Unternehmensbewertung in Krisenzeiten: Anpassungen, Unsicherheit, Szenarien

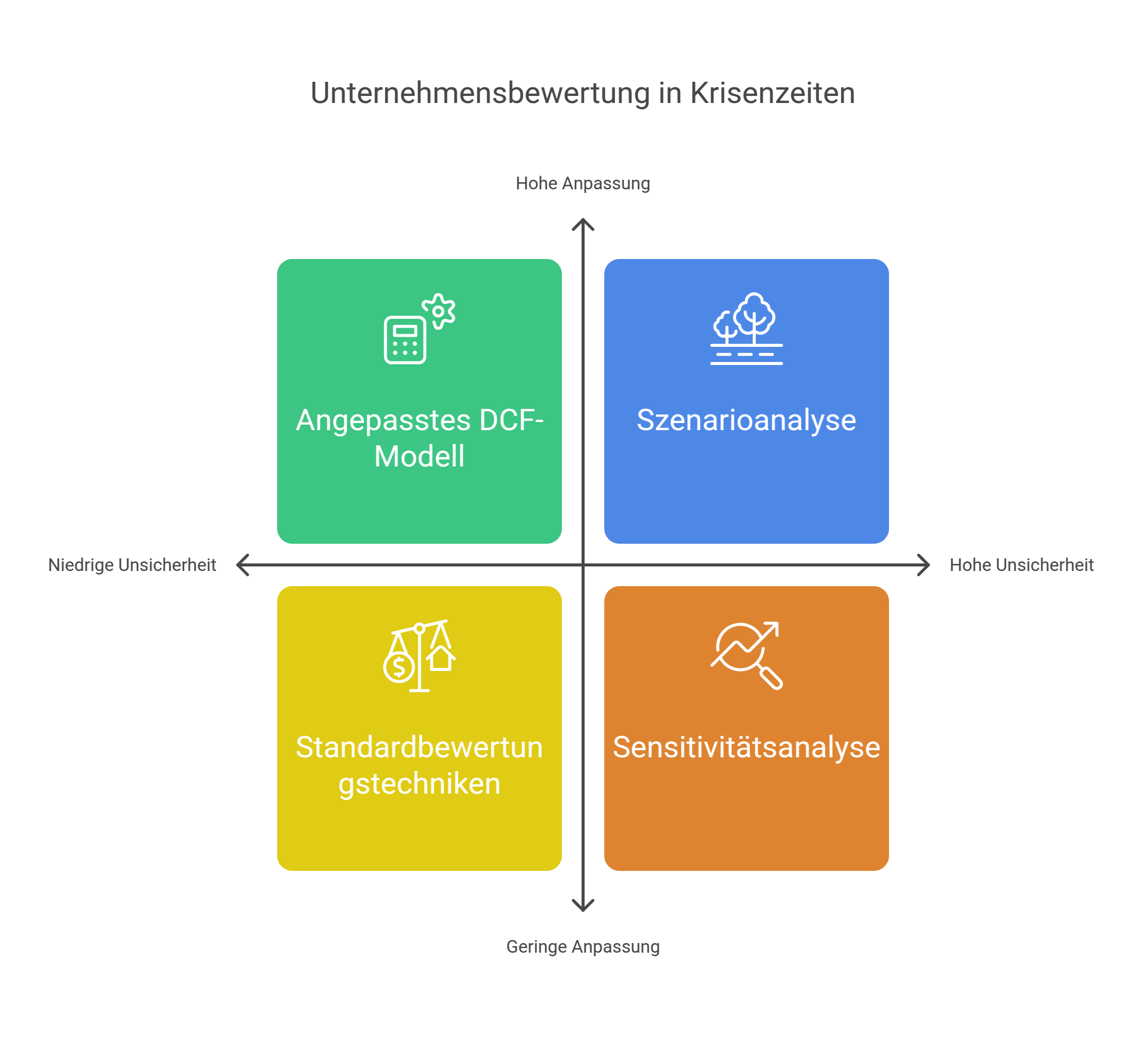

Die Bewertung von Unternehmen stellt in Krisenzeiten besondere Herausforderungen. Dieser Artikel zeigt auf, wie Bewertungsmethoden angepasst werden müssen, mit Unsicherheit umzugehen ist und Szenarienanalysen genutzt werden können.

Die Bewertung eines Unternehmens ist bereits unter normalen Umständen eine komplexe Aufgabe, die viel Erfahrung und Sachkenntnis erfordert. In Krisenzeiten potenziert sich diese Herausforderung nochmals - eine Realität, mit der aktuell viele kleine und mittlere Unternehmen (KMU) in Deutschland konfrontiert sind. Ob Ukraine-Krieg, explodierende Energiepreise oder zunehmender Fachkräftemangel: Die Unsicherheiten und Risiken für Unternehmen haben sich in jüngster Zeit drastisch erhöht.

Plötzlich sind Prognosen über zukünftige Erträge und Cashflows mit viel größerer Unsicherheit behaftet. Etablierte Bewertungsmethoden wie das Ertragswert- oder das DCF-Verfahren stoßen an ihre Grenzen, da sie auf der Annahme einer stabilen und einigermaßen vorhersehbaren Zukunft basieren. Doch wie stabil und vorhersehbar ist die Zukunft für einen Maschinenbauer, dessen Energiekosten sich innerhalb eines Jahres vervierfacht haben? Oder für ein Technologieunternehmen, das händeringend Software-Entwickler sucht, aber aufgrund des Fachkräftemangels kaum geeignete Kandidaten findet?

Auch Multiplikatoren aus Vergleichstransaktionen sind in solchen Zeiten nur noch bedingt aussagekräftig, da sich die Marktbedingungen fundamental geändert haben können. Was ist eine angemessene EBIT-Multiple für einen Automobilzulieferer, wenn die gesamte Branche vor einem strukturellen Umbruch steht? Und selbst Substanzwerte bieten keinen sicheren Hafen mehr, wenn Assets plötzlich an Wert verlieren oder gar zu "stranded assets" werden. Man denke nur an energieintensive Produktionsanlagen, die aufgrund hoher Strompreise oder strengerer CO2-Vorgaben nicht mehr wirtschaftlich betrieben werden können.

Die Liste der Herausforderungen ließe sich fortsetzen - und sie alle haben direkte Auswirkungen auf den Unternehmenswert und dessen Ermittlung. Wie also kann eine fundierte Bewertung in diesen stürmischen Zeiten gelingen? Welche Anpassungen und neuen Denkweisen sind nötig, um der erhöhten Komplexität und Unsicherheit Rechnung zu tragen? Diesen Fragen wollen wir in diesem Artikel nachgehen.

** Bevor Sie starten, empfehlen wir Ihnen, unseren Beitrag Unternehmen bewerten Faustformel: 8 einfache Methoden zur schnellen Unternehmensbewertung zu lesen. Dort finden Sie eine Übersicht über die verschiedenen Bewertungsmethoden und deren Vor- und Nachteile.

Anpassung der Bewertungsmethoden

Eine erste Antwort lautet: Durch Anpassung der Bewertungsmethoden an die geänderten Umstände. Nehmen wir das DCF-Verfahren als Beispiel. Hier müssen die Prognosen für zukünftige Cashflows kritisch hinterfragt und an die neuen Realitäten angepasst werden. War man in der Vergangenheit vielleicht von einem stetigen Wachstum ausgegangen, so sind nun mögliche Einbrüche bei Umsatz und Ergebnis explizit zu modellieren. Dabei sind Branchenbesonderheiten zu berücksichtigen: Ein Einzelhändler wird die Krise anders spüren als ein Software-as-a-Service Unternehmen. Auch staatliche Hilfsmaßnahmen wie Kurzarbeitergeld, Zuschüsse oder Steuerstundungen können die Cashflow-Situation entscheidend beeinflussen und sollten in die Überlegungen einbezogen werden.

Auf der anderen Seite gilt es, potenzielle Veränderungen auf der Kostenseite im Blick zu haben. Führen unterbrochene Lieferketten zu höheren Einstandspreisen? Schlagen sich gestiegene Energiekosten in den Margen nieder? Hier ist jedes Geschäftsmodell individuell zu analysieren. Auch Wechselkurseffekte können in Krisenzeiten eine größere Rolle spielen, insbesondere für exportorientierte Unternehmen.

Ein weiterer kritischer Faktor sind die verwendeten Diskontierungszinssätze. In Krisen steigen in der Regel die Risikoprämien, was zu höheren Kapitalisierungszinssätzen (WACC) führt und den Unternehmenswert ceteris paribus reduziert. Doch wie stark soll dieser Effekt berücksichtigt werden? Hier ist eine differenzierte Betrachtung nötig. Nicht jedes Unternehmen ist gleichermaßen von der Krise betroffen, nicht jede Branche gleichermaßen volatil. Auch die Kapitalstruktur spielt eine Rolle: Unternehmen mit einem hohen Eigenkapitalpolster werden anders bewertet als solche mit knapper Liquidität und drohender Insolvenz. All diese Aspekte müssen in der Festlegung individueller, fairer Diskontierungszinssätze einfließen.

Schließlich ein Blick auf die Multiplikatorverfahren: Hier sollte in Krisenzeiten noch stärker auf die Vergleichbarkeit der herangezogenen Peer Group geachtet werden. Sind die Referenzunternehmen strukturell ähnlich aufgestellt und gleichermaßen von der Krise betroffen? Ein Vergleich von Äpfeln mit Birnen führt gerade in volatilen Zeiten zu verzerrten Ergebnissen. Auch Einmaleffekte wie Sonderabschreibungen oder Restrukturierungsaufwendungen können die Aussagekraft von Multiplikatoren beeinträchtigen. Gegebenenfalls ist die Bandbreite der Vergleichsmultiples anzupassen, um der höheren Unsicherheit Rechnung zu tragen. In manchen Fällen kann es auch sinnvoll sein, temporär auf alternative Bewertungsansätze auszuweichen, etwa auf Substanzwertmethoden.

Unterm Strich zeigt sich: Die Bewertungsmethoden müssen in Krisenzeiten angepasst und justiert werden. Pauschalannahmen und Standardparameter haben ausgedient. Stattdessen ist eine differenzierte, individualisierte Betrachtung gefragt, die die spezifischen Effekte der Krise auf das jeweilige Unternehmen und seine Branche berücksichtigt. Mehr denn je sind Fingerspitzengefühl und Erfahrung gefragt. Nur so lässt sich ein realistisches, belastbares Bewertungsergebnis erzielen.

Umgang mit Unsicherheit

Ein zweites Schlüsselthema bei der Bewertung in Krisenzeiten ist der Umgang mit Unsicherheit. Anders als in stabilen Marktphasen gibt es in Krisen oft keine verlässliche "Single-Point-Schätzung" für den Unternehmenswert mehr. Zu groß sind die Unwägbarkeiten, zu vielfältig die möglichen Entwicklungspfade. Stattdessen ist es ratsam, eine Bandbreite plausibler Werte zu bestimmen und unterschiedliche Szenarien durchzuspielen.

Hier kommt die Szenarioanalyse ins Spiel. Dabei werden alternative Zukunftsszenarien definiert, die beispielsweise von einer schnellen Erholung (Best Case), einer länger anhaltenden Krise (Base Case) oder sogar einer fundamentalen Disruption (Worst Case) ausgehen. Für jedes dieser Szenarien werden die Cashflows und Werttreiber unterschiedlich projiziert und der Unternehmenswert separat berechnet. Im Ergebnis erhält man eine Bandbreite möglicher Unternehmenswerte, die die Auswirkungen unterschiedlicher Krisenverläufe widerspiegelt.

Die Definition der Szenarien ist dabei alles andere als trivial. Sie erfordert eine sorgfältige Analyse der Branche, des Geschäftsmodells und der spezifischen Krisentreiber. Auch makroökonomische Faktoren wie die erwartete Dauer der Rezession, mögliche Nachholeffekte oder strukturelle Änderungen im Konsumverhalten müssen berücksichtigt werden. Je besser es gelingt, die Szenarien an der Realität auszurichten, desto aussagekräftiger sind die resultierenden Bandbreiten.

Eine weitere wichtige Methode ist die Sensitivitätsanalyse. Hier werden ausgewählte Werttreiber wie Umsatzwachstum, Margen oder Investitionsquoten systematisch variiert, um ihren Einfluss auf den Unternehmenswert zu untersuchen. Man spannt gewissermaßen einen Möglichkeitsraum auf und schaut, wie sich der Wert in Abhängigkeit von Veränderungen einzelner Parameter entwickelt. Angenommen, der Umsatz bricht krisenbedingt um 20% oder sogar 30% ein - was bedeutet das für den Unternehmenswert? Oder die EBIT-Marge sinkt von 10% auf 5% - wie sensitiv reagiert die Bewertung darauf?

Durch die Betrachtung unterschiedlicher Sensitivitäten lassen sich Chancen und Risiken besser einschätzen und kritische Schwellen identifizieren. Gleichzeitig zeigt sich, welche Werttreiber in der aktuellen Situation besonders relevant sind und wie sich ihre Bedeutung gegenüber einer Normalsituation möglicherweise verschoben hat. Diese Erkenntnisse können wertvolle Hinweise geben, worauf bei der Due Diligence, aber auch im operativen Krisenmanagement besonderes Augenmerk zu legen ist. Hat etwa die Kundenbindung in der Krise überragende Bedeutung für den Werterhalt, sollten Maßnahmen zur Churn-Reduzierung ganz oben auf der Agenda stehen.

