Business Valuation: How to Calculate the Company Value?

In this article, we present the most important methods for business valuation and explain the differences between income value, multiplier, and asset value.

The valuation of a company is a crucial step in business sales, investments, or strategic decisions. There are various approaches to determining the company's value. In this article, we present the most important methods and answer questions such as "How do I value my company?", "What is the difference between valuation methods?" and "When should I use which method?".

How to Calculate the Company Value?

1. Income Approach

The income approach is based on a company's ability to generate profits in the future. Future earnings are estimated and discounted to their present value. This method is particularly suitable for companies with stable and predictable profits.

The calculation is done in two steps:

-

Forecasting future profits: Expected earnings for a specific period (usually 3-5 years) are estimated. This estimate is based on historical data, market trends, and growth expectations.

-

Applying an appropriate discount rate: Future profits are discounted to present value using a discount rate. This rate reflects the risk and opportunity costs. The higher the risk, the higher the discount rate.

The formula for the income approach is:

Where:

- = Expected profit in period t

- = Discount rate

- = Number of periods

An example: A company expects profits of €100,000, €120,000, €140,000, €160,000, and €180,000 over the next 5 years. With a discount rate of 10%, the income value is:

The income approach is one of the most commonly used valuation methods. It is particularly suitable for established companies with stable cash flows and a predictable future. However, its accuracy heavily depends on the quality of the forecasts.

Source: IHK: Unternehmensbewertung mit der Ertragswertmethode

2. Multiples Approach

The multiples approach uses metrics such as revenue or profit, multiplied by an industry-specific factor, to calculate the company's value. This method is especially common in industries with well-defined valuation standards (e.g., technology, real estate).

The calculation is done in two steps:

-

Selecting an appropriate company metric: Commonly used metrics include revenue, EBIT (Earnings Before Interest and Taxes), or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

-

Applying an industry-specific multiple: The multiple is determined based on market data and comparable transactions. It reflects the typical ratio between company value and metric in the respective industry.

The formula for the multiples approach is:

An example: A technology company achieves an EBITDA of €1 million. In the industry, a multiple of 15 is typically applied. The company value is then:

The multiples approach has the advantage of being relatively easy to apply and market-oriented. It is particularly suitable for companies in industries with many comparable transactions. However, it neglects company-specific factors and can lead to distorted results with unusual metrics.

For a further simple overview, read our article Company Valuation Formula: 8 Simple Methods for Quick Company Valuation.

Source: Handelsblatt: Multiplikatorverfahren

3. Asset-Based Approach

The asset-based approach calculates the value of a company's assets, minus its liabilities. It is often used for manufacturing companies or those with significant tangible assets.

The calculation is done in two steps:

-

Determining the assets: This includes tangible assets like land, buildings, machinery, and inventories, as well as intangible assets like patents or brands. Valuation is usually based on market prices or replacement costs.

-

Deducting liabilities: All debts and liabilities are subtracted from the total assets. This includes loans, bonds, accounts payable, and provisions.

The formula for the asset-based approach is:

An example: A manufacturing company has the following values:

- Land and buildings: €5 million

- Machinery and equipment: €3 million

- Inventories: €1 million

- Patents: €500,000

- Bank liabilities: €2 million

- Accounts payable: €1 million

The asset value is then:

The asset-based approach is particularly suitable for companies with high fixed assets and low intangible value. It provides a conservative valuation, especially relevant for lending or liquidation. However, it neglects the earning potential and is less suitable for service or technology companies.

Source: Bundesministerium für Wirtschaft und Klimaschutz: Substanzwertverfahren

4. Mixed Methods and Individual Factors

In practice, a combination of different methods is often used to obtain a realistic picture. Individual factors also play a role, which are not always adequately considered in standard methods:

-

Market position: A company with a strong market position and high entry barriers is often worth more than the pure asset or income value.

-

Growth opportunities: Companies with above-average growth prospects can have a higher value, even if current earnings are still low.

-

Management quality: The skills and experience of the management team can significantly influence the company's value.

A popular mixed method is the Discounted Cash Flow (DCF) method. It combines elements of the income and asset-based methods. Future free cash flows are forecasted and discounted to present value using a risk-adjusted rate. Subsequently, the terminal value is determined, representing the company's value after the forecast period.

The formula for the DCF method is:

Where:

- = Free cash flow in period t

- = Weighted Average Cost of Capital

- = Terminal Value

- = Length of the forecast period

An example: A company expects free cash flows of €500,000, €600,000, €700,000, €800,000, and €900,000 over the next 5 years. The WACC is 8% and the terminal value is estimated at €10 million. The company value is then:

The DCF method is considered very robust and flexible. It takes into account both earning potential and asset value and can be adapted to individual circumstances. However, it is complex and requires detailed forecasts and assumptions.

Source: KPMG: Unternehmensbewertung in der Praxis

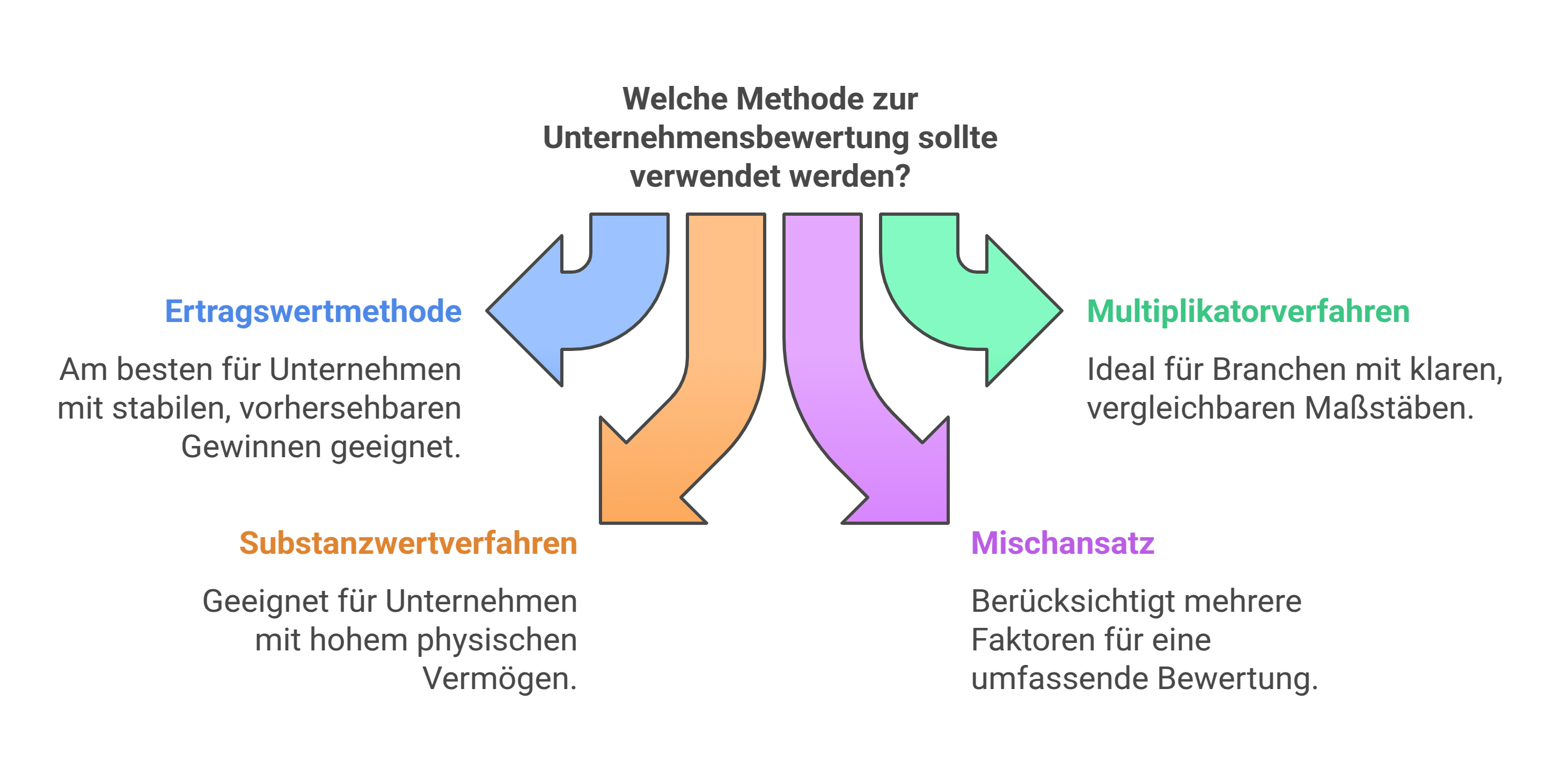

The choice of the right valuation method depends on many factors. Important criteria include the industry, size, and age of the company, the availability of data, and the purpose of the valuation.

For young, innovative companies with high growth potential, multiples or DCF approaches are often suitable. For established companies with stable earnings, the income approach is recommended. For companies with high asset value and low earning potential, the asset-based approach is a good choice.

In any case, it is advisable to apply multiple methods and compare the results. A sensitivity analysis, examining the impact of changes in assumptions, can also provide valuable insights.

A sound company valuation requires experience and often the support of experts to consider all relevant factors. Tax advisors, auditors, and specialized consultants can help select and apply the right methods.

Ultimately, a company valuation is always a snapshot based on assumptions about the future. It can never fully capture the complexity of a company. Nevertheless, it is an indispensable tool for business sales, investment decisions, and strategic planning.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO