Unternehmensverkauf: ESG-Kriterien als Werttreiber

ESG-Kriterien sind in der Unternehmensbewertung immer wichtiger. Dieser Artikel zeigt, wie Sie ESG-Kriterien bei der Unternehmensbewertung berücksichtigen und welche Rolle ESG-Kriterien bei der Unternehmensbewertung spielen.

In einer Welt, in der Konsumenten, Investoren und Regulierungsbehörden immer höhere Ansprüche an die ökologische und soziale Verantwortung von Unternehmen stellen, werden Nachhaltigkeitsaspekte zu einem zentralen Faktor für den langfristigen Erfolg. Doch nicht nur im operativen Geschäft, sondern auch bei Unternehmensverkäufen und -übernahmen spielen sogenannte ESG-Kriterien eine zunehmend wichtige Rolle. Dieser Artikel beleuchtet, warum eine positive Nachhaltigkeitsbilanz den Wert einer Firma steigern kann und worauf Verkäufer und Käufer achten sollten.

Was verbirgt sich hinter dem Begriff ESG?

ESG steht für "Environmental, Social, Governance" - zu Deutsch: Umwelt, Soziales und Unternehmensführung. Es handelt sich um drei zentrale Bereiche, anhand derer die Nachhaltigkeit und gesellschaftliche Verantwortung eines Unternehmens bewertet werden. Dazu zählen beispielsweise:

- Umweltschutz: CO2-Bilanz, Ressourcenverbrauch, Anteil erneuerbarer Energien, Abfallmanagement

- Soziale Verantwortung: Mitarbeiterrechte, Diversity, Gesundheit und Sicherheit am Arbeitsplatz, faire Bezahlung

- Governance: Transparenz, Compliance, Anti-Korruption, verantwortungsvolle Führung

Je besser ein Unternehmen in diesen Bereichen abschneidet, desto positiver ist seine ESG-Bewertung. Immer mehr Investoren, aber auch Kunden und potenzielle Mitarbeitende achten auf diese Kennzahlen, wenn sie Entscheidungen treffen.

Nachhaltigkeit zahlt sich aus: Höhere Bewertungen, geringere Risiken

Studien zeigen: Unternehmen, die in Sachen ESG punkten, werden an der Börse oft höher bewertet als ihre weniger nachhaltigen Konkurrenten. Das hat mehrere Gründe:

- Sie gelten als zukunftsfähiger und krisenresistenter, weil sie Ressourcen schonen und auf langfristigen Erfolg setzen.

- Sie haben weniger Ärger mit Aufsichtsbehörden und NGOs, weil sie Gesetze und Standards einhalten oder sogar übertreffen.

- Sie sind attraktiver für junge Talente, denen Sinnhaftigkeit und Verantwortung oft wichtiger sind als das letzte Quäntchen Gehalt.

- Sie erschließen neue Kundengruppen und Märkte, die Wert auf Nachhaltigkeit und ethisches Handeln legen.

All das macht sich auch bei Unternehmenstransaktionen bemerkbar. Eine gute ESG-Performance kann den Verkaufspreis spürbar erhöhen, weil Käufer bereit sind, für zukunftssichere Geschäftsmodelle tiefer in die Tasche zu greifen. Umgekehrt steigen die Bewertungen für Unternehmen mit Nachhaltigkeitslücken oft weniger stark oder brechen im Krisenfall regelrecht ein.

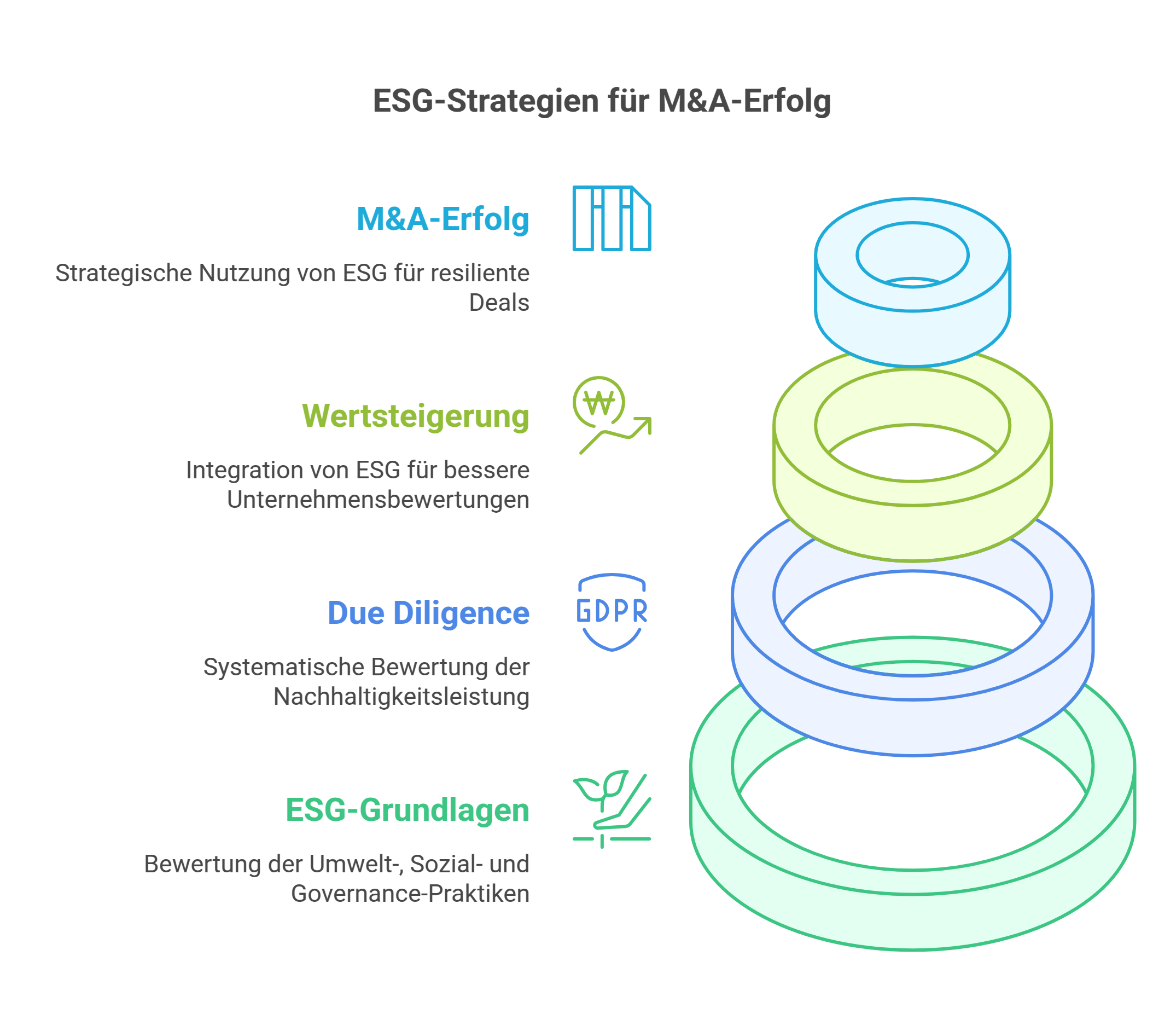

Due Diligence: Den ESG-Reifegrad objektiv messen

Umso wichtiger ist es, ESG-Faktoren bereits frühzeitig in den M&A-Prozess einzubeziehen. In der Due Diligence sollten Kaufinteressenten systematisch prüfen, wie nachhaltig und verantwortungsvoll die Zielgesellschaft agiert. Dabei helfen spezialisierte ESG-Dienstleister, die z.B.:

- Umwelt- und Sozialbilanzen analysieren und vergleichen

- Lieferketten und Beschaffungspraktiken unter die Lupe nehmen

- Führungs- und Kontrollstrukturen bewerten

- Zertifizierungen, Branchenratings und Medienberichte auswerten

Aus diesen Informationen lässt sich der ESG-Reifegrad eines Unternehmens zuverlässig ermitteln. Gleichzeitig zeigen sich mögliche Schwachstellen und Risiken, die sich auf den Wert und die Zukunftsfähigkeit auswirken können.

Nachhaltigkeit aktiv gestalten: Hebel für Wertsteigerung

Für Verkäufer bedeutet das: Wer frühzeitig in ESG investiert und Nachhaltigkeit zum integralen Bestandteil seiner Unternehmensstrategie macht, kann beim Exit mit höheren Bewertungen rechnen. Drei Stellhebel sind dabei besonders wirkungsvoll:

- Transparenz & Reporting: Nachhaltigkeitsberichte nach anerkannten Standards wie GRI oder DNK zeigen, wo man steht und welche Fortschritte man macht.

- Innovation & Transformation: Investitionen in ressourcenschonende Technologien, Cradle-to-Cradle-Produktdesign oder emissionsarme Mobilität zahlen sich langfristig aus.

- Stakeholder-Dialog: Wer mit Mitarbeitenden, Lieferanten, Kunden und Kommunen partnerschaftlich zusammenarbeitet, etabliert ein positives Ökosystem.

Diese Maßnahmen machen ein Unternehmen nicht nur nachhaltiger, sondern auch krisenresistenter, wettbewerbsfähiger und attraktiver für Investoren.

Auch Käufer profitieren: ESG schafft Win-win-Situationen

Käufer wiederum können von einer positiven ESG-Bilanz gleich mehrfach profitieren. Sie erwerben ein Unternehmen, das

- mit innovativen, zukunftsorientierten Geschäftsmodellen punkten kann,

- eine engagierte, sinnorientierte Belegschaft und loyale Kunden hat,

- weniger anfällig für Imageschäden und Complianceverstöße ist,

- sich leichter in die eigenen Nachhaltigkeitsstrategien integrieren lässt.

Gerade in einem schwierigen Marktumfeld kann der ESG-Faktor so zum entscheidenden Pluspunkt werden - sowohl für das gekaufte als auch für das kaufende Unternehmen. Beide Seiten gewinnen.

ESG ganzheitlich denken: Königsdisziplin für M&A-Profis

So verlockend die Chancen sind: Der Weg zu mehr Nachhaltigkeit ist oft steinig und verlangt Ausdauer, Kreativität und Überzeugungskraft. Denn ESG ist keine isolierte Disziplin, sondern eine Querschnittsaufgabe, die in alle Bereiche eines Unternehmens ausstrahlt, von der Produktion bis zum Personalwesen.

Wer sie meistern will, braucht ganzheitliche Konzepte und abgestimmte Maßnahmen. Im Rahmen einer Transaktion kommt die Kunst hinzu, zwei unterschiedlich weit entwickelte ESG-Kulturen zusammenzuführen, Synergien zu erkennen und zu heben.

Hier sind M&A-Spezialisten gefragt, die nicht nur sicher mit Bewertungsmodellen jonglieren, sondern auch über den Tellerrand schauen und die Schnittstellen zwischen Ökonomie, Ökologie und sozialer Verantwortung im Blick haben. Sie verstehen Nachhaltigkeit als Wertschöpfungshebel, als Innovationsmotor und als Schlüssel zu krisenfesten, zukunftsgerichteten Geschäftsmodellen.

Wer sich dieses Know-how ins Haus holt - als Verkäufer wie als Käufer - hat gute Karten, ESG-Kriterien zum strategischen Erfolgsfaktor zu machen. Und so nicht nur einzelne Deals zu optimieren, sondern auch das eigene Unternehmen langfristig resilienter und wertvoller zu machen. Eine Win-win-Situation par excellence.

Christopher Heckel

Co-Founder & CTO

Christopher hat als CTO des Mittelstandsfinanziers Creditshelf die digitale Transformation von Finanzlösungen für den Mittelstand geleitet. viaductus wurde mit dem Ziel gegründet, mit Technologie für Unternehmensübernahmen und -verkäufe Menschen zu unterstützen, ihre finanziellen Ziele zu erreichen.

Über den Autor

Christopher Heckel

Co-Founder & CTO