Buy-and-Build Strategies: A Solution to the Succession Crisis for German SMEs

Buy-and-Build strategies offer medium-sized enterprises a promising solution to the succession crisis. Learn how targeted acquisitions and their integration can unlock growth potential and enhance company value.

The German Mittelstand faces a significant challenge. According to the KfW SME Monitor, around 190,000 companies will exit the market by 2026 due to a lack of suitable successors. In total, 560,000 SMEs are searching for successors. These figures highlight the extent of the succession issue, which will pose serious difficulties for many companies in the coming years. However, there is a promising solution that has gained increasing importance recently: Buy-and-Build strategies.

Buy-and-Build (B&B) refers to a growth strategy where an existing company, known as the platform, is expanded and strengthened through targeted acquisitions. The goal pursued is multifaceted. It involves acquiring complementary companies to gain new capabilities, access additional markets, or expand the existing product and service portfolio. This approach aims to enhance the overall company's value.

The basic idea behind Buy-and-Build is simple yet effective: by acquiring smaller companies at relatively low valuation multiples and subsequently integrating them into a larger entity with a higher valuation, a so-called "multiple arbitrage" can be achieved. This means that the relatively cheaper acquired companies automatically gain value by being incorporated into the higher-valued platform. Additionally, significant synergies often arise from the merger of companies, such as the shared use of resources, know-how, and distribution channels.

The rise of Buy-and-Build strategies in the corporate landscape is also evident from concrete figures. Between 2012 and 2022, the share of B&B deals in all M&A transactions more than doubled from an initial 6% to an impressive 15%. This trend shows that more and more companies and investors are recognizing and seeking to leverage the potential of this strategy.

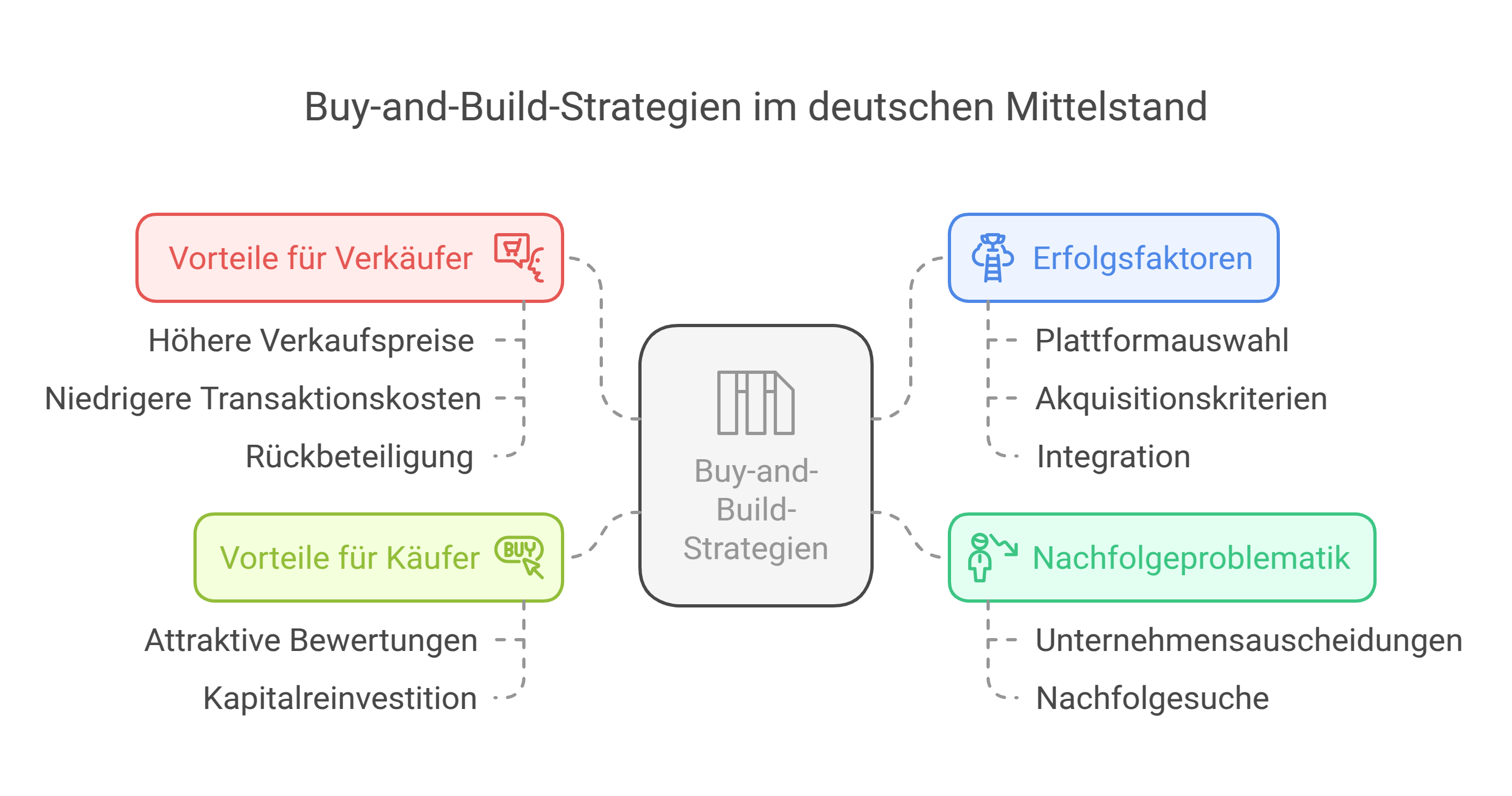

Advantages for Sellers

For medium-sized companies seeking a suitable successor, selling to a Buy-and-Build investor offers numerous advantages. Chief among these are the often higher sale prices that can be achieved due to the scale and synergy effects factored in by the buyer. Since B&B investors are typically strategic buyers with extensive industry experience, the risk of transaction failure or integration issues is significantly lower than with a sale to an industry outsider.

Moreover, the transaction costs associated with a company sale, such as those for due diligence, are often significantly lower when selling to a B&B investor. This is because buyers in this area possess extensive know-how and standardized processes, which considerably reduce the effort and thus the costs. This is a crucial factor for smaller SMEs, as transaction costs in a standalone sale can quickly become disproportionately high.

Another interesting aspect is the possibility of reinvestment in the buyer's holding company. Many B&B investors offer former owners the opportunity to reinvest in the transaction through shares, options, or other instruments. This is particularly appealing to entrepreneurs who are not yet ready to completely withdraw from their life's work. Through reinvestment, they can continue to benefit from the investor's know-how and network and participate in future value increases. At the same time, it sets the stage for a gradual withdrawal from operational business and an orderly transition.

Advantages for Buyers

But the Buy-and-Build strategy offers much to buyers as well. Acquisitions can typically be made at attractive valuations well below the platform's level. Through the subsequent integration of acquired companies and the realization of synergies, the corporate group can then be further developed as a whole and its value increased. If successful, a later exit, or resale, can yield a significantly higher return compared to the initial investment due to the "multiple arbitrage" effect.

Buy-and-Build strategies also provide institutional investors and private equity firms with the opportunity to reinvest large amounts of capital profitably and with high returns. In times of low interest rates, many market participants have substantial cash inflows and corresponding high cash reserves, for which lucrative investment opportunities are sought. This "dry powder" can be profitably directed into promising Buy-and-Build projects by skillfully bundling attractive "company packages."

Success Factors

To achieve the desired results with Buy-and-Build strategies and meet the expectations of all parties involved, several important points must be considered. First and foremost is the careful selection of the platform company. It should be active in a market with high growth and consolidation potential and have a strong market position and solid financial foundation. The best platforms are typically successful, profitable companies and not "turnaround cases."

Once the right platform is found, the acquisition criteria for the purchases must be defined. These must strategically and culturally fit the platform and bring genuine value enhancement potential. A realistic assessment of the targets and a careful evaluation of achievable synergies are essential to avoid later negative surprises. Excessive purchase prices or overly optimistic assumptions quickly lead to the anticipated effects not materializing, causing the overall strategy to falter.

Equally important as the selection of acquisitions is their rapid and effective integration into the platform. This requires a structured approach to bring together all relevant areas—from procurement and production to administration and IT, to marketing and sales. Speed is often the key here, as the integration process loses momentum over time, increasing the risk of friction losses, employee uncertainty, and cultural conflicts. At the same time, quality and diligence must be ensured, as a failed integration is hardly correctable later.

To overcome all these challenges, a great deal of experience and competence is required on the part of management. The responsible parties must not only have a deep understanding of the industry and business model but also be able to identify growth potentials and consistently realize synergies and economies of scale. Communication skills are as essential as analytical thinking, negotiation skills, and assertiveness. Buy-and-Build projects are highly complex undertakings and not tasks for beginners.

Conclusion

Despite the challenges described, Buy-and-Build strategies offer many medium-sized companies an attractive way out of the succession crisis. They enable former owners to transfer their business under favorable conditions and open up development opportunities under the umbrella of a strong partner. Buyers, in turn, have the chance to build powerful corporate groups with manageable risk and benefit from the advantages of a stronger market position.

Ultimately, the success depends primarily on three factors: careful strategic planning, a stringent, disciplined acquisition process, and the consistent realization of integration synergies. Where these prerequisites are met, and the necessary entrepreneurial skill and industry understanding are present, Buy-and-Build offers enormous value creation potential for all parties involved.

This potential is not just theoretical, as numerous success stories from recent years demonstrate. From the major waves of hospital consolidation to the emergence of powerful craft groups and the Buy-and-Build activities of leading software providers—the list could go on almost indefinitely. Done well, Buy-and-Build is a win-win strategy that opens new perspectives for sellers, buyers, and the entire Mittelstand. In times of demographic change and intensified global competition, this is needed more than ever.

Sources:

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO