Do I Have What It Takes to Buy a Business?

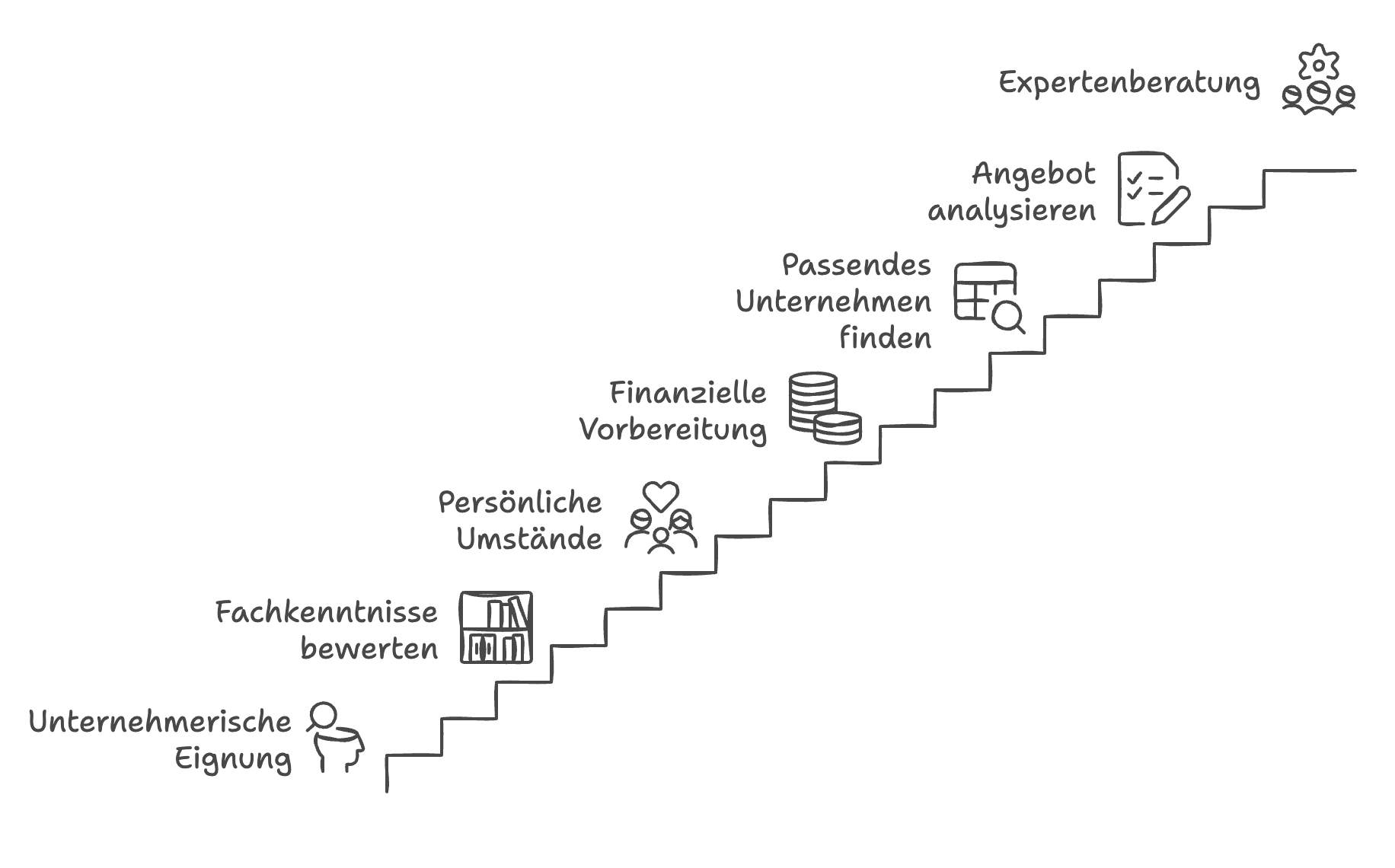

Do I have what it takes to buy a business? This is a question you should ask yourself before you start searching for a company. In this article, you will learn which factors to consider when purchasing a business.

The idea of taking over an existing business can be both exciting and intimidating. Many people dream of entrepreneurship but wonder if they truly have what it takes. In this article, we highlight the key factors you should consider before embarking on the journey of buying a business.

Self-Assessment: Core Questions About Personal Suitability

Am I the entrepreneurial type?

Not everyone is cut out for entrepreneurship—and that’s perfectly fine. Honestly evaluate whether you possess these typical entrepreneurial traits:

- Decisiveness: Can you make clear decisions even under uncertainty?

- Willingness to take risks: Are you prepared to take calculated risks and live with uncertainties?

- Resilience: How do you handle stress, long working hours, and setbacks?

- Leadership skills: Can you motivate and guide people?

- Adaptability: How quickly can you adjust to new situations?

Practical tip: Have conversations with entrepreneurs in your target industry. Ask about their daily routines, biggest challenges, and how they manage them. This will give you a realistic picture.

Do I have the necessary expertise?

Running a successful business requires various competencies:

- Industry knowledge: How well do you know the industry in which you want to buy a business?

- Business management know-how: Do you understand balance sheets, profit and loss statements, and other financial metrics?

- Leadership experience: Have you led teams before?

- Formal qualifications: Do you need specific degrees or certifications (e.g., a master craftsman certificate in a trade)?

Practical tip: Make an honest inventory of your skills and identify knowledge gaps. Consider how to close these—through further training, partnerships, or hiring qualified employees.

Is my personal situation suitable?

Buying a business can fundamentally change your life:

- Family support: Does your family support your decision?

- Health: Are you physically and mentally fit for the challenges?

- Time availability: Are you willing to work significantly more than 40 hours per week, at least initially?

- Relocation: Would you be willing to move if the business is located in another region?

Practical tip: Involve your family early in your plans. An open discussion about expectations, concerns, and necessary adjustments can prevent conflicts later on.

Financial Requirements

What is the status of my equity capital?

Financing is often one of the biggest hurdles in buying a business:

- Equity capital: Typically, you should be able to contribute 20-30% of the purchase price from your own funds.

- Collateral: Do you have assets that can serve as security for loans?

- Creditworthiness: What is your credit rating? Do you have existing liabilities?

- Financial reserves: Do you have savings for unforeseen expenses or initial revenue shortfalls?

Practical tip: Consult a financial advisor or your bank about financing options. Also, inform yourself about special funding programs for business successors.

Can I secure my livelihood?

Especially in the early phase, your business may not generate sufficient profit immediately:

- Transition phase: Do you have reserves to cover 6-12 months with reduced income?

- Social security: How is your social protection (health insurance, retirement provision)?

- Minimum income: What income do you need at a minimum to cover your fixed costs?

Practical tip: Calculate your necessary minimum income and ensure that buying the business does not jeopardize it.

Research: How Do I Find the Right Business?

Which industry suits me?

Not every business for sale is right for you:

- Personal interests: In which industry do you enjoy working?

- Future viability: What are the future prospects for the industry?

- Market situation: How competitive is the market? Is there growth potential?

- Entry barriers: What are the typical purchase prices in the industry?

Practical tip: Create a clear search profile with must-have and desired criteria before starting your active search.

Where can I find businesses for sale?

There are various ways to find sales offers:

- Succession exchanges: Online platforms like nexxt-change

- Chambers and associations: Chambers of Industry and Commerce (IHK) and trade chambers often facilitate succession inquiries

- M&A advisors: Specialized intermediaries for business acquisitions

- Network: Your own contacts in the industry, tax advisors, lawyers

- Direct approach: Targeted contact with potential sellers

Practical tip: Use multiple search channels simultaneously and register for notification services on succession platforms.

Analysis: How Do I Recognize a Good Offer?

What factors make a business attractive?

Not every business for sale is a good investment:

- Stability: Does the business have a healthy financial structure and stable earnings?

- Customer base: How broad is the customer base? Are there dependencies on a few major clients?

- Employee structure: Does the business have qualified, loyal employees?

- Future prospects: How sustainable is the business model?

- Location: Is the location favorable for business operations?

- Need for transformation: How much would you have to change to successfully continue the business?

Practical tip: Create a checklist with evaluation criteria for potential acquisition candidates to objectively compare different offers.

How do I identify hidden risks?

Attractive offers can conceal problems:

- Financial liabilities: Outstanding tax payments, unrecorded liabilities

- Legal risks: Ongoing lawsuits, warranty claims

- Investment backlog: Outdated technology or equipment

- Personnel risks: Key employees who might leave the company

- Market changes: New competitors, technological shifts, regulatory changes

Practical tip: Conduct a thorough due diligence review, ideally supported by experts such as tax advisors, lawyers, and industry specialists.

Support: Who Can Help Me?

Which experts should I involve?

Buying a business is complex and requires expertise in various areas:

- Management consultants: For evaluating the business model and future potential

- Tax advisors: For tax optimization of the purchase

- Lawyers: For contract drafting and legal protection

- Financial advisors: For structuring financing

- Industry experts: For assessing market situation and competition

Practical tip: Look for experts with specific experience in business acquisitions in your target industry. Investing in good advice often pays off multiple times later.

What funding opportunities are available?

There are numerous support programs for business successors:

- KfW promotional loans: Low-interest loans for business successors

- Guarantees: Securing bank loans through public guarantee banks

- Consulting subsidies: Grants for using consulting services

- Regional funding programs: Different offers depending on the federal state

Practical tip: Use funding databases or consult with an economic development agency about suitable programs.

The Purchase Process: How Does Buying a Business Work?

What does the typical process look like?

A business acquisition usually follows this pattern:

- Initial contact and getting to know each other

- Signing a confidentiality agreement (NDA)

- Exchange of basic information

- Non-binding price indication (Letter of Intent)

- Detailed examination (Due Diligence)

- Contract negotiations

- Signing the purchase agreement

- Transition phase and onboarding

Practical tip: Plan 12-18 months for the entire process. Don’t rush—hasty purchases can be costly.

What should I pay attention to during negotiations?

Negotiations in business acquisitions are complex and often emotional:

- Professional distance: Don’t let emotions drive your decisions

- Negotiation scope: Identify negotiation points beyond price (payment terms, transition arrangements)

- Willingness to compromise: Seek win-win solutions

- Fairness: Respect the seller’s life’s work

- Communication: Maintain regular, open contact

Practical tip: Define your limits in advance—both regarding purchase price and other key contract terms.

Conclusion: The Honest Self-Check

The decision to buy a business should be well considered. Take time for an honest self-assessment and carefully review your personal, professional, and financial prerequisites. Don’t hesitate to seek support—whether from family, friends, or professional advisors.

Buying a business offers unique opportunities but also involves significant risks. With the right preparation, realistic expectations, and a structured approach, you can minimize these risks and maximize your chances of success.

Ultimately, there is no guarantee of success—but thorough self-examination and careful preparation are the best foundations to answer the question “Do I have what it takes to buy a business?” positively for yourself.

Christopher Heckel

Co-Founder & CTO

Christopher has led the digital transformation of financial solutions for SMEs as CTO of SME financier Creditshelf. viaductus was founded with the goal of helping people achieve their financial goals with technology for corporate acquisitions and sales.

About the author

Christopher Heckel

Co-Founder & CTO