Corporate Sale: Remote M&A and Virtual Business Acquisitions

Remote M&A and virtual business acquisitions are becoming increasingly important in today's environment. This article demonstrates how to successfully execute remote M&A and virtual business acquisitions.

The COVID-19 pandemic has fundamentally changed the business world in many areas. What once seemed unthinkable is now commonplace in many places: virtual meetings, digital signatures, remote work. This trend has also reached M&A processes. Business acquisitions and mergers are increasingly taking place partially or even entirely remotely. This article examines the opportunities and challenges this development brings and what buyers and sellers should consider to succeed even from a distance.

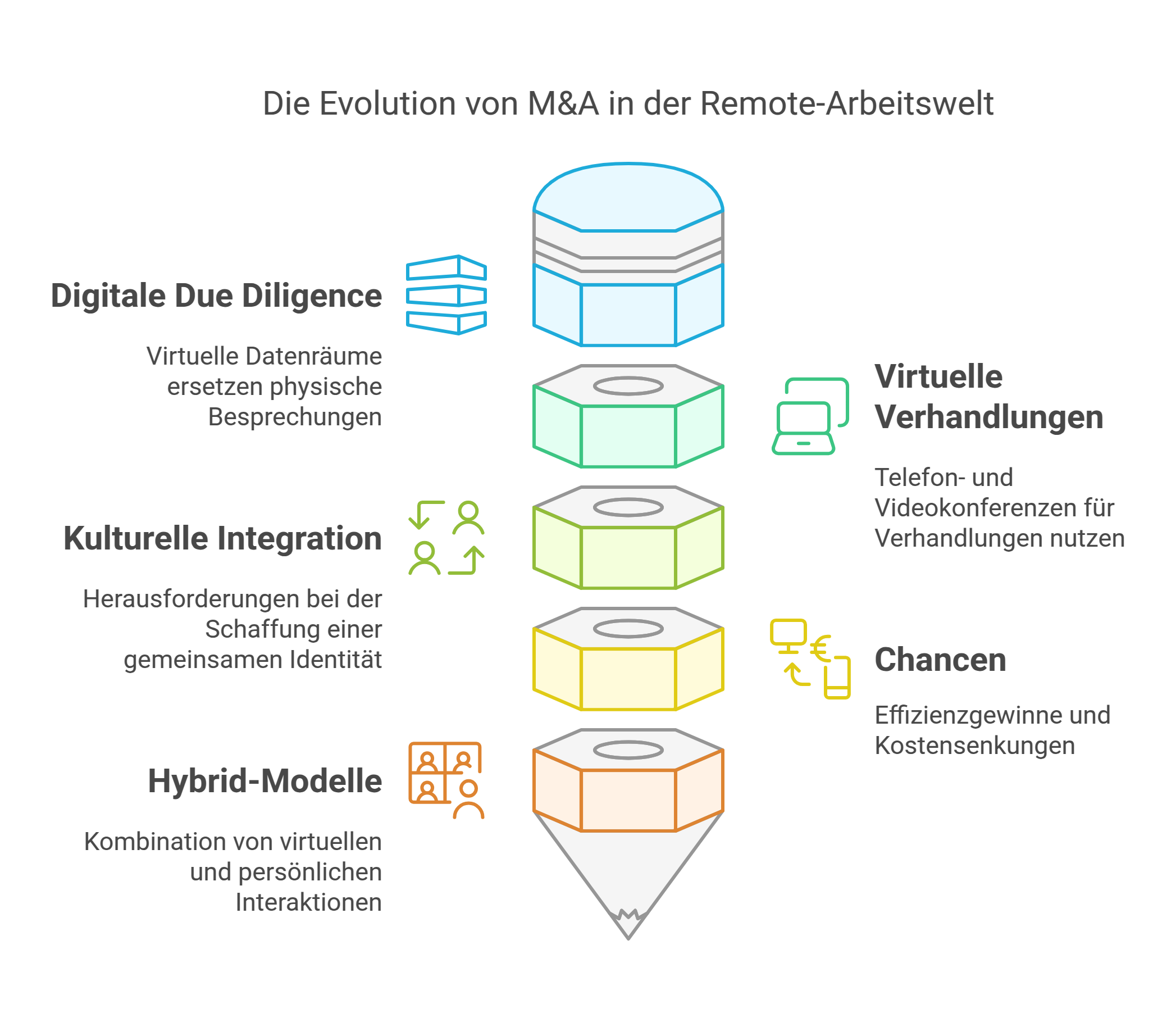

Digital Due Diligence: Data Rooms Replace On-Site Meetings

One of the biggest changes concerns due diligence. Where entire teams of lawyers, auditors, and specialists once gathered in stuffy data rooms to sift through boxes of folders, the review today mostly takes place virtually. Cloud-based data rooms, where all relevant documents are centrally stored and accessible, have become the new standard. This offers many advantages:

- Time and cost savings by eliminating travel

- More efficient processes through parallel work and quick data access

- Improved compliance through seamless access history and granular permission settings

- Reduced risk thanks to highly secure, certified platforms

However, digital due diligence is also more demanding. It requires careful preparation, clear structures, and smooth data exchange among all parties involved. The personal impression gained on-site cannot be fully replaced. This makes regular video calls all the more important to clarify open questions and nurture interpersonal relationships.

Virtual Negotiations: Mastering Communication at a Distance

Negotiations in the era of remote M&A also mostly take place via telephone or video conference. This certainly has advantages: saving time and travel costs, enabling greater flexibility, and allowing for short-notice meetings. At the same time, important elements of communication such as facial expressions, gestures, and body language—which are crucial for building trust and sensing moods—are missing. Therefore, three aspects deserve special attention:

-

Technology & Environment: A stable connection, good sound quality, and a quiet, tidy environment are the foundation for professional video calls.

-

Preparation & Structure: A precise agenda, documents shared in advance, and clear speaker roles help make meetings efficient.

-

Moderation & Mindfulness: Sensitive moderation is required to give everyone space, allow for questions, and perceive unspoken signals.

As a general rule: the more important and complex the topic, the more worthwhile it is to schedule at least occasional physical meetings. For key moments such as signing or closing day, meeting in person should be prioritized whenever possible.

Cultural Integration: Remote Onboarding as a Challenge

One of the greatest hurdles in virtual M&A transactions is cultural integration. When teams rarely or never meet physically, it becomes difficult to create a shared identity and trust. Instead, silo formation, misunderstandings, and friction losses threaten. Thoughtful remote onboarding is therefore essential. This includes, for example:

- Virtual introductory meetings and team-building activities

- Regular communication about goals, progress, and quick wins

- Clearly defined roles, responsibilities, and interfaces

- Technical and organizational support for remote work

- Opportunities for informal exchange and the growth of a shared culture

Leaders are particularly challenged here. They must take the lead, motivate, and integrate even more than usual—especially over distance.

Remote M&A as an Opportunity: More Flexible, Faster, More Cost-Effective

Despite all challenges, remote M&A also offers great opportunities. Companies that consistently digitize and virtualize their processes can benefit in many ways:

- Larger deal flow through location-independent search and outreach

- Accelerated transactions through efficient, digital processes

- Lower costs by eliminating travel and accommodation expenses

- Better work-life balance for the teams involved

- Reduced ecological footprint through avoided business trips

Of course, there will still be situations in the future where physical presence is indispensable. But in many cases, at least parts of the M&A process can be conducted remotely—more efficiently, more affordably, and more sustainably.

Conclusion: The Future of M&A is Hybrid

The COVID-19 pandemic has triggered a digitalization boost that has not left the M&A industry untouched. Virtual deal making has become the new normal—and this will not fundamentally change after the pandemic. The advantages and efficiency gains are simply too great.

At the same time, the crisis has shown how important interpersonal relationships and personal encounters are. Purely virtual transactions reach their limits, especially when it comes to building trust, cultural change, and integration.

The future of M&A therefore lies in hybrid models that combine the best of both worlds. Digital processes and tools where they increase speed and efficiency. Physical meetings and workshops where they are indispensable for relationship building and creativity. Travel with purpose, not out of routine. Remote work as the norm, not a fallback.

Companies and M&A advisors who master this balance will have the edge. They are more flexible, faster, and often more cost-effective. They can close deals in times when others are still stuck in traffic or waiting at the gate.

This requires new skills, both technical and human. Confident handling of digital tools, excellent project management, and above all virtual leadership skills will become key qualifications for M&A professionals.

Those who deliberately develop these competencies and intelligently design hybrid deal structures will be well prepared for the post-COVID era—and for an M&A world where remote becomes the new standard. But where one principle remains true: Deals are made by people. Even—and especially—at a distance.