 6 and 12 months—sometimes even longer.

Typical Timeframe and Key Milestones

The business acquisition process can be divided into several key phases:

- Initial Contact and Exploration: 1-2 months

- Due Diligence and Business Valuation: 2-3 months

- Contract Negotiations: 2-4 months

- Financing and Closing: 1-3 months

Consider Parallel Processes

During the acquisition process, various activities occur simultaneously:

- Coordination with tax advisors and auditors

- Negotiations with banks for acquisition financing

- Legal reviews by attorneys

- Discussions with key stakeholders

This parallelism makes good coordination and effective time management essential. Experienced M&A advisors can assist here and expedite the process.

Emotional Challenges During Waiting Periods

The lengthy duration of a business acquisition can be emotionally taxing:

- Uncertainty during the negotiation phase

- Stress from managing the existing business simultaneously

- Impatience during the due diligence phase

- Concern over potential transaction failure

To overcome these challenges, it is advisable to:

- Plan realistic timelines from the outset

- Build a reliable advisory team

- Maintain regular communication with all parties involved

- Allow sufficient buffer for unexpected delays

A business acquisition is a marathon, not a sprint. Understanding the typical process duration helps mentally prepare and develop the necessary endurance. Thorough preparation and professional guidance are the keys to successfully closing the transaction.

2. Due Diligence is More Complex Than Expected

Due diligence in business acquisition is far more multifaceted than many buyers initially assume. A common mistake is focusing too heavily on financial aspects and neglecting other critical areas.

More Than Just Numbers

Financial due diligence is undoubtedly important, but it is only part of the overall picture. In addition to analyzing financial statements, controlling metrics, and cash flow forecasts, other critical areas must be scrutinized. A holistic business evaluation is crucial for acquisition success.

Legal Safeguarding is Fundamental

Legal due diligence is often underestimated. Contracts, licenses, patents, and labor agreements must be carefully examined. Particularly important are:

- Shareholder agreements

- Intellectual property rights

- Compliance requirements

- Liability risks

Operational Review as a Key Element

Operational due diligence often reveals the biggest surprises. It involves:

- Process quality and efficiency

- Condition of facilities and equipment

- Quality of management

- Corporate culture and employee satisfaction

Utilize External Expertise

The complexity of due diligence often makes external support indispensable. Experienced M&A advisors, auditors, and specialized attorneys can:

- Uncover blind spots

- Identify industry-specific risks

- Objectify evaluations

- Save time and resources

Avoid Common Pitfalls

Common pitfalls in due diligence include:

- Too tight schedules

- Insufficient data quality

- Neglecting IT systems and cybersecurity

- Underestimating cultural factors

- Lack of integration across different review areas

Professional due diligence is time-consuming and costly, but this investment pays off. It minimizes risks and provides a solid decision-making foundation for the business acquisition. It is especially important to allocate sufficient time for all review areas and proceed systematically.

3. Employees Are the Key

The most valuable resource in a business acquisition is not the machinery or patents—it is the employees. Unfortunately, this realization came too late in my first business acquisition.

Understand and Respect Corporate Culture

The existing corporate culture is the foundation of the acquired company's success. An abrupt cultural change can lead to resistance and performance declines. Instead, it is important to first understand the existing values and work practices and introduce changes gradually.

Transparent Communication Builds Trust

A clear communication strategy is crucial during the acquisition. Employees have understandable fears and questions:

- How secure are the jobs?

- What changes are coming?

- What does the acquisition mean for each employee?

Regular updates and open discussions help reduce uncertainties and build trust.

Identify Key Personnel Early

Identifying key personnel in the company is particularly important. These employees:

- Possess critical know-how

- Have important customer relationships

- Are informal leaders

Retention strategies should be developed early for these key players, such as through incentives or new development opportunities.

Systematically Approach Change Management

The acquisition process always means change. Professional change management should be planned from the beginning:

- Analyze the current situation

- Define clear goals

- Develop a transformation plan

- Involve employees in the change process

A structured change process minimizes friction losses and maximizes the chances of successful integration after the business acquisition.

Experience shows: Underestimating the importance of employees risks the success of the entire acquisition. Invest time and resources in your new workforce—it will pay off multiple times over.

4. Financing is More Than Just the Purchase Price

In business acquisitions, many buyers underestimate the actual costs. The purchase price is only the tip of the iceberg. Here are the key financial aspects to consider in succession financing.

Hidden Costs in Business Acquisition

In addition to the actual purchase price, various ancillary costs arise:

- Notary fees and land registry charges

- Due diligence review by auditors

- Legal advice for contract drafting

- Brokerage commissions

- Possibly real estate transfer tax

These transaction costs can quickly add up to 5-10% of the purchase price.

Working Capital for Ongoing Operations

The capital requirement for operational business is often underestimated. The following items need financing:

- Inventory and stock

- Receivables and claims

- Personnel costs

- Ongoing operating costs

- Seasonal fluctuations

Necessary Investments After Acquisition

Many companies require additional investments after acquisition:

- Modernization of machinery and equipment

- Digitalization measures

- Product development

- Marketing and sales

- Personnel development

Financing Sources and Their Characteristics

Various financing options are available:

Equity

- High independence

- No interest payments

- Limited availability

Bank Loans

- Classic form of financing

- Fixed interest and repayment obligations

- Collateral required

Subsidies

- Favorable conditions

- Often combinable with grants

- Longer application processes

Seller Loans

- Signals seller's trust

- Flexible structuring options

- Reduces initial capital requirement

A realistic financial plan should consider all these aspects and allow sufficient buffer for the unexpected. Experts recommend planning at least 20% more capital than initially calculated.

5. Post-Merger Integration Begins Before the Acquisition

Successful integration of an acquired company is a critical success factor in M&A transactions. Many business acquisitions fail not due to the transaction itself, but due to inadequate post-merger integration (PMI).

Early Integration Planning

Integration planning should begin during due diligence. Create a detailed integration roadmap that includes key milestones, responsibilities, and timelines. Identify potential synergies and cultural differences between the companies early on. Professional change management is essential here.

Realistic Assessment of Your Own Capacities

Do not underestimate the resource requirements for integration. PMI requires:

- Dedicated project teams

- Sufficient time alongside daily business

- Possibly external consultants

- Clear communication structures

Be honest with yourself about whether your organization can provide these capacities.

Importance of the First 100 Days

The first 100 days after the business acquisition are crucial for long-term success. During this phase, you must:

- Establish clear leadership structures

- Involve key stakeholders

- Achieve quick wins

- Reduce uncertainties among employees

- Harmonize core processes

Avoid Common Integration Mistakes

Common mistakes in post-merger integration include:

- Late integration planning

- Underestimating cultural differences

- Lack of communication

- Neglecting operational business

- Hasty decisions

Avoid these pitfalls through:

- Professional project management

- Regular status meetings

- Open communication culture

- Realistic timelines

- Adequate resource planning

Post-merger integration is a complex change process that requires strategic foresight, operational excellence, and emotional intelligence. The earlier you engage with it, the higher your chances of a successful acquisition.

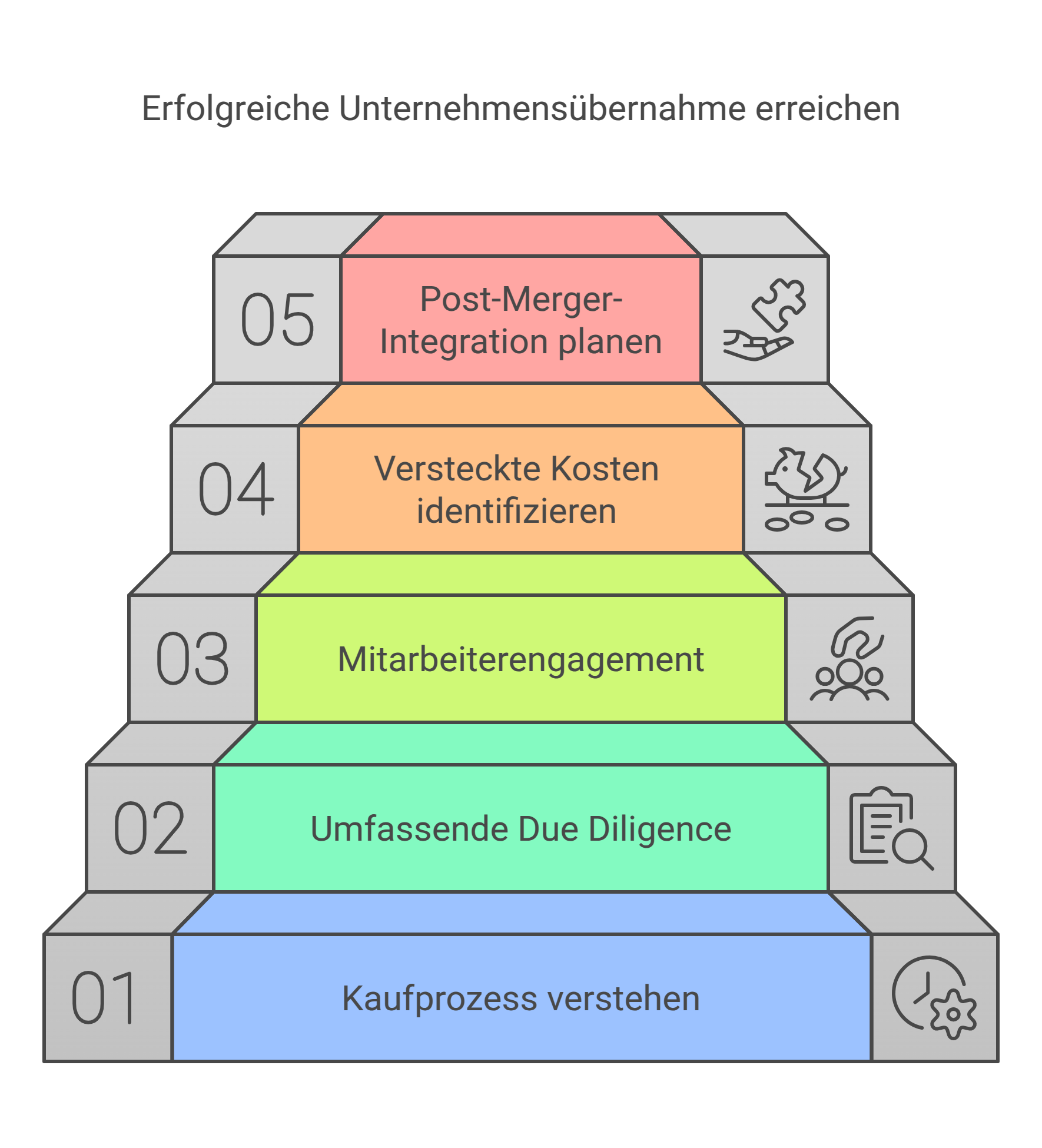

Conclusion: Successfully Acquiring a Business - Key Insights

- 1The purchase process takes longer than you think

- 2Due diligence is more complex than expected

- 3Employees are the key

- 4Financing is more than just the purchase price

- 5Post-merger integration begins before the acquisition

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO