M&A Advisor: Your Professional Partner for Successful Corporate Transactions

Learn how to find the right M&A advisor and optimize the costs of consulting.

Mergers and Acquisitions (M&A) are among the most complex and consequential decisions in an entrepreneur’s life. Whether it’s the sale of one’s life’s work, the search for a successor, or entering a new market—the challenges and pitfalls are numerous. To master these challenges and leverage opportunities optimally, more and more entrepreneurs are relying on the expertise of professional M&A advisors. These experts accompany the entire transaction process, from analysis and valuation through buyer search and negotiation to contract drafting and integration. But how do you find the right M&A advisor, and what should you consider when choosing one? What costs can you expect, and who pays them? And what do terms like “retainer” or “success fee” actually mean? This article provides answers to the most important questions about M&A advisory services.

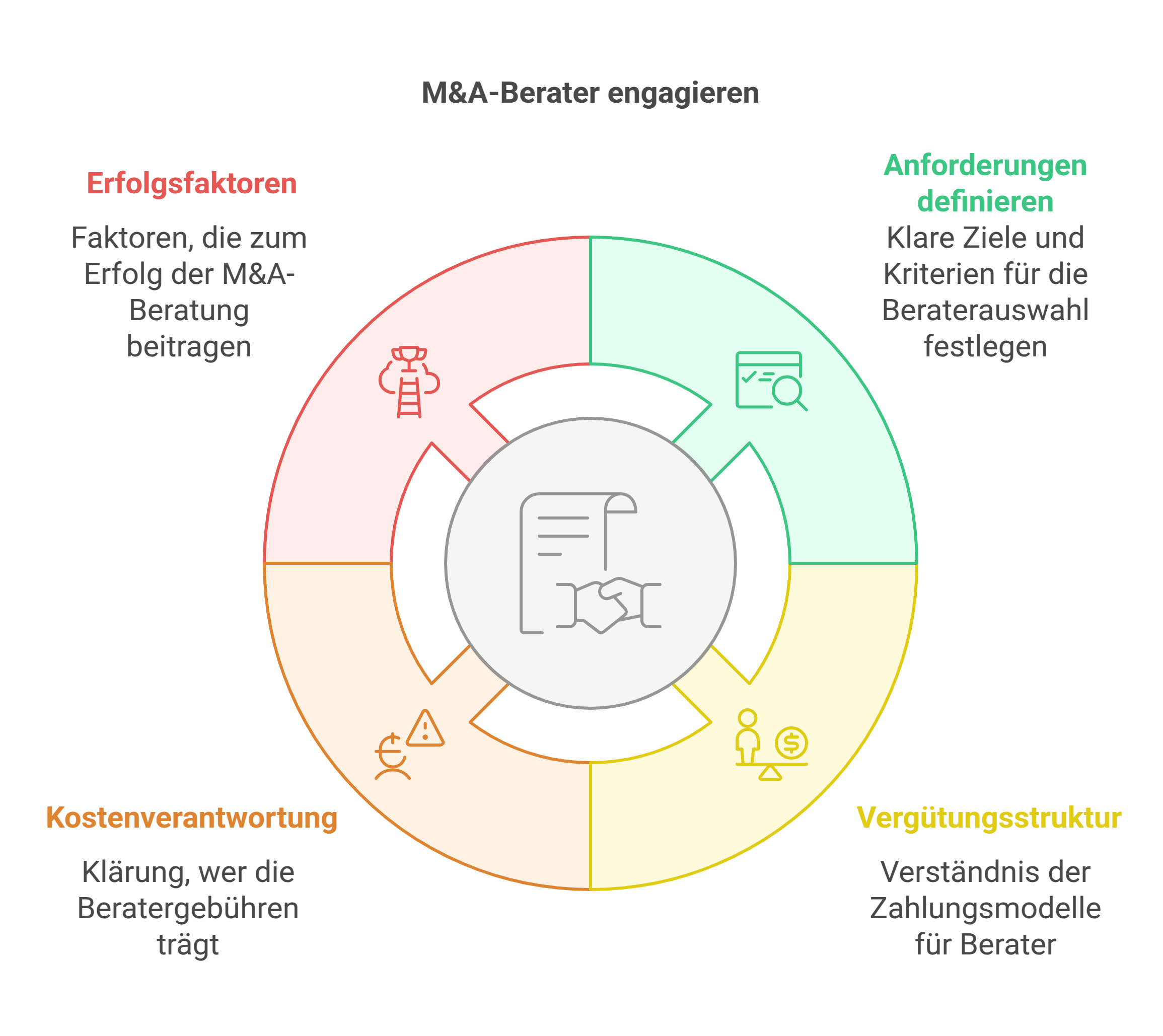

Define Your Requirements and Goals

The first step in finding an M&A advisor is defining your own requirements and goals. The clearer you communicate your expectations, the easier it will be for the advisor to support you effectively. Important criteria when selecting an advisor include their experience and expertise in your industry and type of transaction, their market knowledge and networks, negotiation skills, and communication abilities. Also pay attention to the “chemistry” between you and the advisor—after all, you will be working closely together over the coming months and exchanging confidential information. A good M&A advisor is more than just a service provider—they are a trusted sparring partner on equal footing. To find the right advisor, targeted research and a formal request for proposals are recommended. Use your network to gather recommendations and don’t hesitate to meet several advisors and request offers. Investing time in a careful selection is well worth it—after all, the success of your transaction largely depends on the quality of your M&A advisor.

Compensation Structure

A central aspect when engaging an M&A advisor is the compensation structure. There are various models that are used depending on the type and scope of the transaction. A common model is the so-called “retainer,” a fixed monthly or quarterly base fee paid regardless of the transaction’s outcome. The retainer covers the advisor’s ongoing costs for analysis, preparation, and process support, providing a solid planning basis for both parties. In addition to the retainer, many advisors agree on a “success fee” that becomes payable upon the successful completion of the transaction. This fee can be a fixed amount or a percentage of the transaction volume and creates an additional performance incentive for the advisor. The specific amount of the retainer and success fee depends on several factors, such as the complexity and size of the transaction, the advisor’s experience and reputation, and the market situation. As a rule of thumb, you can expect a retainer ranging from €10,000 to €50,000 per month and a success fee of 1 to 5 percent of the transaction volume. However, caution is advised: a high fee is no guarantee of quality. What matters are the concrete services provided and the added value the advisor brings.

Who Pays the Costs?

A common question from entrepreneurs is who bears the costs for the M&A advisor—buyer or seller? The answer is: it depends. Typically, each party hires and pays their own advisor to represent their specific interests. As a seller, you engage an advisor who supports you in valuation, buyer search, and negotiation, ensuring your goals are achieved as effectively as possible. You initially bear these costs yourself, but they can be factored into the purchase price and passed on to the buyer. On the buyer’s side, it is similar: the buyer hires and pays their own advisor to conduct due diligence, structure financing, and draft contracts. A special case is the advisory support for management in transactions such as a Management Buy-Out (MBO) or Buy-In (MBI). Here, it can make sense for the target company to cover the costs of the management’s advisors since it ultimately benefits from the transaction. Regardless of who pays the bill in the end: professional M&A advisory is an investment that usually pays off through greater transaction security and a better purchase price.

Conclusion

The success of a business transaction largely depends on the quality of the M&A advisory. An experienced and trustworthy advisor by your side is invaluable—they bring structure and expertise to the process, manage complexity, and vigorously represent your interests. When selecting an advisor, pay attention not only to professional and industry-specific expertise but also to interpersonal factors. Only if the chemistry is right and a trusting collaboration is possible can you fully realize the potential of a transaction. The costs for an M&A advisor may seem high at first glance—but measured against the value and risks of a transaction, they are a sensible investment. With the right compensation structure combining retainer and success fee, you also create a fair alignment of interests and a strong performance incentive. And one final tip: don’t hesitate to involve an M&A advisor early on—even if the sale or purchase is not yet concrete. The sooner you bring professional support on board, the better you can shape the process and achieve your goals.