Szenario- und Sensitivitätsanalysen sind mächtige Instrumente, um die Bewertungsunsicherheit zu reduzieren und handhabbar zu machen. Sie ersetzen zwar nicht die fundamentale Arbeit an den Werttreibern und Cashflows, erlauben aber eine strukturiertere Auseinandersetzung mit den Bandbreiten und möglichen Ausprägungen. Am Ende steht zwar immer noch eine gewisse Unschärfe, die sich nicht vollständig eliminieren lässt. Aber es ist eine eingegrenzte, fassbare Unschärfe, mit der sich kalkulieren und planen lässt. Und das ist in Krisenzeiten schon sehr viel wert.

Impairment-Test-Logik

Eine besonders weitreichende Form der Szenariobetrachtung ist die sogenannte "Impairment-Test-Logik". Hierbei wird untersucht, ob das Unternehmen durch die Krise so stark betroffen ist, dass der Substanzwert (z. B. ausgedrückt als Net Asset Value) den Ertragswert unterschreitet. In diesem Fall wäre eine außerplanmäßige Abschreibung (Impairment) auf Vermögenswerte wie Firmenwerte (Goodwill), Sachanlagen oder Beteiligungen angezeigt.

Die Impairment-Test-Logik folgt der Prämisse, dass kein Investor bereit wäre, für ein Unternehmen mehr zu bezahlen als die Summe seiner Einzelteile wert ist. Wenn also der auf Ertragsüberschüssen basierende Unternehmenswert unter die Substanzwerte fällt, muss dieser nach unten korrigiert werden. Für die Bewertung bedeutet das oft eine "Zweiteilung" des Kalkulationsmodells:

In der ersten, unmittelbar von der Krise betroffenen Phase wird auf Basis des Substanzwerts bewertet. Damit wird dem Umstand Rechnung getragen, dass die Ertragsaussichten vorübergehend eingetrübt sind und keine verlässliche Grundlage für die Bewertung darstellen. Für die Zeit nach Bewältigung der Krise, wenn sich die Cashflows normalisiert haben, kann dann wieder auf ein Ertragswertmodell übergegangen werden.

Dieses zweistufige Vorgehen ist zweifellos komplex und mit zusätzlichem Aufwand verbunden. Dafür kann es aber ein realistischeres, den tatsächlichen Wertverhältnissen angemesseneres Bild liefern als die undifferenzierte Fortschreibung eines reinen Ertragswertkalküls. Gerade bei schweren, lang anhaltenden Krisen, die mit hoher Unsicherheit und einem strukturellen Umbruch ganzer Branchen einhergehen, kann die Impairment-Test-Logik ein probates Mittel sein, um zu sachgerechten Bewertungsergebnissen zu kommen.

Ein positiver Nebeneffekt: Die Prüfung auf Wertminderungen zwingt Unternehmen, sich intensiv mit der Werthaltigkeit ihrer Aktiva auseinanderzusetzen. Überkapazitäten, unrentable Geschäftsfelder oder nicht mehr strategiekonforme Beteiligungen werden so schneller identifiziert und können entsprechend bereinigt werden. Insofern kann die Impairment-Logik auch ein heilsamer Schock sein und wertvolle Impulse für eine Restrukturierung oder Neuausrichtung des Unternehmens geben.

Fazit

Alles in allem zeigt sich: Die Unternehmensbewertung wird in Krisenzeiten zwar schwieriger, bleibt aber möglich und sinnvoll. Entscheidend ist, dass die Berechnungsmethoden angepasst werden, Unsicherheiten transparent gemacht und aktiv adressiert werden und die individuelle Situation des Unternehmens bestmöglich erfasst wird. Dazu braucht es Fachkenntnis, Erfahrung und eine gehörige Portion gesunden Menschenverstand. Spezialisierte Berater, die schon viele Krisen erlebt haben, können wertvolle Unterstützung leisten. Gerade weil Unternehmensbewertungen in Krisen so herausfordernd sind, können sie ein wichtiger Kompass sein. Sie helfen, den realistischen Wert eines Unternehmens abzuschätzen - und auf dieser Basis tragfähige Entscheidungen zu treffen. Sei es die Preisfindung bei einer Transaktion, die Definition von Kreditbedingungen oder die Festlegung der weiteren Unternehmensstrategie. Denn auch in der Krise gilt: Wer Risiken kennt und richtig einpreist, kann Chancen besser nutzen.

Christopher Heckel

Co-Founder & CTO

Christopher hat als CTO des Mittelstandsfinanziers Creditshelf die digitale Transformation von Finanzlösungen für den Mittelstand geleitet. viaductus wurde mit dem Ziel gegründet, mit Technologie für Unternehmensübernahmen und -verkäufe Menschen zu unterstützen, ihre finanziellen Ziele zu erreichen.

Über den Autor

Christopher Heckel

Co-Founder & CTO